- United States

- /

- Entertainment

- /

- NYSE:LION

Does Recent Streaming Growth Justify Lionsgate Studios’ Rising Share Price in 2025?

Reviewed by Bailey Pemberton

- Ever wonder if Lionsgate Studios stock is a hidden gem or just another name in entertainment? Let’s break down what might make it a compelling buy or not right now.

- The share price has climbed 8.2% over the past week and is up 4.8% for the month, bouncing back despite a YTD slip of 14.2% and a one-year gain of 6%.

- Industry buzz has been stirred by recent strategic studio partnerships and growing interest in Lionsgate's expanding streaming catalog. This has fueled speculation that the company’s growth engine could shift into a higher gear. Additionally, analyst commentary has highlighted the studio's merger activity and media asset sales as catalysts for recent price swings.

- Lionsgate Studios currently sits at a valuation score of 4 out of 6, suggesting there’s measurable value but also room for debate. Up next, we’ll dig into what goes into that score and why some methods might not capture the full picture until you see our favorite approach at the end.

Find out why Lionsgate Studios's 6.0% return over the last year is lagging behind its peers.

Approach 1: Lionsgate Studios Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to today's value using a required rate of return. This approach relies on both recent and forecasted cash flows to determine what the business might truly be worth now versus its market price.

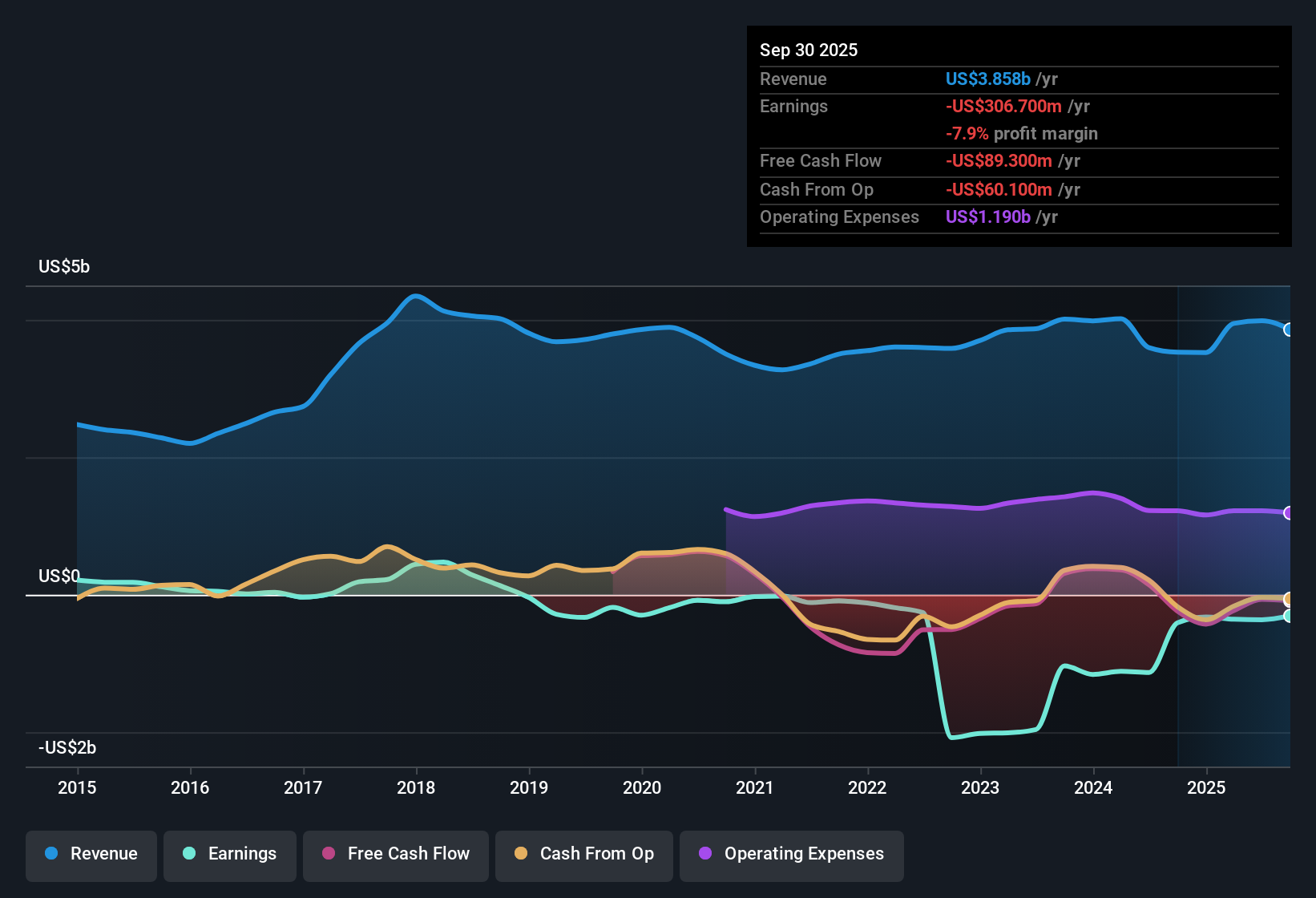

Looking at Lionsgate Studios, the company reported a last twelve months Free Cash Flow (FCF) of negative $88.13 million, meaning more money has gone out than in over this period. Analysts expect a turnaround, projecting positive FCF of $131.73 million by 2028. Simply Wall St extends these projections out to 2035, showing a trend of rising cash flows each year, with their estimates reaching as high as $186.01 million, discounted to $58.20 million in today's money.

When all these projections are discounted back, the DCF model calculates an intrinsic value of $4.50 per share. With the current share price about 49.6% above this value, the DCF approach suggests that Lionsgate Studios stock is significantly overvalued at present.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lionsgate Studios may be overvalued by 49.6%. Discover 848 undervalued stocks or create your own screener to find better value opportunities.

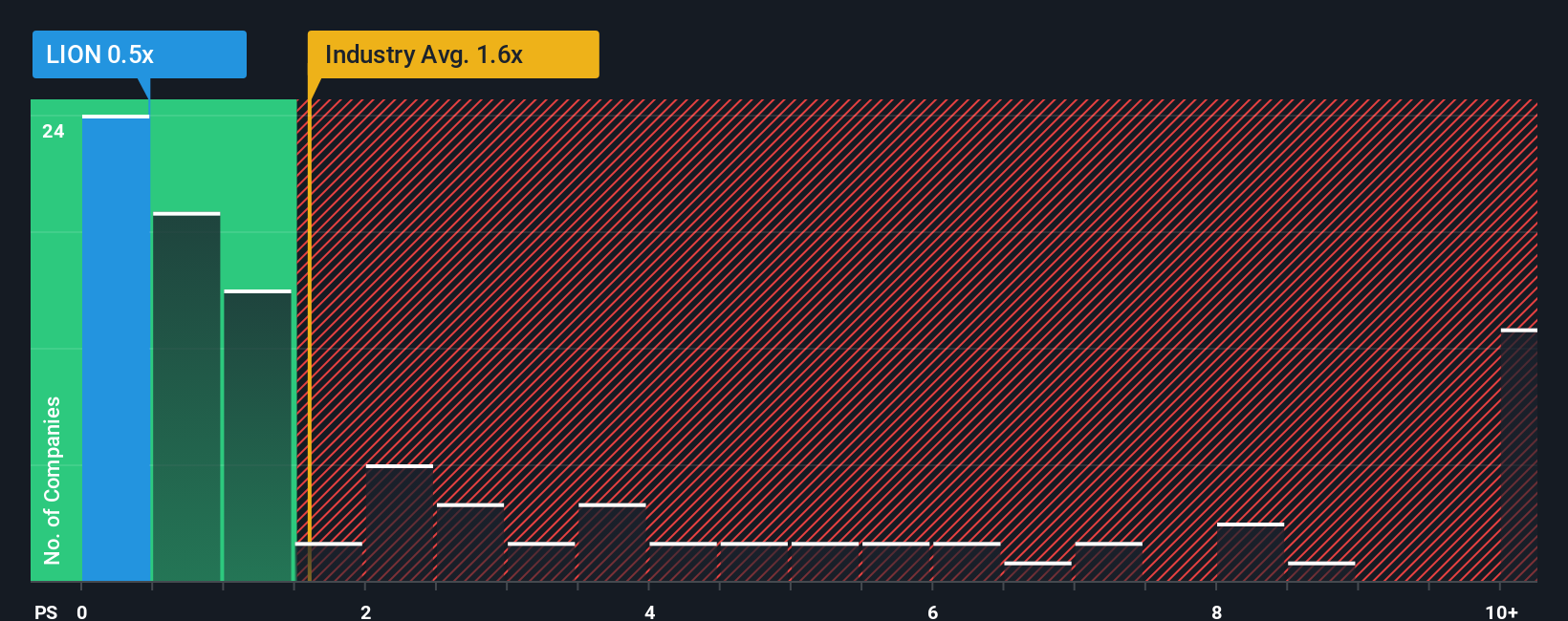

Approach 2: Lionsgate Studios Price vs Sales

The Price-to-Sales (P/S) ratio is a useful valuation tool, especially for companies like Lionsgate Studios where profits may be negative or inconsistent, but revenue growth gives a clearer view of underlying business activity. Since earnings can fluctuate due to industry cycles or major investments, the P/S multiple is especially relevant in the entertainment sector because it reflects what investors are willing to pay for each dollar of sales.

Growth prospects and business risk help determine what a “normal” or “fair” P/S ratio should be. A fast-growing company in a stable environment often commands a higher multiple, while riskier companies or slower growers generally see lower standards. Lionsgate Studios is currently trading at a P/S ratio of 0.49x, which is well beneath both the Entertainment industry average of 1.59x and the peer average of 2.79x.

Simply Wall St’s proprietary Fair Ratio aims to improve on these traditional comparisons by considering more than just headline figures. It analyzes key company-specific factors such as profit margins, expected sales growth, industry context, market capitalization, and risk profile to estimate what represents a "fair" multiple for Lionsgate Studios at this time. The Fair Ratio for Lionsgate Studios is 0.64x, a number tailored for its unique fundamentals rather than simply benchmarking against peers or the wider industry.

Comparing the Fair Ratio of 0.64x to the actual P/S multiple of 0.49x shows that the stock currently trades below what would be considered fair value based on its specific financial outlook and circumstances. This points to underappreciation in the current market pricing.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lionsgate Studios Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story for a company, the reasoning behind your personal fair value, driven by your own beliefs about future revenues, earnings, and margins, all tied together with a set of transparent financial assumptions. Narratives connect a company's real-world story to a financial forecast and then to a grounded estimate of what the shares are really worth.

This approach is designed to be intuitive and is available on Simply Wall St's Community page, where millions of investors craft and share their Narratives with a few clicks. By comparing each Narrative’s Fair Value with the current share price, you get a tailored view of whether it’s time to buy, hold, or sell. As major news or results come out, Narratives update in real time so your analysis never gets stale.

For example, the most optimistic investors see Lionsgate Studios riding ongoing franchise expansion and cost efficiencies, projecting a fair value as high as $10.71 per share. The most cautious highlight unpredictable box office results and competitive threats, estimating fair value as low as $7.00. Narratives let you explore these perspectives or construct your own, so your investment decision always fits your view of the business.

Do you think there's more to the story for Lionsgate Studios? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LION

Lionsgate Studios

Engages in diversified motion picture and television production and distribution businesses in the United States, Canada, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives