- United States

- /

- Interactive Media and Services

- /

- NYSE:GETY

Getty Images Holdings, Inc.'s (NYSE:GETY) Popularity With Investors Under Threat As Stock Sinks 27%

Getty Images Holdings, Inc. (NYSE:GETY) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

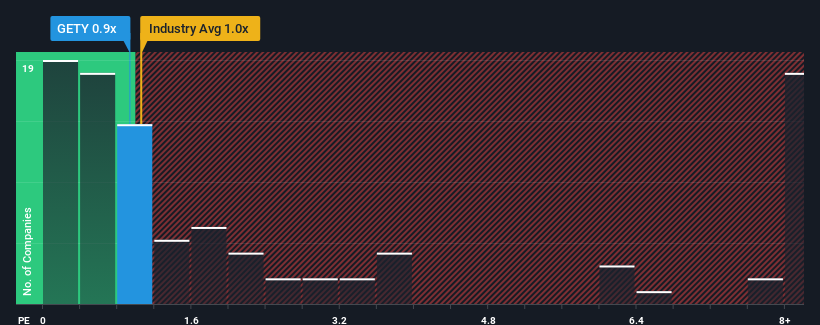

Although its price has dipped substantially, there still wouldn't be many who think Getty Images Holdings' price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S in the United States' Interactive Media and Services industry is similar at about 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Getty Images Holdings

What Does Getty Images Holdings' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Getty Images Holdings' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Getty Images Holdings.How Is Getty Images Holdings' Revenue Growth Trending?

Getty Images Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. Therefore, it's fair to say that revenue growth has definitely eluded the company recently.

Looking ahead now, revenue is anticipated to climb by 3.9% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 13%, which is noticeably more attractive.

In light of this, it's curious that Getty Images Holdings' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

Getty Images Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Getty Images Holdings' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You need to take note of risks, for example - Getty Images Holdings has 3 warning signs (and 1 which is potentially serious) we think you should know about.

If these risks are making you reconsider your opinion on Getty Images Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GETY

Getty Images Holdings

Provides creative and editorial visual content solutions in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives