- United States

- /

- Interactive Media and Services

- /

- NYSE:GETY

Can Getty Images (GETY) Leverage AI Partnerships to Reinforce Its Competitive Advantage?

Reviewed by Sasha Jovanovic

- On October 31, 2025, Perplexity announced a multi-year global licensing agreement with Getty Images, enabling the integration of Getty's creative and editorial images into Perplexity's AI-powered search and discovery tools.

- This collaboration highlights the growing importance of ethical licensing and copyright attribution as AI platforms integrate premium visual content for enhanced user experiences.

- We'll explore how entering the AI-driven search market through the Perplexity deal could reshape Getty Images Holdings' investment case.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Getty Images Holdings Investment Narrative Recap

To be a shareholder in Getty Images Holdings, you need to believe the company's expansion into AI-driven licensing, like the Perplexity agreement, can help offset pressure from declining creative agency revenue and intense competitive threats. This latest partnership is a potential boost to Getty's largest catalyst: multi-year technology client deals that secure licensing revenue amid shifts in content consumption. However, the long-term risk tied to legal disputes over generative AI remains significant, and this announcement does not materially reduce that uncertainty.

The company's recent launch of brand apps in the Webflow Marketplace is particularly relevant, as it reinforces the catalyst of deepening integration with technology partners. This type of announcement reflects Getty's aim to broaden reach among business customers and designers, who increasingly expect seamless access to high-quality, licensed images for digital projects. Whether such tech partnerships are enough to counter the steepest risks is still an open question.

By contrast, investors should be aware of ongoing legal battles around AI-generated content that...

Read the full narrative on Getty Images Holdings (it's free!)

Getty Images Holdings' narrative projects $991.2 million revenue and $112.3 million earnings by 2028. This requires 1.5% yearly revenue growth and a $227.7 million increase in earnings from -$115.4 million.

Uncover how Getty Images Holdings' forecasts yield a $4.42 fair value, a 135% upside to its current price.

Exploring Other Perspectives

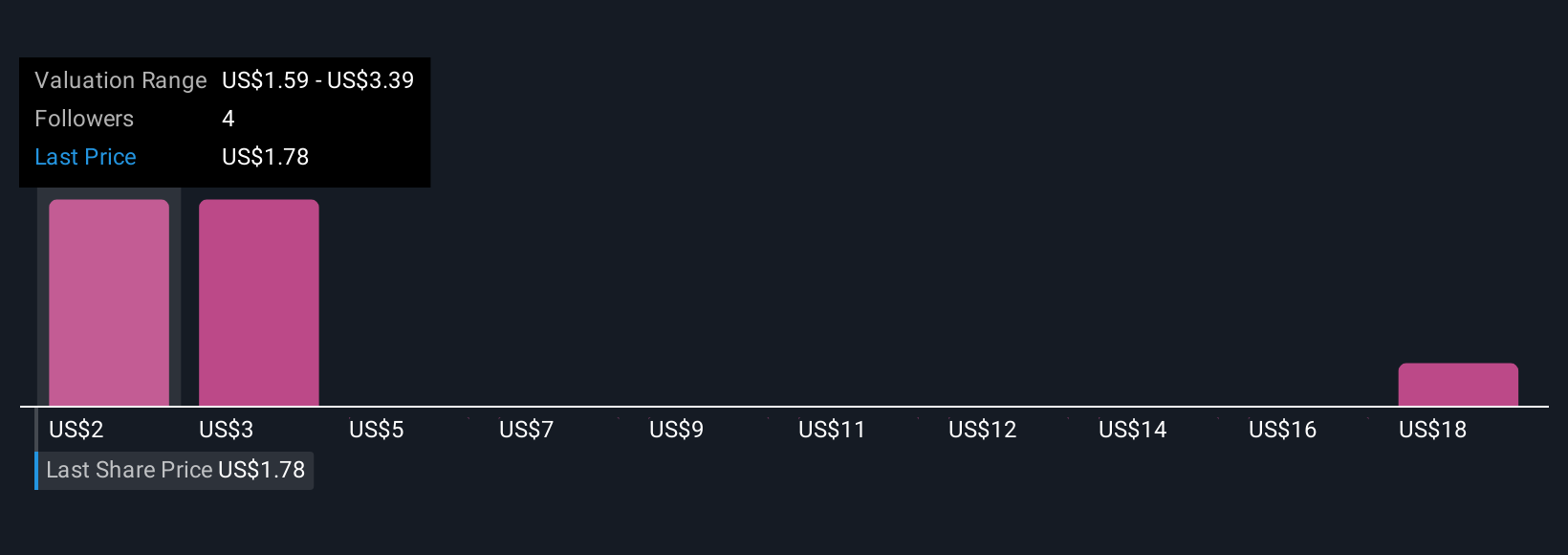

You have four fair value estimates from the Simply Wall St Community, ranging from US$1.59 to US$19.55 per share. Community views are split, while the main analyst concern remains Getty’s legal risk around AI content licensing.

Explore 4 other fair value estimates on Getty Images Holdings - why the stock might be worth over 10x more than the current price!

Build Your Own Getty Images Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Getty Images Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Getty Images Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Getty Images Holdings' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GETY

Getty Images Holdings

Provides creative and editorial visual content solutions in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion