- United States

- /

- Real Estate

- /

- NasdaqGS:ZG

This Just In: Analysts Are Boosting Their Zillow Group, Inc. (NASDAQ:ZG) Outlook for This Year

Zillow Group, Inc. (NASDAQ:ZG) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analysts modelling a real improvement in business performance. Investors have been pretty optimistic on Zillow Group too, with the stock up 28% to US$201 over the past week. Could this upgrade be enough to drive the stock even higher?

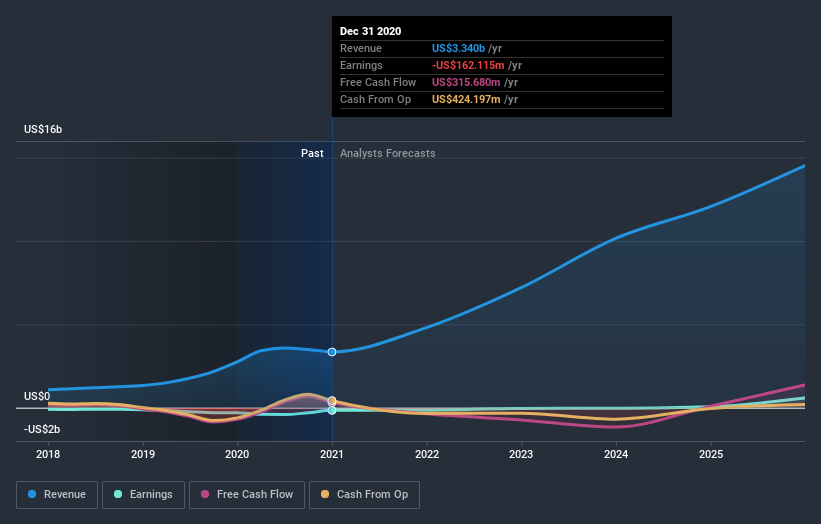

Following the upgrade, the most recent consensus for Zillow Group from its 18 analysts is for revenues of US$5.6b in 2021 which, if met, would be a major 66% increase on its sales over the past 12 months. The losses are expected to disappear over the next year or so, with forecasts for a profit of US$0.021 per share this year. However, before this estimates update, the consensus had been expecting revenues of US$4.8b and US$0.71 per share in losses. So we can see that this has sparked a pretty clear upgrade to expectations, with higher revenues anticipated to lead to profit sooner than previously forecast.

See our latest analysis for Zillow Group

With these upgrades, we're not surprised to see that the analysts have lifted their price target 23% to US$169 per share. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Zillow Group analyst has a price target of US$202 per share, while the most pessimistic values it at US$33.00. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely differing views on what kind of performance this business can generate. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Zillow Group's past performance and to peers in the same industry. The analysts are definitely expecting Zillow Group's growth to accelerate, with the forecast 66% growth ranking favourably alongside historical growth of 37% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 15% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Zillow Group to grow faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that there is now an expectation for Zillow Group to become profitable this year, compared to previous expectations of a loss. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at Zillow Group.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Zillow Group going out to 2025, and you can see them free on our platform here..

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade Zillow Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zillow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:ZG

Zillow Group

Operates real estate brands in mobile applications and Websites in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion