- United States

- /

- Entertainment

- /

- NYSE:IMAX

Did IMAX’s (IMAX) Debt Refinancing Just Shift Its Financial Flexibility and Growth Narrative?

Reviewed by Sasha Jovanovic

- IMAX Corporation recently completed a US$220 million private offering of 0.75% convertible senior notes due 2030, using the proceeds to repurchase outstanding convertible notes maturing in 2026 and to cover costs related to capped call transactions.

- This refinancing not only extends IMAX’s debt maturity profile but also aims to reduce the risk of shareholder dilution and bolster the company’s financial flexibility for future initiatives.

- We'll examine how IMAX’s refinancing and debt extension could influence the company's growth plans and margin resilience over time.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

IMAX Investment Narrative Recap

To own IMAX stock, you need confidence in the movie theater industry's ongoing ability to attract audiences and IMAX's position as a premium screen provider worldwide. The recent US$220 million convertible note refinancing gives IMAX a longer debt runway and more financial flexibility, but it doesn't fundamentally change the near-term catalysts: new system installations and major film releases remain central to earnings, while exposure to unpredictable box office performance is still a key risk.

IMAX's expansion deal with Cinemark unlocks 17 new and upgraded premium screens across the US and South America, directly addressing the importance of install growth as a short-term driver. This aligns with the broader trend of studios and exhibitors prioritizing blockbuster releases in IMAX formats, supporting the company's core catalyst even as it manages its capital structure more efficiently.

On the other hand, investors should be aware that if blockbuster output falters or audience habits shift, IMAX could face...

Read the full narrative on IMAX (it's free!)

IMAX's outlook forecasts $466.0 million in revenue and $74.0 million in earnings by 2028. This projection assumes an annual revenue growth rate of 8.7% and reflects an increase of $41.2 million in earnings from the current $32.8 million.

Uncover how IMAX's forecasts yield a $37.18 fair value, a 11% upside to its current price.

Exploring Other Perspectives

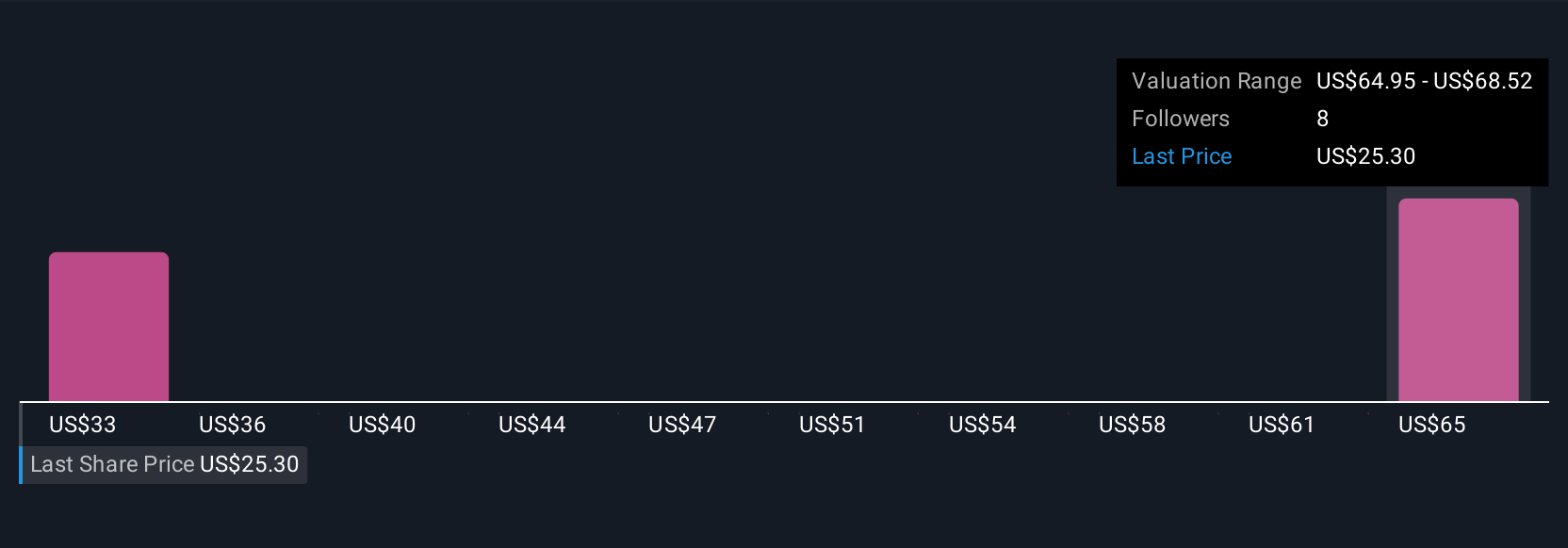

Retail investors in the Simply Wall St Community have posted fair value estimates for IMAX ranging from US$37.18 to US$59.23. With only three distinct perspectives, this diversity reflects both bullish and cautious outlooks, where installation growth remains central to the bull case but is counterbalanced by risks tied to cinema attendance trends. Explore several viewpoints to broaden your understanding of the stock.

Explore 3 other fair value estimates on IMAX - why the stock might be worth as much as 76% more than the current price!

Build Your Own IMAX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IMAX research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free IMAX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IMAX's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IMAX

IMAX

Operates as a technology platform for entertainment and events in the United States, Greater China, rest of Asia, Western Europe, Canada, Latin America, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives