- United States

- /

- Media

- /

- NYSE:OPTU

Altice USA, Inc.'s (NYSE:ATUS) P/E Is Still On The Mark Following 35% Share Price Bounce

Altice USA, Inc. (NYSE:ATUS) shareholders have had their patience rewarded with a 35% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 27% over that time.

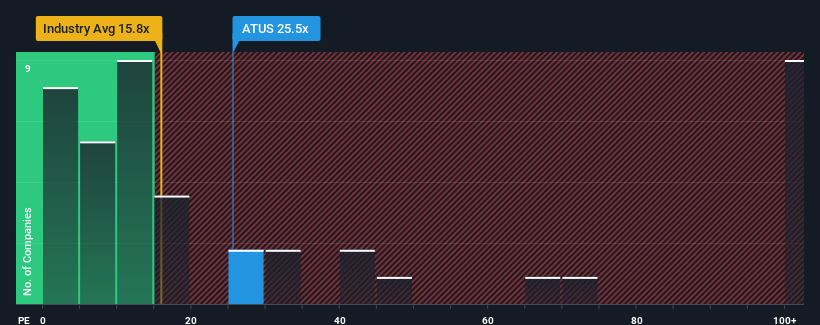

Following the firm bounce in price, Altice USA may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 25.5x, since almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 9x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Altice USA has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Altice USA

Does Growth Match The High P/E?

Altice USA's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 73%. The last three years don't look nice either as the company has shrunk EPS by 84% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 57% per annum as estimated by the analysts watching the company. With the market only predicted to deliver 11% per year, the company is positioned for a stronger earnings result.

With this information, we can see why Altice USA is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Altice USA's P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Altice USA maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Altice USA is showing 5 warning signs in our investment analysis, and 3 of those are a bit concerning.

If you're unsure about the strength of Altice USA's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OPTU

Optimum Communications

Provides broadband communications and video services under the Optimum brand in the United States, Canada, Puerto Rico, and the Virgin Islands.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth