- United States

- /

- Entertainment

- /

- NYSE:LYV

Live Nation Entertainment, Inc.'s (NYSE:LYV) P/S Still Appears To Be Reasonable

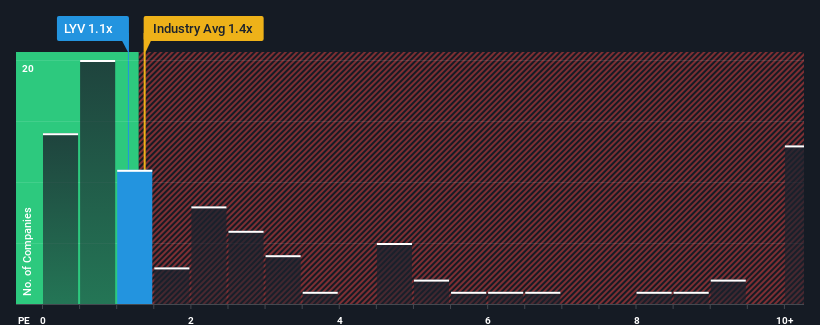

It's not a stretch to say that Live Nation Entertainment, Inc.'s (NYSE:LYV) price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" for companies in the Entertainment industry in the United States, where the median P/S ratio is around 1.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Live Nation Entertainment

What Does Live Nation Entertainment's Recent Performance Look Like?

Recent times have been advantageous for Live Nation Entertainment as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Live Nation Entertainment.How Is Live Nation Entertainment's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Live Nation Entertainment's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 131% last year. Pleasingly, revenue has also lifted 61% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 8.3% per year over the next three years. With the industry predicted to deliver 9.6% growth per year, the company is positioned for a comparable revenue result.

In light of this, it's understandable that Live Nation Entertainment's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Live Nation Entertainment's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Live Nation Entertainment's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Live Nation Entertainment with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LYV

Live Nation Entertainment

Operates as a live entertainment company worldwide.

High growth potential with excellent balance sheet.