Stock Analysis

- United States

- /

- Entertainment

- /

- NYSE:LYV

Exploring 3 High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.1% drop, yet it has impressively risen by 30% over the past year with earnings projected to grow by 15% annually. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for innovation and scalability while aligning with these robust market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Invivyd | 50.60% | 71.37% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Clene | 78.50% | 60.70% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Travere Therapeutics | 31.75% | 72.43% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 251 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

PowerFleet (NasdaqGM:AIOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PowerFleet, Inc. offers Internet-of-Things solutions across the United States, Israel, and internationally, with a market capitalization of $785.90 million.

Operations: The company generates revenue through its Wireless IoT Asset Management segment, contributing $221.07 million.

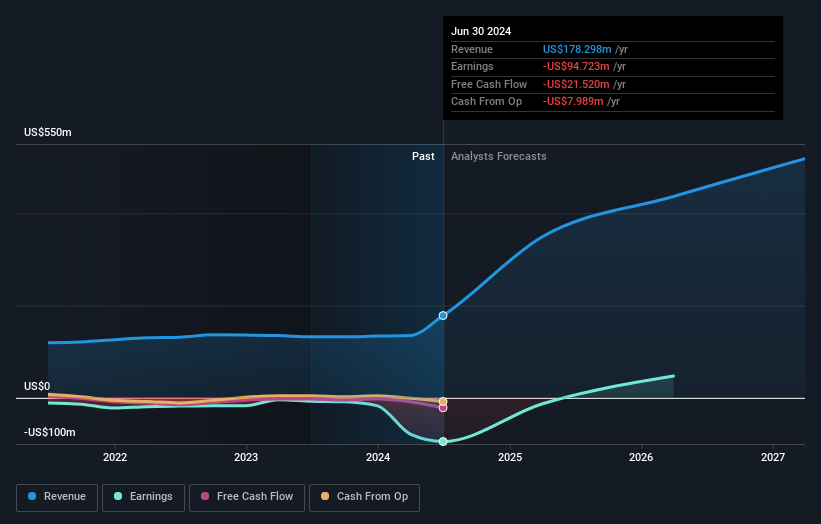

PowerFleet's trajectory in the high-tech sector is underscored by a robust 29.7% forecasted annual revenue growth, outpacing the broader U.S. market's 8.9%. Despite current unprofitability, there's an optimistic outlook with earnings expected to surge by 142.1% annually over the next three years, signaling potential for significant financial turnaround. Recent strategic moves, including the acquisition of Fleet Complete, position PowerFleet as a burgeoning leader in AIoT SaaS solutions, enhancing its competitive edge and market footprint. This strategic expansion is complemented by reaffirmed revenue expectations for 2025 exceeding $352 million and recent substantial share dilution through a $70 million equity raise aimed at fueling these growth initiatives.

- Delve into the full analysis health report here for a deeper understanding of PowerFleet.

Examine PowerFleet's past performance report to understand how it has performed in the past.

Live Nation Entertainment (NYSE:LYV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Live Nation Entertainment, Inc. is a global live entertainment company with a market capitalization of approximately $29.75 billion.

Operations: The company generates revenue primarily from its Concerts segment, contributing approximately $19.33 billion, followed by Ticketing at about $2.89 billion and Sponsorship & Advertising at roughly $1.17 billion.

Live Nation Entertainment, navigating through a dynamic entertainment landscape, has demonstrated resilience with a 9.2% annual revenue growth rate, outstripping the broader U.S. market's expansion of 8.9%. Despite a slight dip in net profit margins from 1.7% to 0.9%, the company's forward-looking strategies signal robust potential, underscored by an anticipated earnings surge of 31.4% per year. This growth trajectory is bolstered by significant R&D investments aimed at enhancing digital and live event integrations, ensuring Live Nation remains at the forefront of entertainment technology innovations and customer engagement trends.

- Click here and access our complete health analysis report to understand the dynamics of Live Nation Entertainment.

Learn about Live Nation Entertainment's historical performance.

Similarweb (NYSE:SMWB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers cloud-based digital intelligence solutions globally, with a market capitalization of approximately $939.95 million.

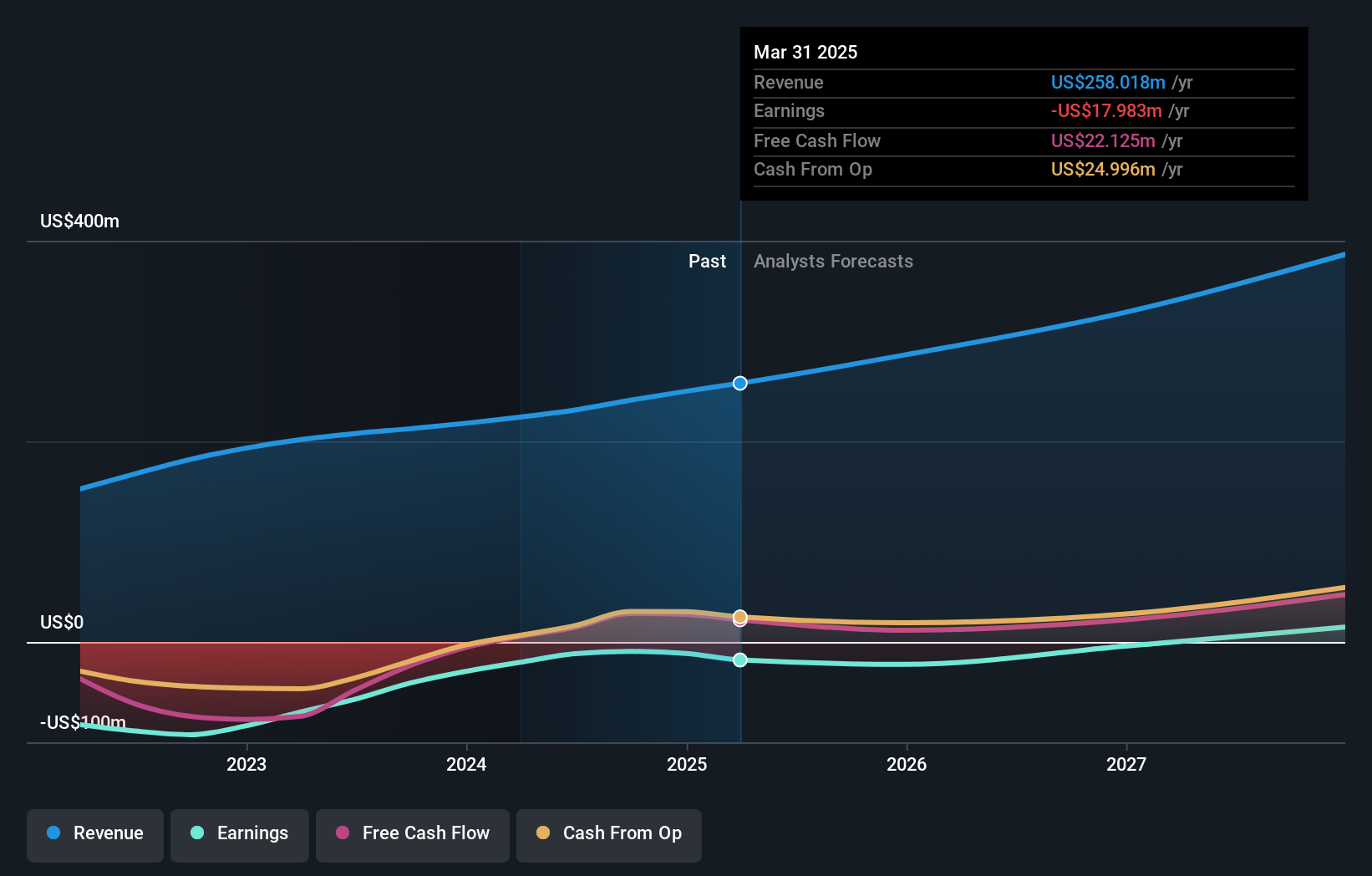

Operations: The company generates revenue primarily from its online financial information provider segment, amounting to $241.08 million.

Navigating through a challenging tech landscape, Similarweb has shown resilience with its recent earnings guidance indicating a revenue growth of about 15% year-over-year, aiming for $64.7 to $65.7 million in the fourth quarter alone. This growth is underpinned by a robust R&D focus, with expenditures aimed at enhancing analytics and market intelligence capabilities—critical as the company transitions more towards data-driven solutions. Despite past profitability challenges, Similarweb's strategic investments in technology and product development are setting the stage for future financial health, evidenced by an impressive forecasted earnings growth of 126.3% annually. With R&D expenses consistently fueling innovations, Similarweb is not just recovering but potentially reshaping its market segment to better meet evolving customer demands.

- Click to explore a detailed breakdown of our findings in Similarweb's health report.

Review our historical performance report to gain insights into Similarweb's's past performance.

Next Steps

- Click here to access our complete index of 251 US High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYV

Live Nation Entertainment

Operates as a live entertainment company worldwide.