- United States

- /

- Media

- /

- NYSE:OPTU

The Market Doesn't Like What It Sees From Altice USA, Inc.'s (NYSE:ATUS) Revenues Yet

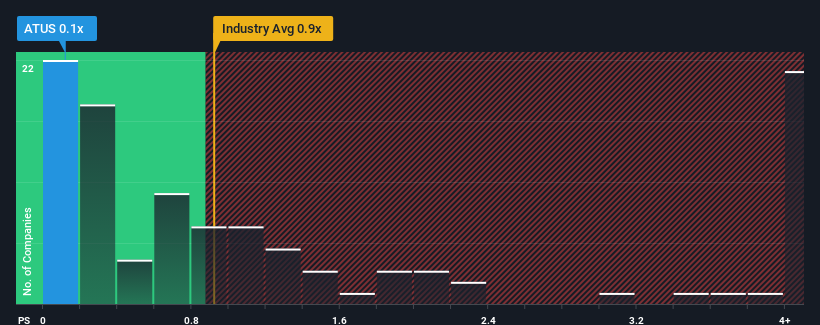

You may think that with a price-to-sales (or "P/S") ratio of 0.1x Altice USA, Inc. (NYSE:ATUS) is a stock worth checking out, seeing as almost half of all the Media companies in the United States have P/S ratios greater than 0.9x and even P/S higher than 3x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Altice USA

What Does Altice USA's Recent Performance Look Like?

Altice USA hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Altice USA's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Altice USA?

The only time you'd be truly comfortable seeing a P/S as low as Altice USA's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 5.1% decrease to the company's top line. As a result, revenue from three years ago have also fallen 5.4% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 1.8% per annum during the coming three years according to the analysts following the company. Meanwhile, the broader industry is forecast to expand by 4.1% per year, which paints a poor picture.

With this in consideration, we find it intriguing that Altice USA's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Altice USA's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Altice USA (2 don't sit too well with us!) that you should be aware of before investing here.

If you're unsure about the strength of Altice USA's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OPTU

Optimum Communications

Provides broadband communications and video services under the Optimum brand in the United States, Canada, Puerto Rico, and the Virgin Islands.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.