- United States

- /

- Media

- /

- OTCPK:AUDA.Q

The Director of Entercom Communications Corp. (NYSE:ETM), Louise Kramer, Just Sold 30% Of Their Holding

We wouldn't blame Entercom Communications Corp. (NYSE:ETM) shareholders if they were a little worried about the fact that Louise Kramer, the Director recently netted about US$915k selling shares at an average price of US$6.10. That sale reduced their total holding by 30% which is hardly insignificant, but far from the worst we've seen.

Check out our latest analysis for Entercom Communications

Entercom Communications Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the Chairman Emeritus, Joseph Field, for US$2.6m worth of shares, at about US$2.57 per share. So it's clear an insider wanted to take some cash off the table, even below the current price of US$6.13. As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. We note that the biggest single sale was only 6.6% of Joseph Field's holding. Notably Joseph Field was also the biggest buyer, having purchased US$2.7m worth of shares.

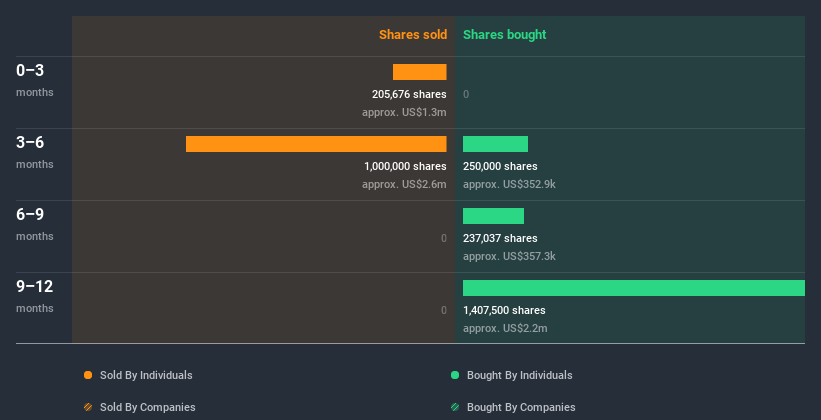

Over the last year, we can see that insiders have bought 1.89m shares worth US$2.7m. On the other hand they divested 1.21m shares, for US$3.8m. All up, insiders sold more shares in Entercom Communications than they bought, over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

I will like Entercom Communications better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Entercom Communications insiders own 17% of the company, currently worth about US$147m based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The Entercom Communications Insider Transactions Indicate?

Insiders sold Entercom Communications shares recently, but they didn't buy any. Despite some insider buying, the longer term picture doesn't make us feel much more positive. It is good to see high insider ownership, but the insider selling leaves us cautious. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. You'd be interested to know, that we found 3 warning signs for Entercom Communications and we suggest you have a look.

Of course Entercom Communications may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Entercom Communications, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:AUDA.Q

Audacy

A multi-platform audio content and entertainment company, engages in the radio broadcasting business in the United States.

Moderate and slightly overvalued.

Market Insights

Community Narratives