- United States

- /

- Interactive Media and Services

- /

- NYSE:GETY

Does Getty Images Holdings (NYSE:GETY) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Getty Images Holdings, Inc. (NYSE:GETY) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Getty Images Holdings

How Much Debt Does Getty Images Holdings Carry?

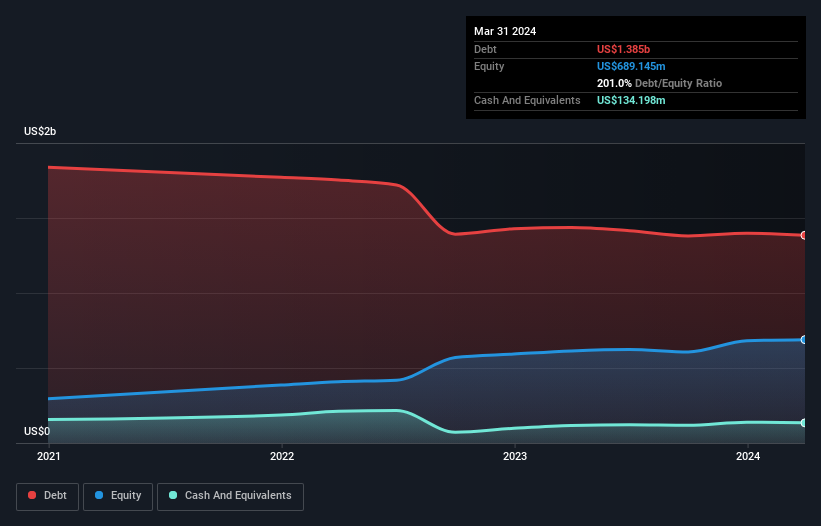

As you can see below, Getty Images Holdings had US$1.38b of debt, at March 2024, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has US$134.2m in cash leading to net debt of about US$1.25b.

How Strong Is Getty Images Holdings' Balance Sheet?

We can see from the most recent balance sheet that Getty Images Holdings had liabilities of US$422.3m falling due within a year, and liabilities of US$1.47b due beyond that. Offsetting these obligations, it had cash of US$134.2m as well as receivables valued at US$195.9m due within 12 months. So it has liabilities totalling US$1.57b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's US$1.34b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Getty Images Holdings's debt to EBITDA ratio (5.0) suggests that it uses some debt, its interest cover is very weak, at 1.3, suggesting high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Investors should also be troubled by the fact that Getty Images Holdings saw its EBIT drop by 14% over the last twelve months. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Getty Images Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Getty Images Holdings produced sturdy free cash flow equating to 51% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Mulling over Getty Images Holdings's attempt at covering its interest expense with its EBIT, we're certainly not enthusiastic. But at least its conversion of EBIT to free cash flow is not so bad. Overall, it seems to us that Getty Images Holdings's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Getty Images Holdings you should be aware of, and 1 of them can't be ignored.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GETY

Getty Images Holdings

Provides creative and editorial visual content solutions in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives