- United States

- /

- Entertainment

- /

- NYSE:AMC

AMC (AMC) Is Down 5.4% After Posting Larger-Than-Expected Q3 Net Loss and Revenue Decline

Reviewed by Sasha Jovanovic

- AMC Entertainment Holdings recently reported third-quarter results that showed revenue of US$1.30 billion and a net loss of US$298.2 million, significantly widening from the same period last year.

- The quarterly update highlighted not only a modest decline in revenue but a substantial increase in net loss, reflecting ongoing operational pressures for the company.

- We will explore how AMC's larger quarterly net loss and evolving leadership roles could reshape the company's investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

AMC Entertainment Holdings Investment Narrative Recap

To be an AMC Entertainment Holdings shareholder today, you need to believe in the ongoing recovery of in-person moviegoing and AMC’s ability to leverage premium experiences, loyalty programs, and alternative content to drive stable growth. The recent third-quarter earnings report, which revealed a widening net loss and softening revenue, does not materially alter the core short-term catalyst: the ability to maximize attendance through blockbuster releases. However, it does highlight the company’s heightened exposure to the biggest near-term risk, persistent unprofitability and reliance on external capital for liquidity.

Among several recent announcements, the wave of senior executive promotions stands out, particularly the expanded leadership in legal, marketing, and business development roles. While these changes will not materially affect short-term cash flow or the timing of marquee film releases, enhanced operational expertise could support AMC’s long-term initiatives to tap into premium audience segments and pursue new revenue channels.

In sharp contrast, potential dilution of shareholder value from ongoing capital needs and debt restructuring is information investors should be aware of...

Read the full narrative on AMC Entertainment Holdings (it's free!)

AMC Entertainment Holdings' outlook anticipates $5.7 billion in revenue and $541.4 million in earnings by 2028. This scenario assumes a 5.3% annual revenue growth and an earnings increase of $904.5 million from the current earnings of -$363.1 million.

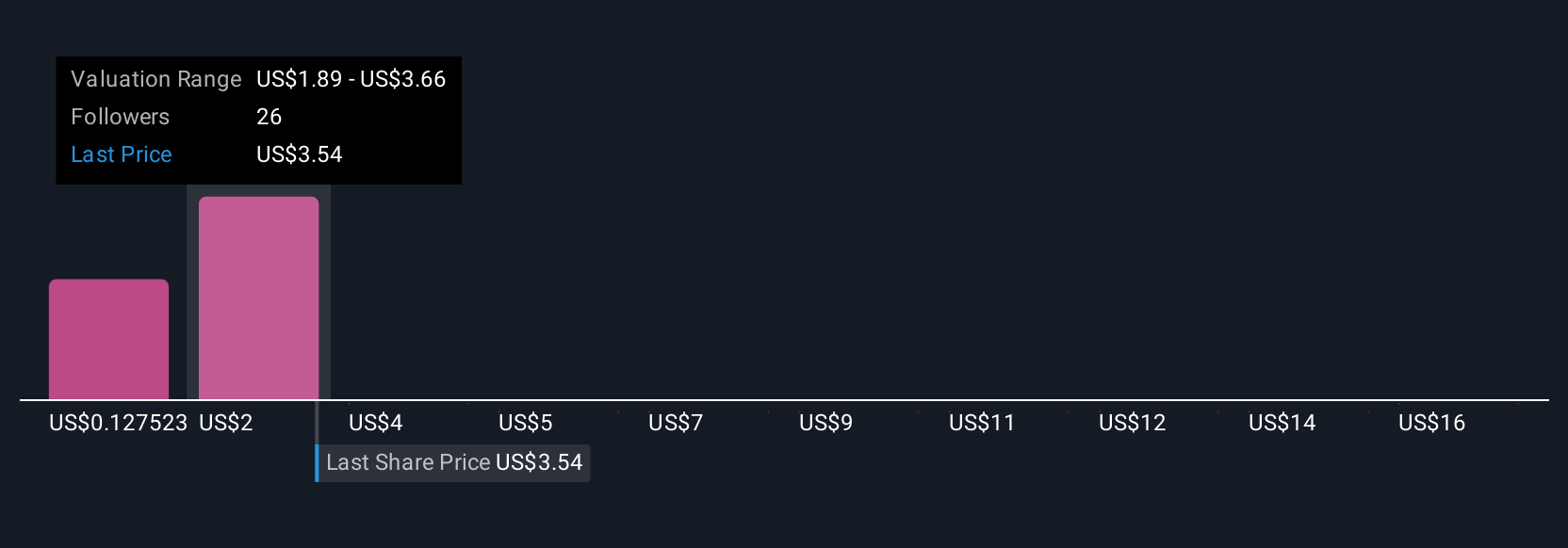

Uncover how AMC Entertainment Holdings' forecasts yield a $3.34 fair value, a 46% upside to its current price.

Exploring Other Perspectives

Seven individual fair value estimates from the Simply Wall St Community range from US$2.60 to US$33.23 per share, illustrating a wide spectrum of expectations. As you assess these views, remember that persistent unprofitability remains a key concern with broader implications for AMC’s financial flexibility and ability to reinvest for growth.

Explore 7 other fair value estimates on AMC Entertainment Holdings - why the stock might be a potential multi-bagger!

Build Your Own AMC Entertainment Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AMC Entertainment Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free AMC Entertainment Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AMC Entertainment Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMC

AMC Entertainment Holdings

Through its subsidiaries, engages in the theatrical exhibition business in the United States and Europe.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives