- United States

- /

- Entertainment

- /

- NYSE:CNK

How Investors Are Reacting To Cinemark Holdings (CNK) $300 Million Buyback and Q3 2025 Earnings

Reviewed by Sasha Jovanovic

- Cinemark Holdings recently announced a US$300 million share repurchase program, outlined its openness to future acquisitions, and reported third quarter 2025 earnings results, detailing revenue of US$857.5 million and net income of US$49.5 million for the quarter ended September 30, 2025.

- Alongside capital allocation updates, management emphasized a focus on optimizing its theater footprint and investing in high-quality acquisition targets to drive long-term growth.

- We'll examine how the initiation of a major share buyback program could shape Cinemark's investment narrative and future growth approach.

Find companies with promising cash flow potential yet trading below their fair value.

Cinemark Holdings Investment Narrative Recap

To invest in Cinemark Holdings, you need conviction in the resilience of out-of-home entertainment and consumer demand for shared moviegoing experiences, especially as management pursues expansion via acquisitions and capital returns. The new US$300 million share repurchase program signals management’s commitment to shareholder value but does not fundamentally shift the key short-term catalyst, namely, the performance of the upcoming film slate, or fully mitigate exposure to the biggest risk: the volatility tied to film release cycles and box office attendance.

Among the recent announcements, the authorization of a major buyback stands out for its potential to influence returns in the near term. While this move may attract investor interest, it occurs against a backdrop of lower year-on-year earnings and ongoing dependency on hit-driven studio releases, both of which shape the short-term outlook.

Yet, despite these initiatives, investors should be aware that when film slates disappoint or competition from streaming intensifies...

Read the full narrative on Cinemark Holdings (it's free!)

Cinemark Holdings' narrative projects $3.7 billion in revenue and $297.4 million in earnings by 2028. This requires 5.0% yearly revenue growth and a $8.6 million earnings increase from current earnings of $288.8 million.

Uncover how Cinemark Holdings' forecasts yield a $33.91 fair value, a 12% upside to its current price.

Exploring Other Perspectives

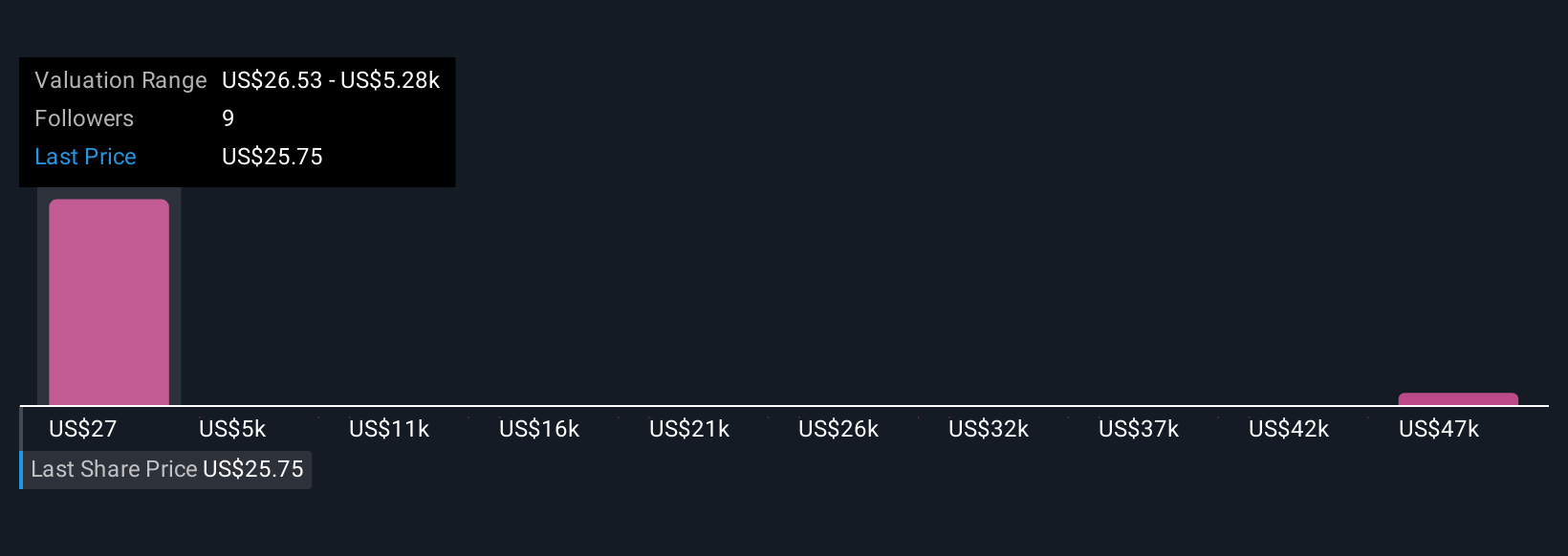

Four Simply Wall St Community members estimate Cinemark's fair value between US$26.53 and an outlier of US$52,608.36 per share. Against this wide backdrop of opinions, consider how box office unpredictability and blockbuster dependence could shape future sentiment.

Explore 4 other fair value estimates on Cinemark Holdings - why the stock might be a potential multi-bagger!

Build Your Own Cinemark Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cinemark Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cinemark Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cinemark Holdings' overall financial health at a glance.

No Opportunity In Cinemark Holdings?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNK

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives