- United States

- /

- Interactive Media and Services

- /

- NYSE:GRND

Grindr (GRND): Taking Stock of Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

Grindr (GRND) has quietly drifted this month, but its longer track record, including a strong 3 year return, makes the current pullback worth a closer look for patient, risk tolerant investors.

See our latest analysis for Grindr.

The stock has bounced 6.2 percent on a 7 day share price return, but that sits against a weaker year to date share price trend and a still impressive 3 year total shareholder return. This suggests momentum has cooled while the longer term growth story remains intact.

If Grindr’s mix of growth and volatility has your attention, it could be a good moment to look for similar upside potential by exploring fast growing stocks with high insider ownership.

With the share price lagging this year despite robust multi year returns and analyst targets far above today’s level, is Grindr quietly trading at a discount, or is the market already factoring in all of its future growth?

Most Popular Narrative Narrative: 36.1% Undervalued

With Grindr last closing at $13.89 against a most popular narrative fair value of $21.75, the story assumes meaningful upside from here.

Ongoing shift toward value added premium tiers, coupled with planned pricing experiments and the introduction of more differentiated features (for example, mapping, intentions based products, A List), positions Grindr to lift ARPU and improve net margins over time. Investments in proprietary AI infrastructure (gAI) and enhanced in app experiences (such as mapping and local discovery) provide durable differentiation and are likely to increase user engagement and retention, thereby supporting stable, recurring revenues and long term earnings growth.

Want to see the math behind that upside, from surging top line forecasts to a future profit engine that looks very different from today? Read on.

Result: Fair Value of $21.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, escalating operating expenses and brand safety concerns could limit Grindr’s ability to fully monetize growth initiatives and pressure the long term margin story.

Find out about the key risks to this Grindr narrative.

Another View: Rich Multiples, Different Story

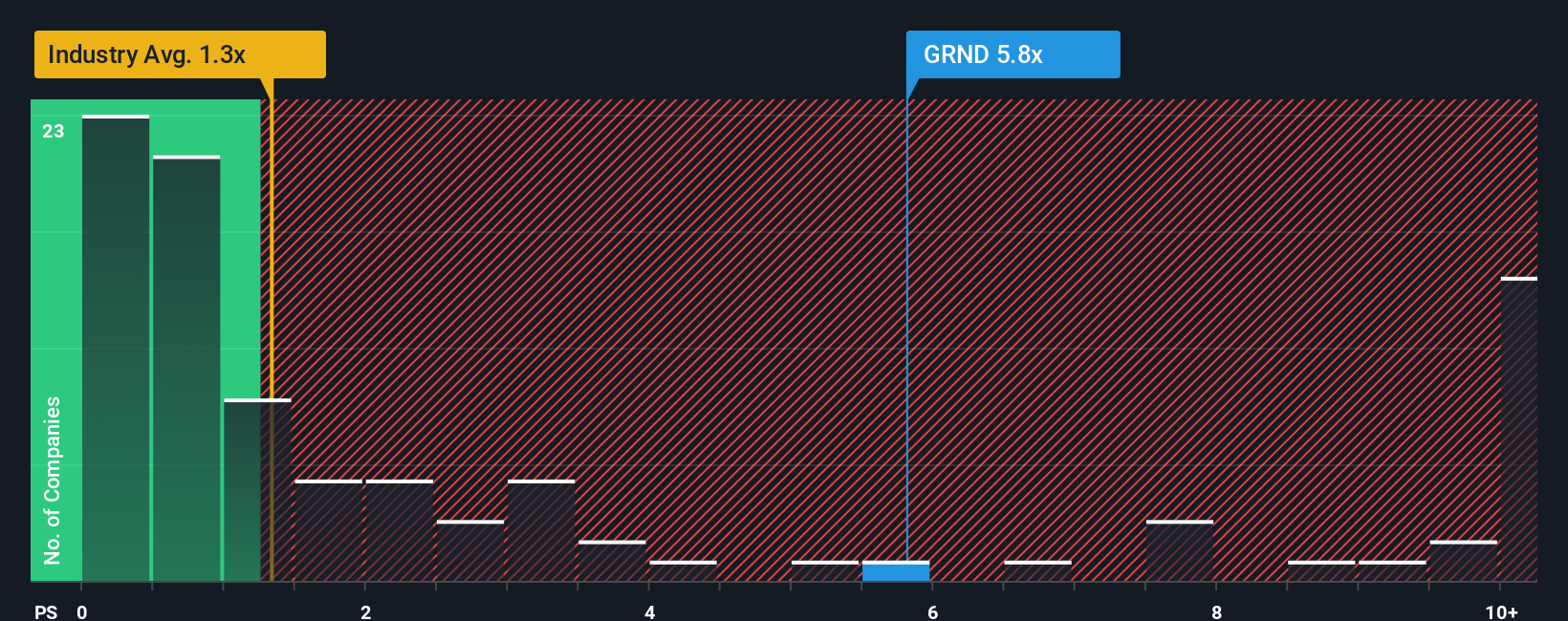

Our fair value work suggests Grindr is undervalued, but the price to sales ratio tells a tougher story. At 6.2 times sales versus a 2.8 times fair ratio and 1 times for the wider industry, the stock appears expensive and raises meaningful valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grindr Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fresh narrative in just minutes using Do it your way.

A great starting point for your Grindr research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover focused stock ideas you might otherwise overlook.

- Target reliable income streams by scanning these 10 dividend stocks with yields > 3% and spot companies paying yields that can strengthen your portfolio’s cash flow.

- Capture explosive innovation potential with these 24 AI penny stocks, where emerging artificial intelligence leaders could reshape entire industries.

- Position yourself ahead of the crowd by reviewing these 899 undervalued stocks based on cash flows that the market may be mispricing based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRND

Grindr

Operates a social networking and dating application for the lesbian, gay, bisexual, transgender, and queer (LGBTQ) communities worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion