- United States

- /

- Entertainment

- /

- NYSE:HUYA

HUYA Inc.'s (NYSE:HUYA) 30% Price Boost Is Out Of Tune With Revenues

HUYA Inc. (NYSE:HUYA) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 26%.

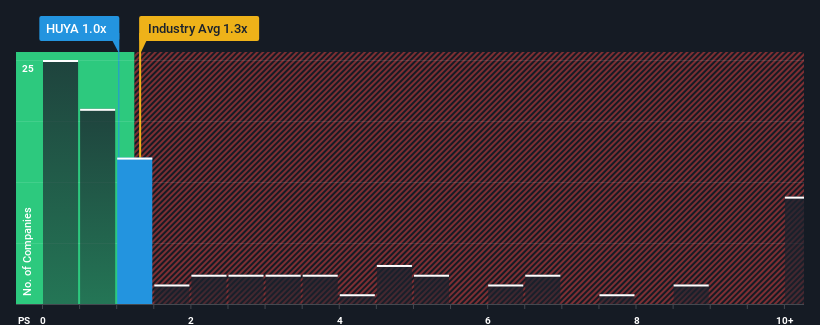

In spite of the firm bounce in price, there still wouldn't be many who think HUYA's price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in the United States' Entertainment industry is similar at about 1.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for HUYA

What Does HUYA's Recent Performance Look Like?

HUYA hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think HUYA's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like HUYA's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. The last three years don't look nice either as the company has shrunk revenue by 47% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 4.5% each year during the coming three years according to the analysts following the company. With the industry predicted to deliver 11% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that HUYA is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does HUYA's P/S Mean For Investors?

HUYA's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that HUYA's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for HUYA with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if HUYA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HUYA

HUYA

Through its subsidiaries, operates game live streaming platforms in the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Community Narratives