- United States

- /

- Interactive Media and Services

- /

- NYSE:FUBO

Evaluating fuboTV (FUBO): Is the Streaming Stock Undervalued After Recent Volatility?

Reviewed by Simply Wall St

fuboTV (FUBO) shares have seen some movement lately, sparking investor curiosity about where the streaming platform stands as the broader streaming market continues to evolve. Many are watching for signs of sustainable growth in the months ahead.

See our latest analysis for fuboTV.

This year has seen fuboTV’s share price soar, with its year-to-date gain of 120.57% grabbing the attention of growth-focused investors. However, recent pullbacks have kept momentum in check. Looking more broadly, the 1-year total shareholder return stands at 113.01% and reflects ongoing volatility, but also renewed optimism about the streaming sector’s upside potential.

If you’re curious what other potential standouts are catching attention this year, it’s a great moment to expand your search and discover fast growing stocks with high insider ownership

The real question for investors is whether fuboTV’s current valuation leaves room for further upside, or if the stock’s rapid rise means the market has already priced in all expectations for future growth.

Most Popular Narrative: 30.9% Undervalued

fuboTV last closed at $3.11, with the most popular narrative setting a fair value at $4.50 per share, hinting at considerable upside if key assumptions hold true. With this gap, the market appears more skeptical about fuboTV's future growth than consensus forecasts suggest. Here is what is driving the valuation outlook:

Expansion of content partnerships (e.g., with DAZN), including distribution of exclusive sports rights and FAST channels, enhances differentiation and could drive higher average revenue per user (ARPU) and sustained premium subscription growth. Ongoing enhancement of user experience through personalized features (Catch Up To Live, Game Highlights, Timeline Markers) directly aligns with rising consumer demand for personalized, interactive content. This is likely to support higher engagement, lower churn, and improved earnings stability.

Want to see what bold assumptions are fueling this sizable upside? There is a surprising combination of profit margin bets and future subscriber targets holding up this price—find out exactly what they are inside the full narrative breakdown.

Result: Fair Value of $4.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent subscriber losses and increased competition from larger streaming bundles could quickly undermine bullish expectations for fuboTV’s future growth and profitability.

Find out about the key risks to this fuboTV narrative.

Another View: Market Ratios Suggest a Tighter Valuation

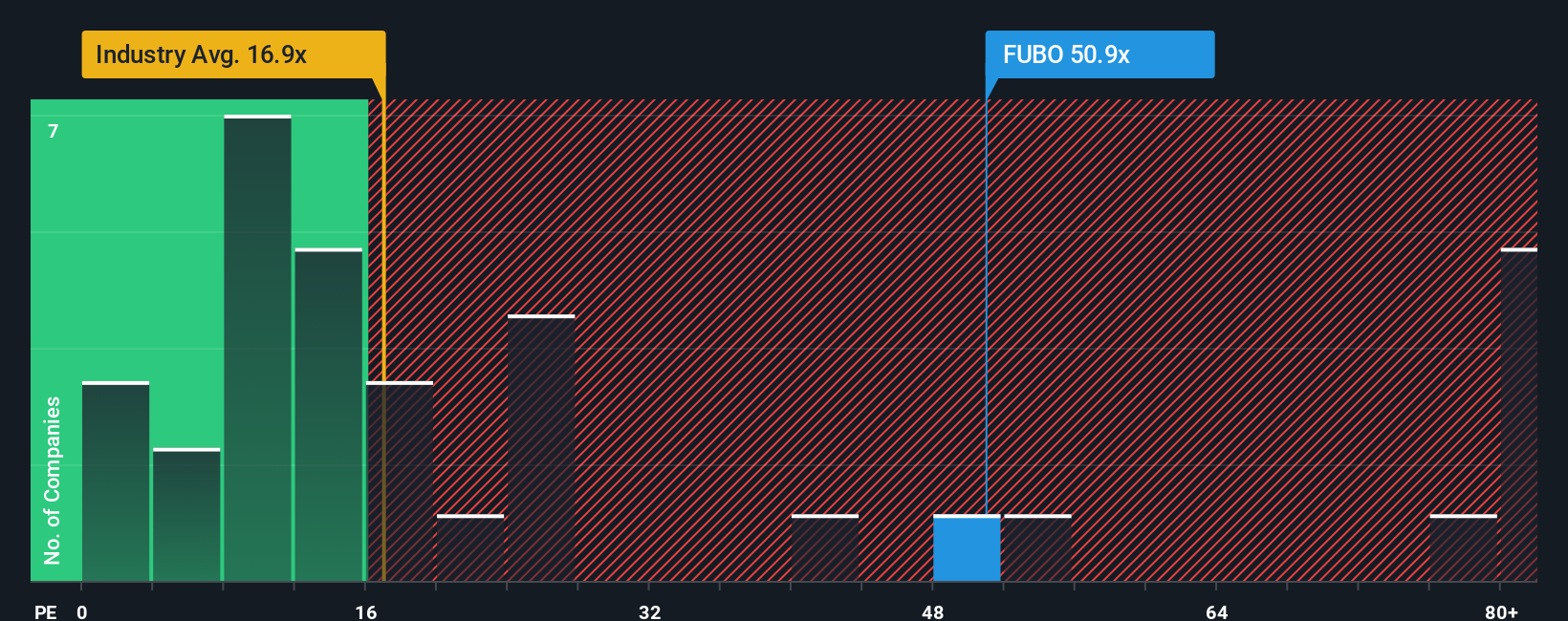

While analyst forecasts imply significant upside, the market's chosen price-to-earnings ratio for fuboTV is 32.6x, which is far higher than the US Interactive Media and Services industry average of 17.4x and the peer average of 14.6x. Even so, it remains below the fair ratio of 35.3x estimated from trends. This gap signals both optimism and caution, raising the stakes for investors to decide which number truly reflects future potential. Could market enthusiasm lead or lag behind fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own fuboTV Narrative

If you see fuboTV's story differently or want to put your own insights to the test, it's easy to build your own perspective, often in just a few minutes. Do it your way

A great starting point for your fuboTV research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't wait for opportunity to find you. Get ahead of the next major trend by searching for stocks that match your goals. Missing these could mean leaving profits behind.

- Accelerate your growth potential by targeting opportunities with these 925 undervalued stocks based on cash flows, offering standout value based on future cash flows and solid fundamentals.

- Capitalize on the booming world of artificial intelligence by checking out these 26 AI penny stocks, featuring pioneering companies shaping tomorrow’s digital economy.

- Secure regular income streams by selecting from these 14 dividend stocks with yields > 3%, focused on businesses with strong yields and a commitment to shareholder returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if fuboTV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUBO

fuboTV

Operates a live TV streaming platform for live sports, news, and entertainment content in the United States and internationally.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success