- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

High Growth Tech Stocks To Watch In September 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 1.0% and is up 28% over the last 12 months, with earnings forecasted to grow by 15% annually. In this favorable environment, identifying high growth tech stocks can be crucial for investors looking to capitalize on robust market conditions and promising future earnings potential.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Super Micro Computer | 20.81% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.44% | 65.92% | ★★★★★★ |

| G1 Therapeutics | 36.07% | 67.23% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.80% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 250 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Take-Two Interactive Software (NasdaqGS:TTWO)

Simply Wall St Growth Rating: ★★★★★☆

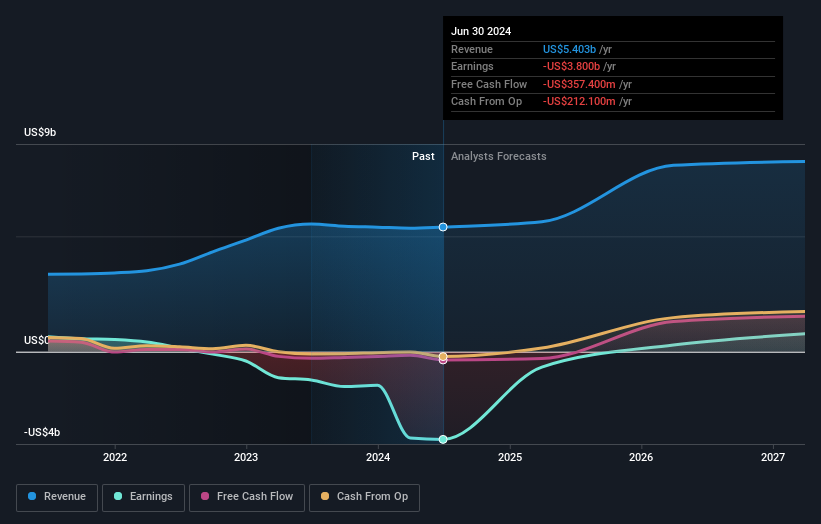

Overview: Take-Two Interactive Software, Inc. develops, publishes, and markets interactive entertainment solutions for consumers worldwide and has a market cap of $26.77 billion.

Operations: Take-Two Interactive Software, Inc. generates revenue primarily through its publishing segment, which accounted for $5.40 billion. The company focuses on developing, publishing, and marketing interactive entertainment solutions globally.

In the dynamic landscape of tech, Take-Two Interactive Software stands out with its strategic focus on enhancing user engagement and expanding its product portfolio. Despite a challenging fiscal quarter with a net loss widening to $262 million from the previous year's $206 million, the company is steering towards an ambitious revenue target of up to $5.67 billion for the fiscal year ending March 2025. This projection is underpinned by robust R&D investments aimed at innovating gaming experiences, as evidenced by their recent unveiling of NBA 2K25 featuring advanced ProPLAY™ technology. Moreover, Take-Two's commitment to growth is reflected in their expected earnings surge of 99.2% per annum, significantly outpacing broader market trends.

Ibotta (NYSE:IBTA)

Simply Wall St Growth Rating: ★★★★★☆

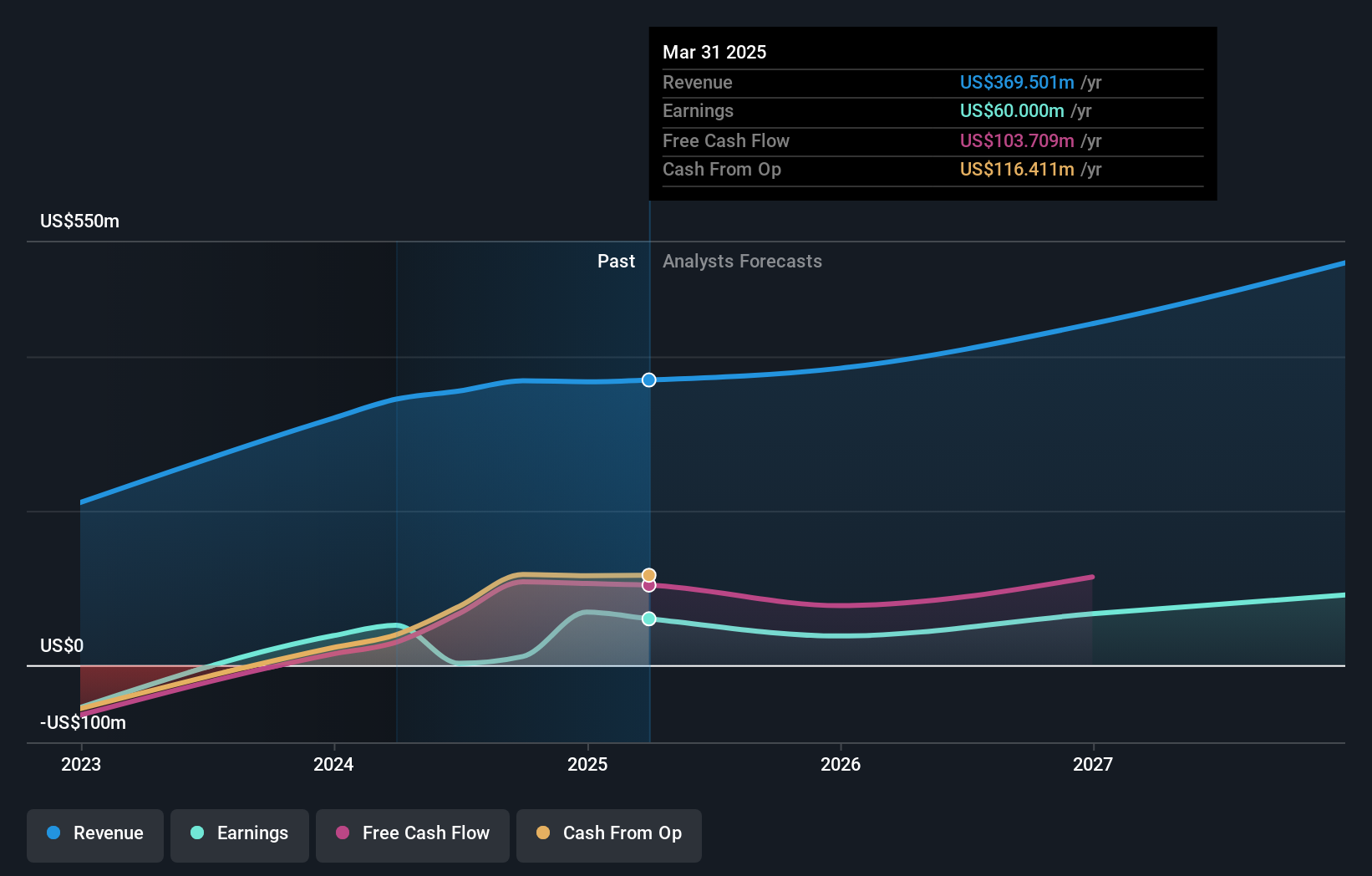

Overview: Ibotta, Inc. is a technology company that provides the Ibotta Performance Network (IPN) for consumer packaged goods brands to deliver digital promotions to consumers, with a market cap of $1.85 billion.

Operations: Ibotta generates revenue primarily through its Internet Software segment, which reported $355.21 million. The company focuses on enabling consumer packaged goods brands to deliver digital promotions directly to consumers through its Ibotta Performance Network (IPN).

Ibotta has demonstrated notable agility in the tech sector, pivoting towards profitability this year with a strategic focus on partnerships and market expansion. The company's revenue is projected to grow at 16.5% annually, outpacing the US market average of 8.7%, while its earnings are expected to surge by an impressive 68.4% per year. This growth trajectory is supported by robust R&D investments, which have been crucial in driving innovation and enhancing Ibotta's service offerings in the competitive digital coupon space. Recently, Ibotta announced a significant partnership with Instacart, positioning it as the preferred coupon provider across Instacart’s extensive network, potentially increasing user engagement and revenue streams from over 85,000 stores across North America. Additionally, the firm has committed to repurchasing up to $100 million of its Class A common stock, underscoring confidence in its financial health and future prospects.

- Navigate through the intricacies of Ibotta with our comprehensive health report here.

Explore historical data to track Ibotta's performance over time in our Past section.

Pinterest (NYSE:PINS)

Simply Wall St Growth Rating: ★★★★★☆

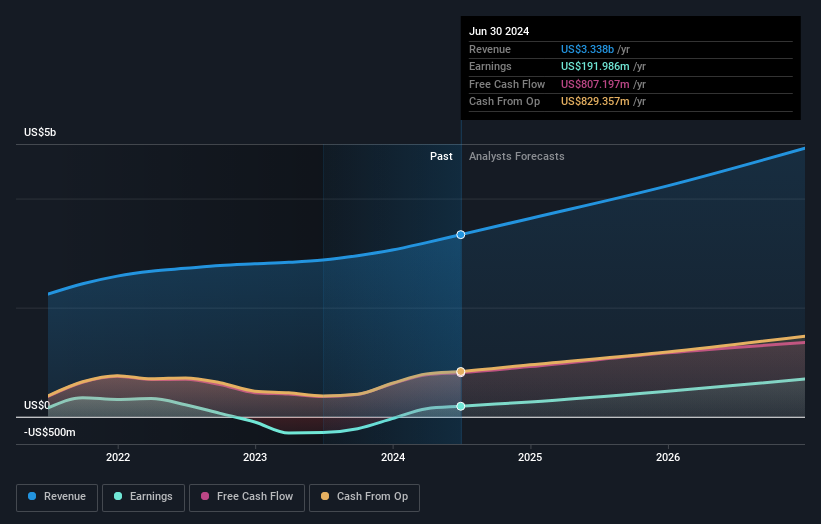

Overview: Pinterest, Inc. operates as a visual search and discovery platform in the United States and internationally, with a market cap of $20.15 billion (NYSE:PINS).

Operations: Pinterest generates revenue primarily through its Internet Information Providers segment, which brought in $3.34 billion. The company leverages its visual search and discovery platform to attract advertisers, contributing significantly to its revenue stream.

Amidst a transformative year, Pinterest has shown resilience and adaptability in the highly competitive tech landscape. With an impressive turnaround from a net loss of $34.94 million to a net income of $8.89 million in Q2 2024, the company's strategic shifts are yielding financial fruits. This reversal is underpinned by robust R&D investments that have not only fueled innovation but also supported a revenue surge to $853.68 million in the same quarter, marking a growth rate of 13.4% year-over-year. Looking ahead, Pinterest's forward guidance anticipates revenues reaching up to $900 million next quarter, reflecting confidence in sustained growth and operational efficiency.

- Get an in-depth perspective on Pinterest's performance by reading our health report here.

Gain insights into Pinterest's past trends and performance with our Past report.

Turning Ideas Into Actions

- Investigate our full lineup of 250 US High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential and fair value.