- United States

- /

- Entertainment

- /

- NYSE:LYV

Does Live Nation’s 2024 Rally Still Make Sense After Antitrust Headlines?

Reviewed by Bailey Pemberton

- Wondering if Live Nation Entertainment is still a good buy after its dramatic rise? Let’s break down what’s really driving that value and if there’s more room to run.

- The stock has delivered a strong 28.2% return over the past year and is up 16.7% so far in 2024, despite a slight dip of -3.6% in the last month.

- Market chatter has focused on the ongoing antitrust scrutiny and major ticketing platform partnerships, both of which are keeping Live Nation in the headlines. These developments have made investors even more attentive to how external factors could impact both risk and growth potential going forward.

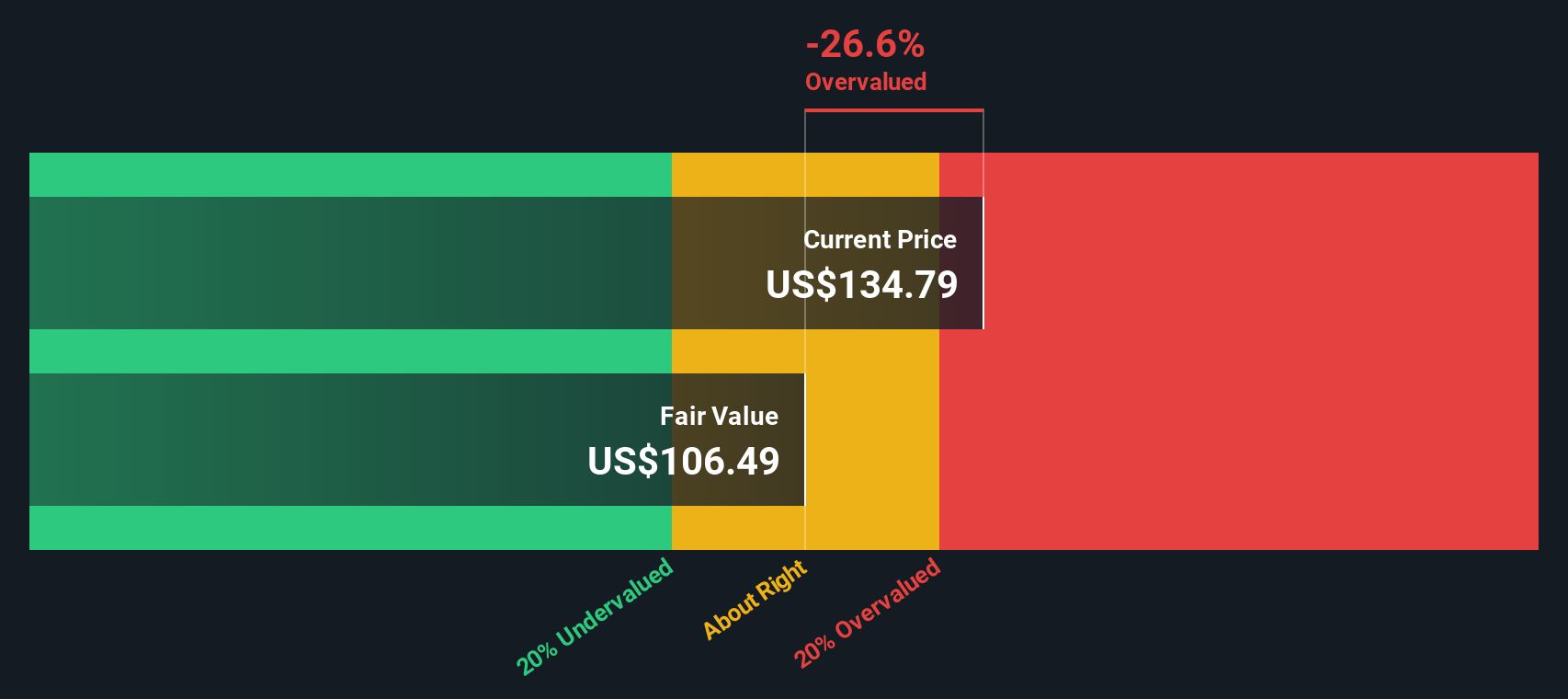

- Currently, Live Nation clocks in at a 1 out of 6 on our valuation score, which means only one metric points to the stock being undervalued. We will dig into how that score is calculated and show you a better way to assess what this means, so stick around for a smarter take on valuation at the end.

Live Nation Entertainment scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Live Nation Entertainment Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its expected future cash flows and discounting those amounts back to their present value. This approach aims to capture the real, underlying worth of the business based on how much cash it is set to generate over time.

For Live Nation Entertainment, the latest reported Free Cash Flow (FCF) stands at $1.24 billion. Analysts forecast continued growth in the coming years, with FCF projections reaching $2.30 billion by 2029. After the first five years, these projections are extended further by Simply Wall St to estimate a full decade, taking into account a likely tapering of growth over time.

Using the 2 Stage Free Cash Flow to Equity model, the resulting intrinsic value for Live Nation shares comes out at $111.49. However, based on where the stock trades today, this valuation implies the shares are 35.2% overvalued by DCF methodology. In other words, the current share price is running well ahead of the underlying fundamentals suggested by future cash flow potential.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Live Nation Entertainment may be overvalued by 35.2%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Live Nation Entertainment Price vs Earnings (PE Ratio)

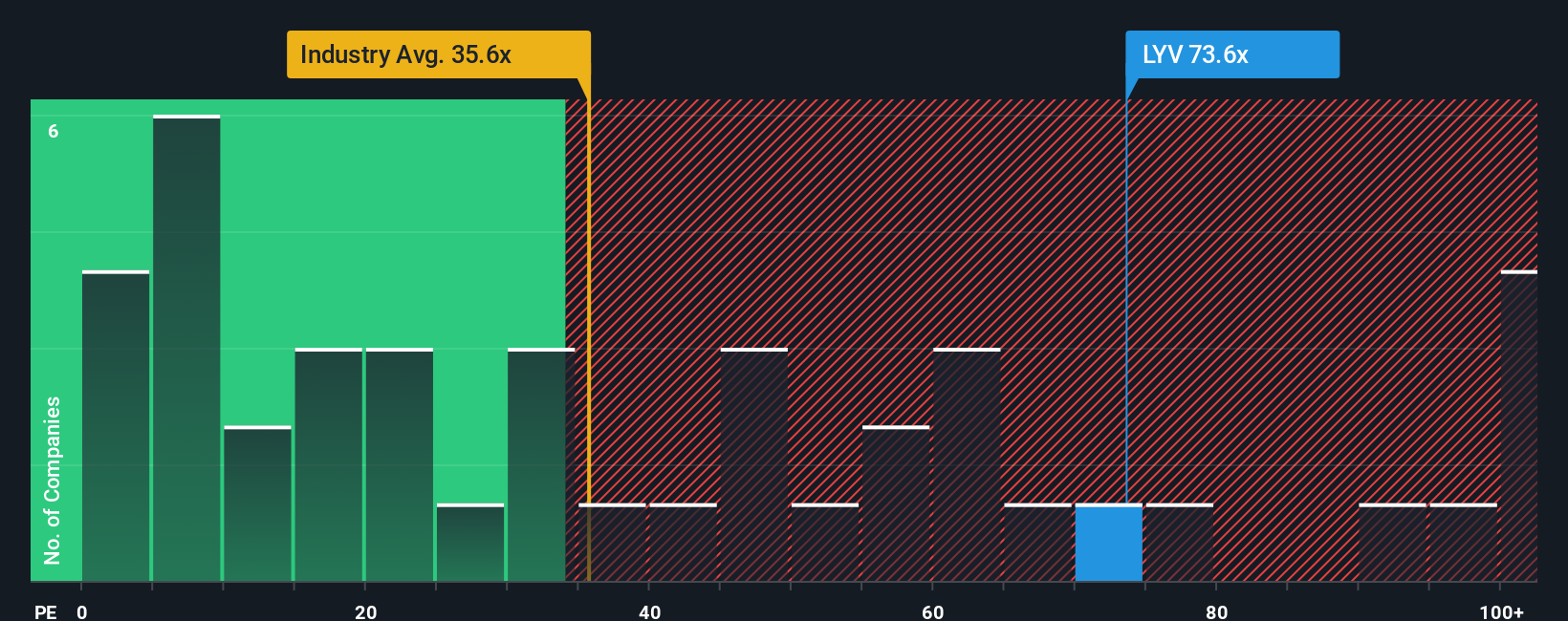

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies because it directly relates share price to a company’s bottom-line earnings. For investors, the PE ratio helps signal how much the market is willing to pay for each dollar of reported profits, making it a quick way to compare valuation across companies and sectors.

Importantly, what counts as a “fair” PE depends on expectations for growth and risk. Rapidly growing businesses can justify a higher PE, while riskier, slower-growing companies should trade at lower multiples. This context is crucial when assessing whether a stock’s PE is reasonable or stretched.

Currently, Live Nation Entertainment trades at a PE ratio of 63.8x. That is notably higher than both the Entertainment industry average of 24.8x and its direct peer average of 65.6x. While comparisons like these are helpful, they can overlook key specifics about a company’s prospects and challenges.

This is where Simply Wall St's “Fair Ratio” comes in. The Fair Ratio for Live Nation, calculated using factors like earnings growth, profit margins, business risks, relative market cap, and industry conditions, sits at 29.4x. Unlike simple peer or industry averages, the Fair Ratio is tailored to Live Nation itself and accounts for its unique position and outlook.

Comparing these numbers, Live Nation’s actual PE of 63.8x is well above its Fair Ratio. This suggests that even factoring in growth and industry trends, the stock is priced above what would be considered reasonable by Simply Wall St’s model.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Live Nation Entertainment Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple but powerful approach that lets you craft the story behind your investment view by combining your perspective on Live Nation's future revenue, profits, margins, and fair value into one coherent forecast. Narratives connect what you believe about a company, the numbers you expect, and the price you think is fair, helping bridge the gap between facts and your investment thesis.

With Narratives on Simply Wall St's Community page, millions of users can easily build and share their investment stories, track new insights, and see how their own forecasts stack up against others. Narratives are especially useful because they update automatically as new information, such as earnings announcements or news, becomes available.

This means you get a living view of fair value compared to current price, helping you decide when to act. For example, with Live Nation Entertainment, one Narrative might project strong international growth and margin improvement, suggesting a fair value of $195.00 per share. Another Narrative could focus on risks from regulatory pressures and more limited margin expansion, leading to a fair value estimate of just $130.00. Narratives make it easy to see and compare these views, turning analysis into actionable decisions.

Do you think there's more to the story for Live Nation Entertainment? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYV

Live Nation Entertainment

Operates as a live entertainment company worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives