- United States

- /

- Entertainment

- /

- NYSE:IMAX

Will Exclusive 70mm Film Re-Releases and Analyst Upgrades Shift IMAX's (IMAX) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, IMAX announced the reissue of Paul Thomas Anderson’s latest film and Ryan Coogler’s “Sinners” in IMAX 70mm format for a limited run at select US, Canadian, and UK theaters, alongside a special advance screening of the film “No Other Choice.”

- This series of high-profile re-releases underscores IMAX’s premium positioning in film exhibition and highlights strong industry partnerships with major filmmakers and studios.

- We'll examine how renewed enthusiasm for exclusive IMAX content, reinforced by analyst upgrades, influences the company's investment outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

IMAX Investment Narrative Recap

To own IMAX, you need to believe that premium, event-driven moviegoing will continue to attract audiences, and that IMAX can turn its exclusive filmmaker partnerships into sustained box office and install growth. The latest wave of high-profile re-releases may boost short-term revenue and strengthen the brand, but the true near-term catalyst remains the pace of new system installations, while reliance on blockbuster content pipeline volatility is still the largest risk; the impact of these reissues on that risk appears immaterial for now.

Among recent developments, IMAX’s agreement with Cinemark to upgrade and expand IMAX with Laser systems in 17 locations stands out. While the exclusive film re-releases reinforce IMAX’s appeal, this installation deal more directly supports scale and recurring cash flow, aligning with the primary growth drivers for the business.

However, investors should also be aware that, unlike a hit film run, shifts in consumer entertainment habits could ...

Read the full narrative on IMAX (it's free!)

IMAX's narrative projects $466.0 million in revenue and $74.0 million in earnings by 2028. This requires 8.7% yearly revenue growth and a $41.2 million earnings increase from current earnings of $32.8 million.

Uncover how IMAX's forecasts yield a $37.18 fair value, a 3% upside to its current price.

Exploring Other Perspectives

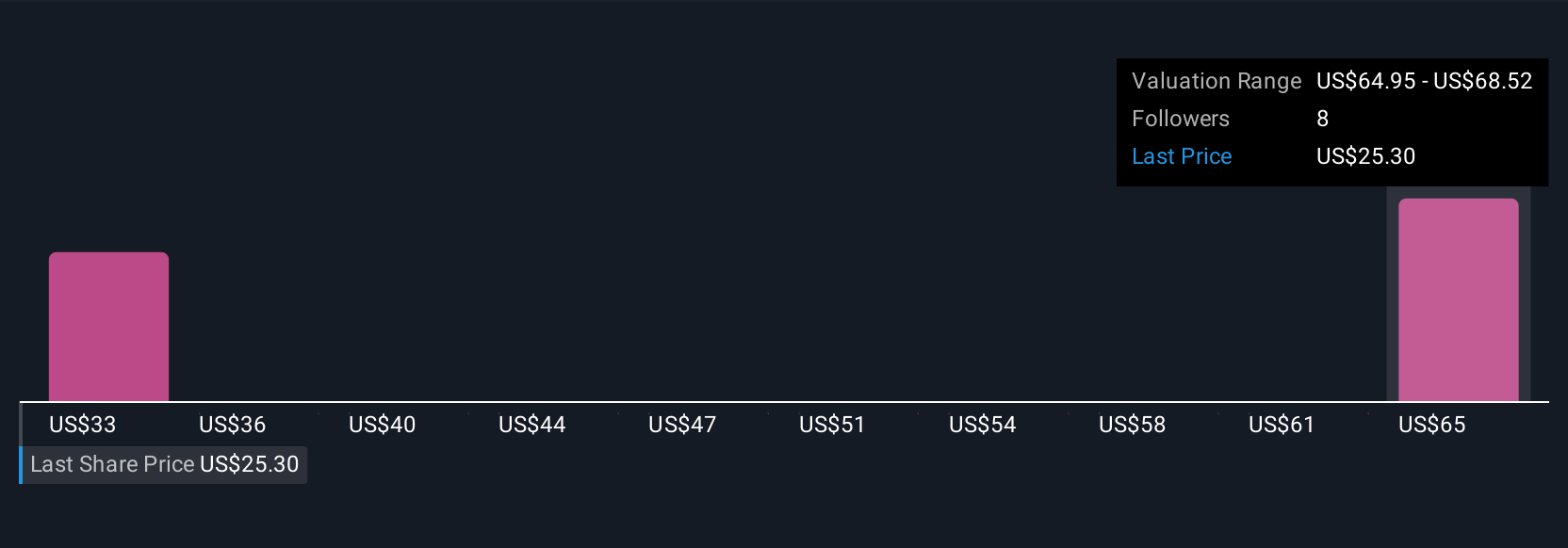

Simply Wall St Community fair value estimates for IMAX range from US$37.18 to US$59.36, based on three distinct forecasts. With so much riding on exclusive partnerships with major filmmakers, it's clear investor opinions can vary, explore more viewpoints to inform your outlook.

Explore 3 other fair value estimates on IMAX - why the stock might be worth as much as 65% more than the current price!

Build Your Own IMAX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IMAX research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free IMAX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IMAX's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IMAX

IMAX

Operates as a technology platform for entertainment and events in the United States, Greater China, rest of Asia, Western Europe, Canada, Latin America, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success