- United States

- /

- Entertainment

- /

- NYSE:DIS

Walt Disney (DIS): Exploring Whether the Entertainment Icon Is Still Undervalued

Reviewed by Simply Wall St

Walt Disney (DIS) has seen shares move in recent days, raising questions about what is shaping sentiment around the entertainment giant. Investors are taking notice of the current valuation, especially given the company’s history of resilience in changing markets.

See our latest analysis for Walt Disney.

This year, Walt Disney’s share price has held mostly steady, but its total shareholder return tells a more positive story. It is up 18.5% over the past twelve months. While the latest dip reflects some wavering market sentiment, ongoing strategic moves have kept investors engaged and highlight the company’s longer-term potential.

If the recent momentum in media stocks has you wondering what else is out there, it might be time to expand your search and discover fast growing stocks with high insider ownership

With Disney still trading around a 20 percent discount to the average analyst price target, investors are left wondering if this is an undervalued opportunity or if the market has already priced in its future growth story.

Most Popular Narrative: 15% Undervalued

Walt Disney’s narrative-backed fair value stands at $131.50, a strong margin above the last close price of $111.68. The numbers suggest investors may be missing the company’s multi-pronged growth drivers.

ESPN remains the most valuable live sports platform, and its evolving partnership with the NFL is a game changer. Exclusive rights, expanded streaming packages, and the launch of ESPN Unlimited could make Disney the default home for professional football. The NFL partnership extends beyond linear broadcasts to streaming exclusives, international rights, and integrated advertising packages, creating enormous revenue upside. By leveraging the NFL brand, Disney can accelerate ESPN’s subscriber growth, command premium ad pricing, and entrench its dominance in live sports.

Think Disney’s value story stops at theme parks and movies? One core business is poised to become a digital cash machine, reshaping profit assumptions. Discover the growth math and see what the market might be overlooking.

Result: Fair Value of $131.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising sports rights costs and fierce streaming competition could pressure Disney’s margins and stall its expected earnings momentum.

Find out about the key risks to this Walt Disney narrative.

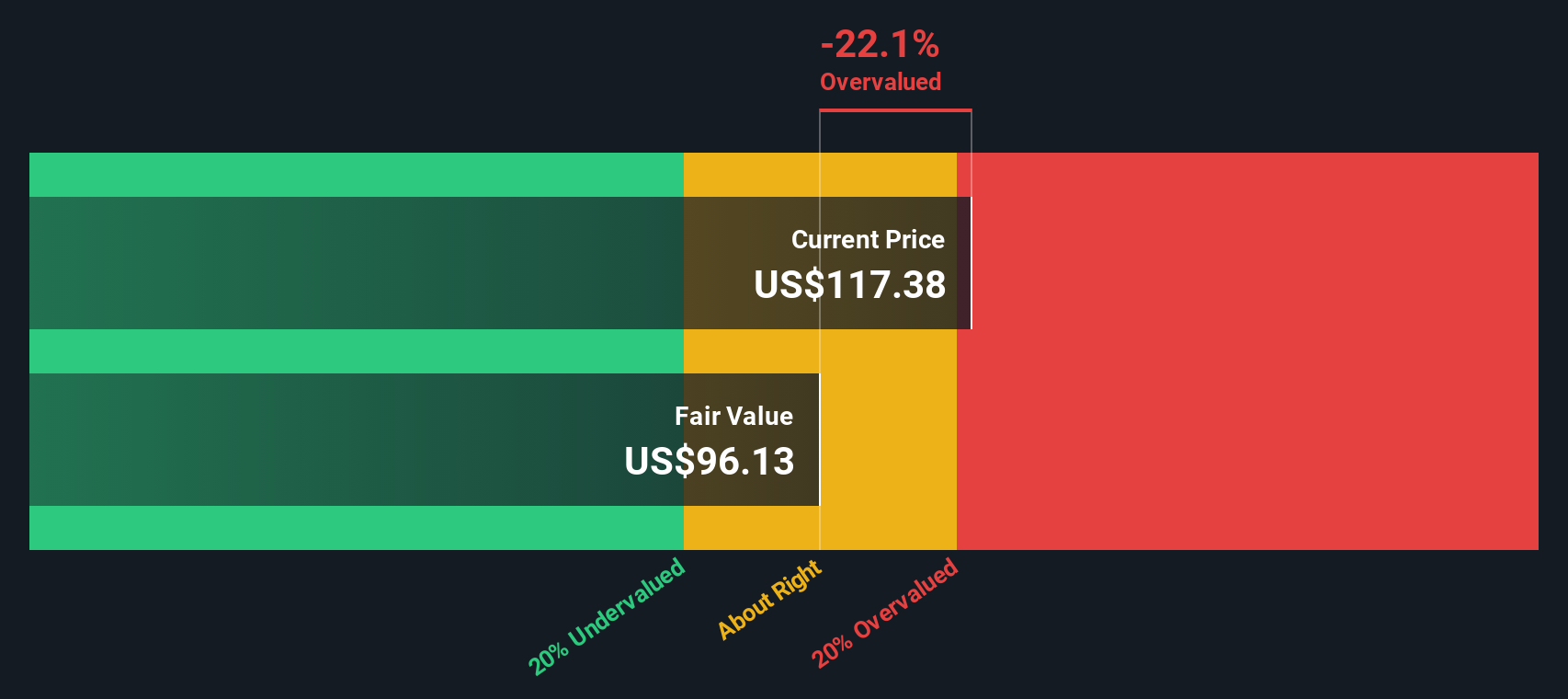

Another View: Discounted Cash Flow Model Takes a Stricter Stance

While the market and narrative valuations hint at significant upside, our DCF model suggests a more conservative angle. It pegs fair value at $106.24, which is slightly below the current share price. This signals caution and prompts investors to weigh future growth assumptions carefully. Could the market be too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Walt Disney for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Walt Disney Narrative

If you want to challenge these perspectives or follow your own instinct, you can dive into the numbers and shape your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Walt Disney.

Looking for More Investment Ideas?

Don’t wait for the next market shift when new opportunities are already within your reach. Open up your investing playbook by charting a course through these handpicked prospects.

- Tap into reliable income streams by checking out these 17 dividend stocks with yields > 3% offering persistent yields for steady returns in any market.

- Ride the AI wave and get ahead with these 27 AI penny stocks powering tomorrow's most innovative breakthroughs.

- Step into the future of finance with these 80 cryptocurrency and blockchain stocks making headlines for transforming transactions and driving blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DIS

Walt Disney

Operates as an entertainment company in the Americas, Europe, and the Asia Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives