- United States

- /

- Entertainment

- /

- NYSE:LION

Assessing Lionsgate (LION) Valuation After a 10% Share Price Rebound This Month

Reviewed by Simply Wall St

See our latest analysis for Lionsgate Studios.

Lionsgate Studios has seen a notable shift recently, with its share price rebounding 10.05% over the past month after a sluggish start to the year. While the year-to-date share price return is still negative, the recent rally hints at growing optimism or changing sentiment among investors. Over the longer term, total shareholder return remains positive, suggesting momentum could be picking up pace.

If you’re curious about where momentum might strike next, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

The question now facing investors is whether growing optimism means Lionsgate Studios is undervalued at current levels, or if recent gains have already factored in expectations for future growth. Is there still a buying opportunity here, or has the market already priced in the rebound?

Most Popular Narrative: 17.3% Undervalued

According to the most popular narrative, Lionsgate Studios appears attractively priced, with its fair value estimate sitting well above the current share price. This provides a sharp contrast to recent price action and positions the company as a potential opportunity for further upside if the projections play out as expected.

Lionsgate is leveraging its franchise-building strategy to expand popular IPs (Hunger Games, John Wick, Saw, Twilight) across film, TV, animation, games, virtual experiences, and live shows. This taps into the growing demand for multi-platform, cross-medium content and creates new recurring revenue streams, which is expected to drive top-line revenue growth and provide greater earnings visibility.

Wondering what’s fueling this bullish outlook? The secret lies in aggressive profit turnaround forecasts, surging margins, and ambitious growth assumptions. See the full narrative to uncover the surprising numbers that underlie this potential value gap.

Result: Fair Value of $8.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent box office unpredictability or increased competition from larger streaming players could undermine Lionsgate Studios' earnings momentum and future market share gains.

Find out about the key risks to this Lionsgate Studios narrative.

Another View: Relative Value Signals

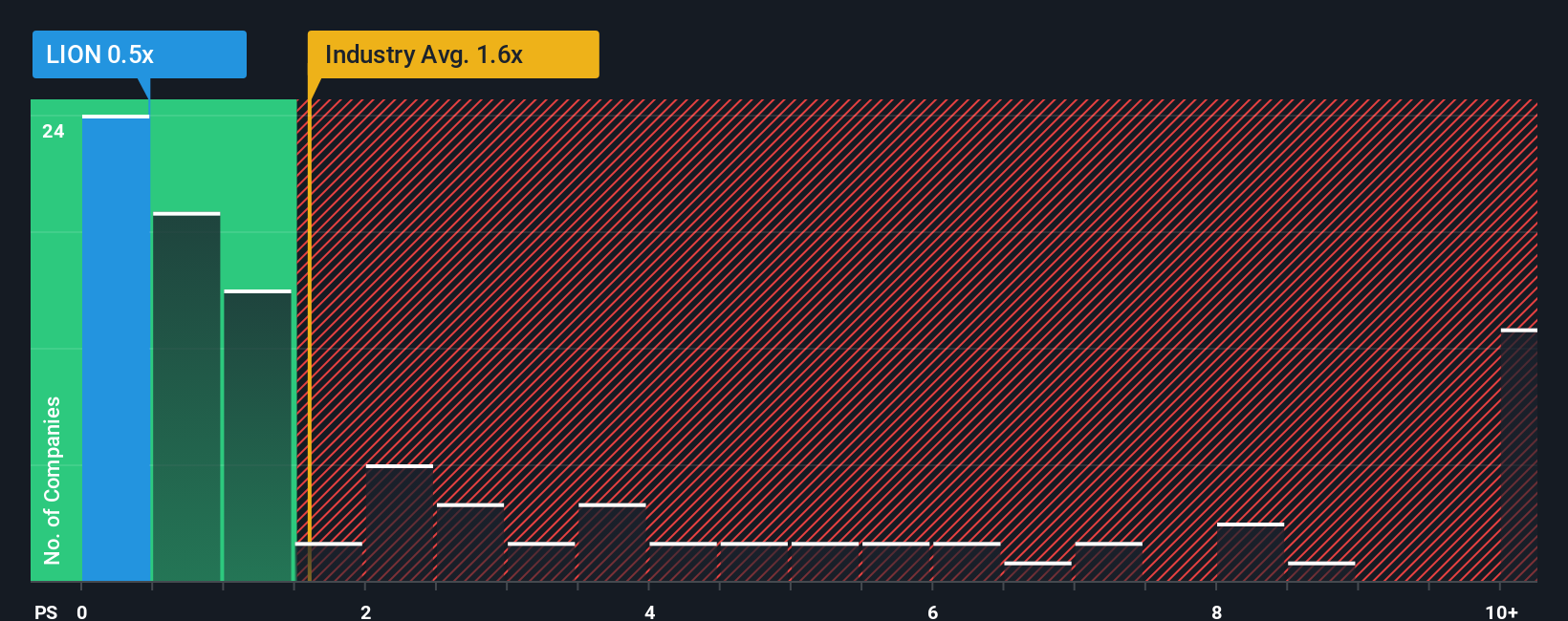

Looking beyond fair value estimates, Lionsgate Studios trades at a price-to-sales ratio of just 0.5x. This is not only well below the US Entertainment industry average (1.3x), but also lower than the peer average (2.8x) and its fair ratio of 0.7x. Such a wide gap suggests investors are cautious, but it might also signal untapped opportunity. Could the market be too skeptical about Lionsgate's turnaround?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lionsgate Studios for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 921 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lionsgate Studios Narrative

If you have a different perspective or want to dive deeper yourself, you can build your own Lionsgate Studios story in just a few minutes with Do it your way.

A great starting point for your Lionsgate Studios research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't settle for just one opportunity. Expand your watchlist now and stay ahead by tapping into fresh trends and overlooked value before everyone else does.

- Spot reliable income streams with these 14 dividend stocks with yields > 3%, featuring strong yields above 3% and consistent payout records.

- Tap into the fast-moving world of next-generation tech by checking out these 26 AI penny stocks, leading innovation at the intersection of artificial intelligence and industry disruption.

- Seize untapped value with these 921 undervalued stocks based on cash flows, powered by rigorous analysis of cash flows to bring you potential hidden gems before they’re widely noticed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LION

Lionsgate Studios

Engages in diversified motion picture and television production and distribution businesses in the United States, Canada, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success