- United States

- /

- Media

- /

- NYSE:DV

DoubleVerify (DV): Evaluating Valuation Following Key Expansions with Meta Threads and Microsoft Advertising

Reviewed by Kshitija Bhandaru

DoubleVerify Holdings (NYSE:DV) is taking another step forward in digital ad verification, expanding its brand suitability measurement across the Meta Threads feed. With this move, advertisers gain broader coverage and increased transparency over campaign performance.

See our latest analysis for DoubleVerify Holdings.

The latest features from DoubleVerify come at a pivotal time, after a rough stretch for the stock. Even with solid annual revenue growth and growing traction with major platforms like Meta and Microsoft, investor enthusiasm has faded. The 1-year total shareholder return is down 37%, while the share price has slid 44% year-to-date. Recent product launches hint at growth potential ahead, but the market’s risk perception remains cautious for now.

If DoubleVerify’s moves in digital ad verification have you thinking about what’s next, it’s worth broadening your outlook and exploring fast growing stocks with high insider ownership

The big question now, after the steep share price decline and new product launches, is whether DoubleVerify is trading at a bargain that overlooks future growth or if the market already has its next moves fully priced in.

Most Popular Narrative: 44% Undervalued

DoubleVerify’s most widely held fair value estimate stands at $19.39, far above the last closing price of $10.87. This sets up a potential gap between market caution and the narrative’s much higher expectation for the business.

The rapid expansion and adoption of DoubleVerify's solutions in emerging digital ad formats, particularly in Connected TV (CTV), social media, and retail media, are fueling sustained double-digit revenue growth. CTV measurement impressions are up 45% year-over-year, and product innovation pipelines (such as new CTV and Meta solutions) are expected to unlock further revenue streams in 2026 and beyond.

Want to know what's powering this ambitious fair value? The real story is a secret cocktail of bold revenue growth and a shockingly high profit multiple, hinting at expansion plans and margin leaps. Why such a leap of faith compared to today's stock price? Click to uncover which mega assumptions drive this narrative.

Result: Fair Value of $19.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant shifts in platform policies or a slowdown in digital ad spending could present challenges to DoubleVerify’s long-term growth story and market optimism.

Find out about the key risks to this DoubleVerify Holdings narrative.

Another View: Testing the Multiples

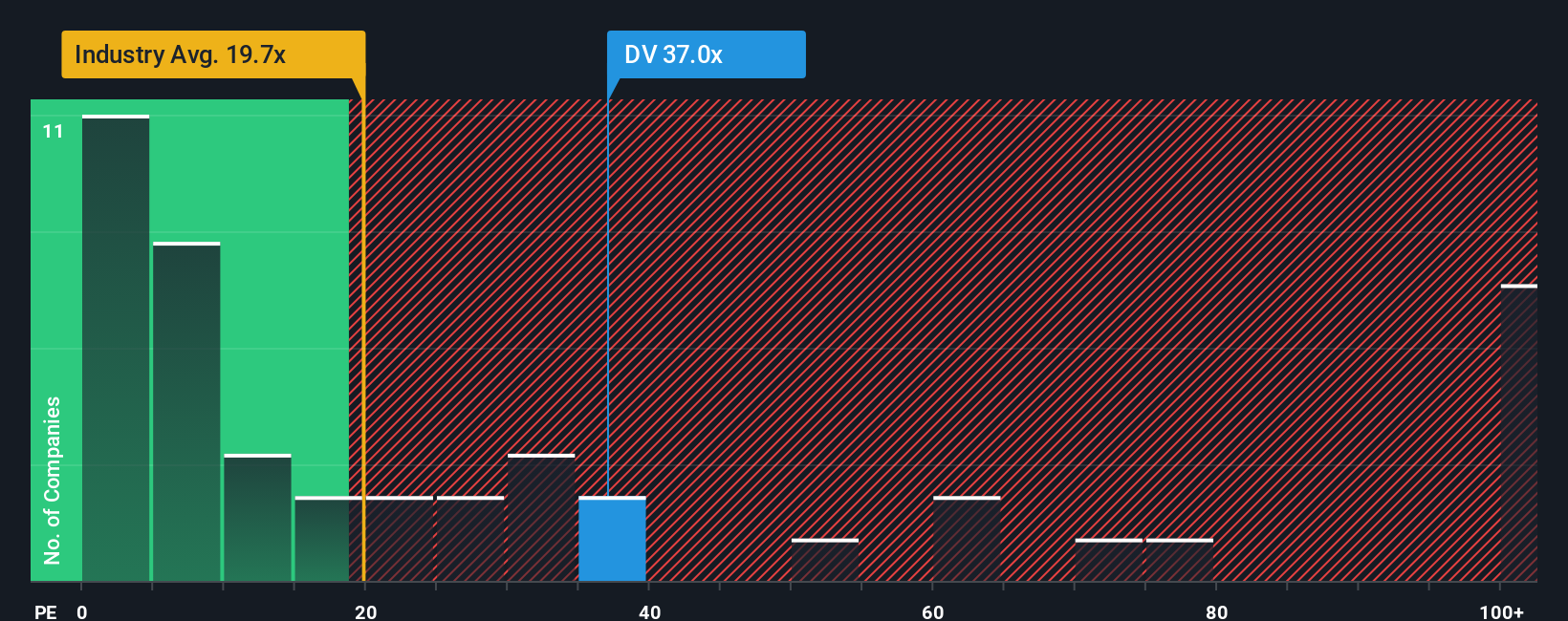

Taking a step back from narrative-driven valuations, DoubleVerify’s current price-to-earnings ratio sits at 33.7x, noticeably higher than both the US Media industry average of 19.2x and the company’s own fair ratio of 22.8x. This premium suggests investors are betting on robust future growth, but it could also signal heightened valuation risk if that growth does not materialize. Is the market’s optimism here grounded, or does it risk running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DoubleVerify Holdings Narrative

If you want to challenge the consensus or dig into the numbers your way, shaping your own story around DoubleVerify takes just a few minutes. Do it your way

A great starting point for your DoubleVerify Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why stick to one stock when game-changing opportunities are a click away? Let Simply Wall Street's screens guide you to the next smart move, right now.

- Capture the income advantage with reliable yields by checking out these 20 dividend stocks with yields > 3% among top-performing companies offering strong payouts.

- Ride the future of medicine and innovation by uncovering breakthroughs from these 33 healthcare AI stocks that are transforming healthcare with cutting-edge technologies.

- Pounce on potential bargains that others may have missed. See these 871 undervalued stocks based on cash flows for stand-out value based on real cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DV

DoubleVerify Holdings

Provides media effectiveness platforms in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion