- United States

- /

- Media

- /

- NYSE:DV

How Investors May Respond To DoubleVerify (DV) Expanding Microsoft Ad Integration and Launching Automation Tool

Reviewed by Sasha Jovanovic

- In the past week, DoubleVerify announced an expanded integration with Microsoft Advertising, offering greater measurement coverage for Audience ads across Microsoft properties and launching the DV Campaign Automator™ to streamline campaign trafficking using Microsoft AI and data.

- This collaboration enhances value for advertisers by improving transparency, media authentication, and campaign efficiency across Microsoft’s premium digital inventory, reflecting DoubleVerify’s focus on innovative solutions and deepened platform partnerships.

- We'll examine how DoubleVerify's expanded Microsoft integration and automation tool may influence its digital ad verification growth thesis.

Find companies with promising cash flow potential yet trading below their fair value.

DoubleVerify Holdings Investment Narrative Recap

To invest in DoubleVerify Holdings, shareholders generally need to believe in the sustained long-term demand for independent digital ad verification, as well as the company’s ability to deepen business with major platforms. The expanded integration with Microsoft Advertising and the launch of the DV Campaign Automator™ directly support DoubleVerify’s short-term growth catalysts by broadening coverage and increasing automation, but platform dependency remains the most important risk, especially if access or terms change abruptly.

Among recent announcements, DoubleVerify’s extension of post-bid brand suitability measurement on Meta’s platforms stands out for investors thinking about catalysts. Like the Microsoft partnership, this move enhances the breadth of DoubleVerify’s verification reach, which could help support recurring revenue growth, assuming large platforms remain open to independent tools.

However, with increasing advertiser migration into walled gardens limiting independent verification, investors should be aware of the implications if access were to become more...

Read the full narrative on DoubleVerify Holdings (it's free!)

DoubleVerify Holdings' narrative projects $1.0 billion in revenue and $114.0 million in earnings by 2028. This requires 11.9% yearly revenue growth and an increase in earnings of $61.3 million from $52.7 million today.

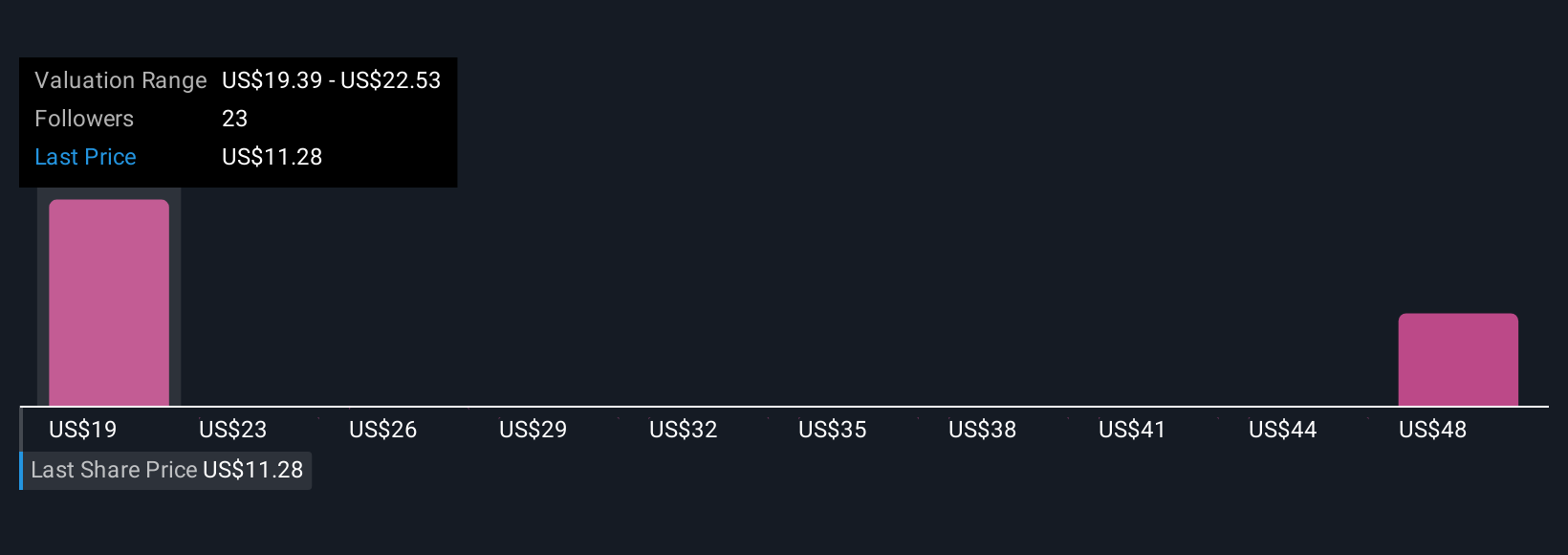

Uncover how DoubleVerify Holdings' forecasts yield a $19.39 fair value, a 73% upside to its current price.

Exploring Other Perspectives

Fair value estimates from 4 Simply Wall St Community members span US$19.39 to US$51.13, highlighting a wide range of expectations. As major partnerships expand coverage, access restrictions from platforms could have broader consequences for DoubleVerify’s growth and market reach.

Explore 4 other fair value estimates on DoubleVerify Holdings - why the stock might be worth just $19.39!

Build Your Own DoubleVerify Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DoubleVerify Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DoubleVerify Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DoubleVerify Holdings' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DV

DoubleVerify Holdings

Provides media effectiveness platforms in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion