- United States

- /

- Entertainment

- /

- NYSE:LYV

Live Nation (LYV): Valuation in Focus as Global Expansion and Concert Demand Drive Growth Prospects

Reviewed by Simply Wall St

Live Nation Entertainment (LYV) has drawn attention after updating its credit facilities, providing fresh capital for expansion just as anticipation builds ahead of its upcoming quarterly earnings. Investors are watching to see how these moves influence the company’s growth strategy.

See our latest analysis for Live Nation Entertainment.

Momentum around Live Nation’s stock has been building, with robust global concert demand and strategic growth moves drawing investor interest. The share price sits at $149.84, up nearly 16% year-to-date, and the one-year total shareholder return stands at an impressive 27.8%. This performance outpaces many peers and reflects both strong business execution and optimistic market sentiment for the company’s global expansion plans.

If the surge in demand for live entertainment has you curious about other fast-moving opportunities, now’s a great moment to discover fast growing stocks with high insider ownership

With analyst targets still above current levels and robust business momentum, the question remains: is Live Nation’s long-term growth already reflected in the current share price, or does room remain for investors to capitalize before the next leg up?

Most Popular Narrative: 13.8% Undervalued

With Live Nation Entertainment's narrative fair value set at $173.80, well above the last close of $149.84, market optimism is clearly reflected in its growth story and ambitious forecasts.

Live Nation is in the early stages of expanding its presence across high-growth international markets such as Latin America (notably Mexico and Brazil) and APAC (notably Japan), leveraging surging demand for live events among younger, increasingly affluent urban populations globally. This is poised to materially drive revenue growth through increased ticket sales, new venues, and event launches.

Eager to unpack what’s driving this aggressive valuation? The narrative rests on a bold financial roadmap: accelerating global growth, new markets, and numbers that would make even tech giants pause. Discover the foundational assumptions and the surprising profit forecast analysts are betting on.

Result: Fair Value of $173.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory scrutiny and growing competitive pressures could quickly reshape Live Nation's trajectory and challenge even the most optimistic forecasts.

Find out about the key risks to this Live Nation Entertainment narrative.

Another View: What Does Our DCF Model Suggest?

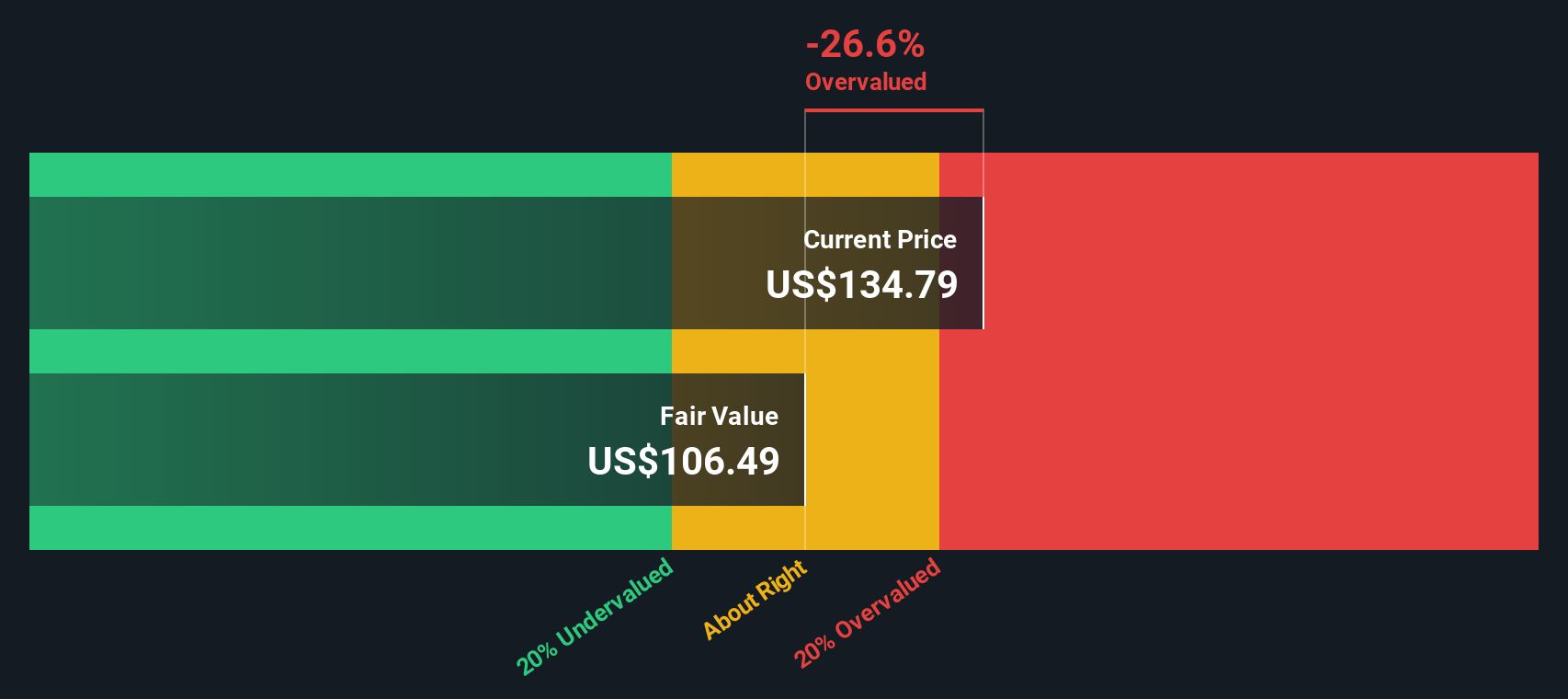

While the market narrative points to Live Nation being undervalued based on ambitious earnings growth, our SWS DCF model tells a different story. According to this method, the current price of $149.84 is above our estimated fair value of $112.21, suggesting the stock could be overvalued if growth or margins fall short. Could the market be pricing in too much optimism, or is risk truly outweighed by opportunity in this case?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Live Nation Entertainment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Live Nation Entertainment Narrative

If you want to dig deeper, question the consensus, or map out your own view, you can generate a personal narrative in just a few minutes. Do it your way

A great starting point for your Live Nation Entertainment research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors don’t just stick with one opportunity. Expand your horizons with powerful screeners to uncover stocks primed for growth, returns, or the next big trend.

- Supercharge your watchlist with these 840 undervalued stocks based on cash flows that look poised for a rebound, thanks to strong cash flow fundamentals and attractive valuations.

- Tap into the future of healthcare by using these 33 healthcare AI stocks to spot companies transforming medicine through artificial intelligence innovation.

- Take aim at long-term passive income and stability by handpicking these 18 dividend stocks with yields > 3% offering reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYV

Live Nation Entertainment

Operates as a live entertainment company worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives