- United States

- /

- Interactive Media and Services

- /

- NYSE:GRND

Does Grindr’s Strategic Deals Signal a Rebound After Shares Rose 12.9% This Month?

Reviewed by Bailey Pemberton

- Curious if Grindr stock is undervalued right now, or just catching your attention for the wrong reasons? You’re not alone. Investors want to know if there is real opportunity hiding behind the headlines.

- After a rough start to the year, Grindr shares are up 5.8% in the past week and 12.9% over the last month. However, the stock is still down almost 20% year-to-date.

- Much of the recent price movement has been driven by news of strategic expansions and fresh partnerships within the digital media landscape. Headlines about brand collaborations and platform growth have added fuel to investor speculation about Grindr’s long-term prospects.

- At first glance, Grindr scores a 3 out of 6 on our valuation checklist, suggesting it is undervalued in half of the key areas we examine. This can be broken down through a few classic valuation perspectives, with a smarter, more holistic approach discussed at the end.

Find out why Grindr's 0.4% return over the last year is lagging behind its peers.

Approach 1: Grindr Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is truly worth by projecting its future free cash flows and discounting them back to today. This process provides investors with an idea of the stock’s intrinsic value.

For Grindr, the DCF uses the 2 Stage Free Cash Flow to Equity approach, starting with reported Free Cash Flow (FCF) of $139 million. Analyst projections expect steady growth and forecast FCF to reach $309 million by 2029. For the years beyond, Simply Wall St extrapolates these figures and estimates FCF will approach $486.8 million by 2035. All cash flows are in US dollars.

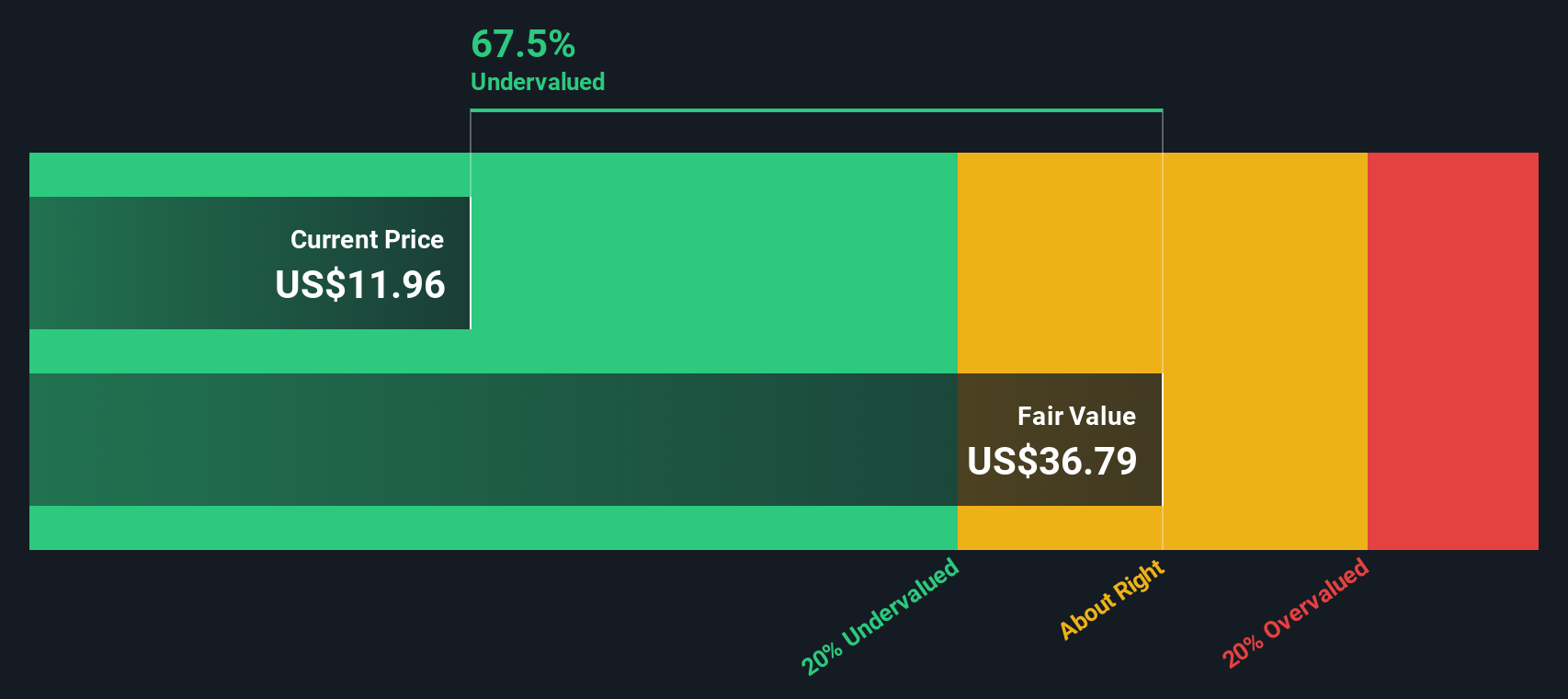

The result of this projection is a DCF fair value estimate of $34.44 per share. With Grindr’s recent share price sitting at a substantial 58.2% discount to this figure, the model suggests the stock is meaningfully undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Grindr is undervalued by 58.2%. Track this in your watchlist or portfolio, or discover 884 more undervalued stocks based on cash flows.

Approach 2: Grindr Price vs Sales (P/S)

The Price-to-Sales (P/S) ratio is a widely used metric for valuing companies, especially when profits may be volatile or still emerging, as is often the case in the digital media sector. It provides a sense of what investors are willing to pay for each dollar of sales, making it particularly useful for high-growth companies that may not yet be consistently profitable but have compelling revenue momentum.

Growth expectations and company risk both play a crucial role in what is considered a “normal” or “fair” P/S ratio. Rapidly expanding businesses with steady sales increases typically command higher P/S multiples, while more mature or riskier firms may see those multiples compressed toward industry or market averages.

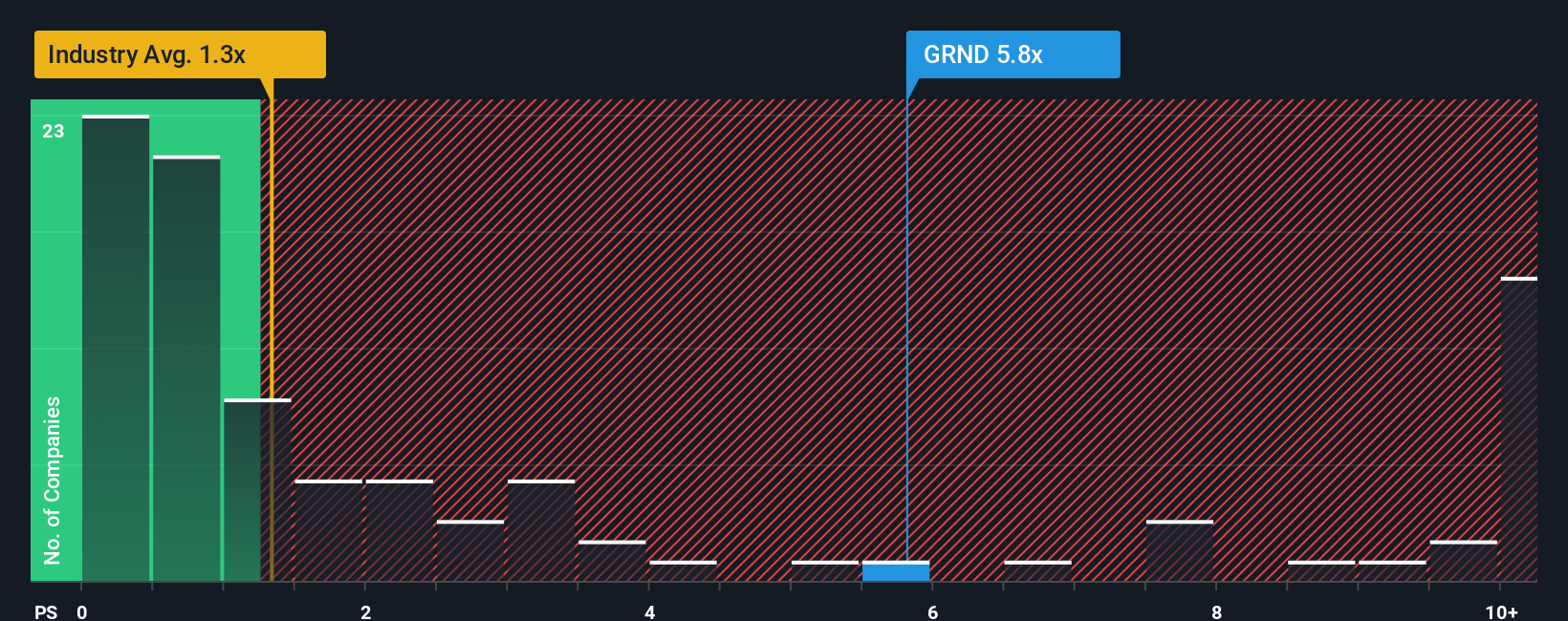

Grindr currently trades at a P/S ratio of 6.45x. This is well above the Interactive Media and Services industry average of 1.26x and also higher than its peer group’s average of 5.59x. On the surface, such a premium might concern value-focused investors.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio for Grindr is 3.14x, a proprietary benchmark tailored to Grindr’s unique outlook, growth rates, risk profile, profitability, and market cap. Unlike basic peer or industry comparisons, the Fair Ratio is designed to reflect what the company’s valuation multiple should be, considering its specific circumstances and overall market environment.

Comparing Grindr’s current P/S (6.45x) to its Fair Ratio (3.14x) suggests the stock is trading at a significant premium to what is justified by its fundamentals, growth, and risk factors.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Grindr Narrative

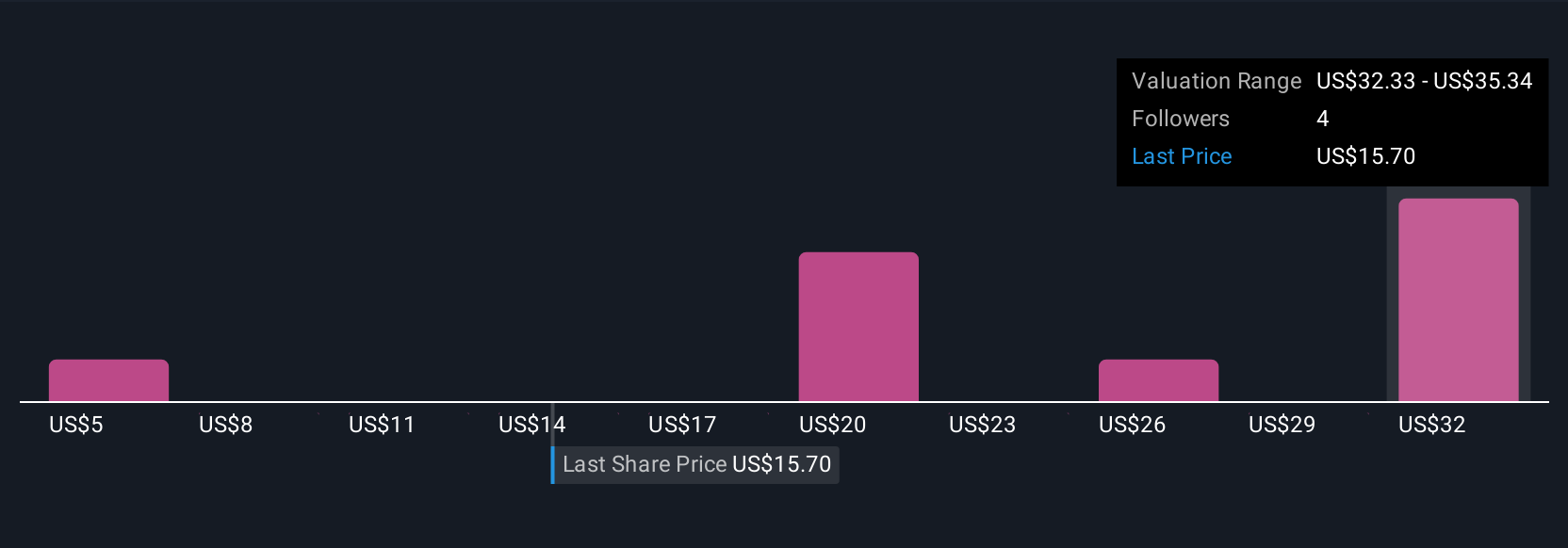

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company's future: how you think revenue, earnings, profit margins, and risks will play out, linked directly to financial forecasts and an estimate of fair value. By connecting your unique perspective to the numbers, Narratives let you see exactly how your assumptions stack up against the current market price and can help you decide when a stock is a potential buy or sell.

Narratives are easy to use and available on Simply Wall St's Community page, where millions of investors share, compare, and update their views. The best part is that Narratives are dynamic, instantly reflecting breaking news or fresh earnings reports, so your fair value estimate is always current.

For example, some investors might back Grindr to exceed $698 million in revenue and justify a fair value of $26.00 per share, thanks to global expansion and AI-powered features. Others may highlight monetization risks and assign a more conservative $20.00 fair value. No matter your take, Narratives help you connect the dots between your story, the numbers, and confident investing decisions.

Do you think there's more to the story for Grindr? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRND

Grindr

Operates a social networking and dating application for the lesbian, gay, bisexual, transgender, and queer (LGBTQ) communities worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives