- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:ZD

Ziff Davis (ZD): Assessing Valuation After AI Disputes and Ad Market Headwinds

Reviewed by Simply Wall St

Ziff Davis (ZD) is drawing fresh attention as investors react to ongoing concerns about AI’s impact and weakness in advertising markets. The company has taken action to protect its content, increasing its legal efforts.

See our latest analysis for Ziff Davis.

Ziff Davis’ story over the past year has been a tougher one, with the share price tumbling 31% year-to-date and the one-year total shareholder return sitting at -19%. The company recently appointed a new Director of Investor Relations and closed two acquisitions. These moves hint at efforts to revive momentum and address recent investor concerns.

If market shifts and proactive management moves interest you, now is the perfect time to expand your toolkit and discover fast growing stocks with high insider ownership

With shares trading well below past highs and a modest rebound in recent weeks, investors may wonder if Ziff Davis is undervalued at these levels, or if the current stock price already reflects all foreseeable upside.

Most Popular Narrative: 16.8% Undervalued

Compared to the most recent closing price of $37.70, the narrative consensus sees Ziff Davis’s fair value much higher. This optimism supports expectations for the company's recovery prospects and sets the stage for a pivotal quote that highlights the essence of its growth story.

Strategic focus on premium, high-margin verticals (health, gaming, cybersecurity) and the monetization of proprietary brands, such as CNET, Everyday Health, IGN, and Lose It!, is delivering both pricing power and margin resilience. This positions the company for further net margin and EBITDA expansion.

What drives this bold outlook? The narrative’s valuation rests on a combination of margin expansion, recurring revenues, and major changes in the business mix. The most notable factor is the presence of aggressive growth forecasts and a profit multiple that remains far below industry averages. Discover which projections make this target distinct.

Result: Fair Value of $45.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing dependence on acquisitions and industry-wide digital advertising challenges could quickly alter the current outlook for Ziff Davis’s recovery story.

Find out about the key risks to this Ziff Davis narrative.

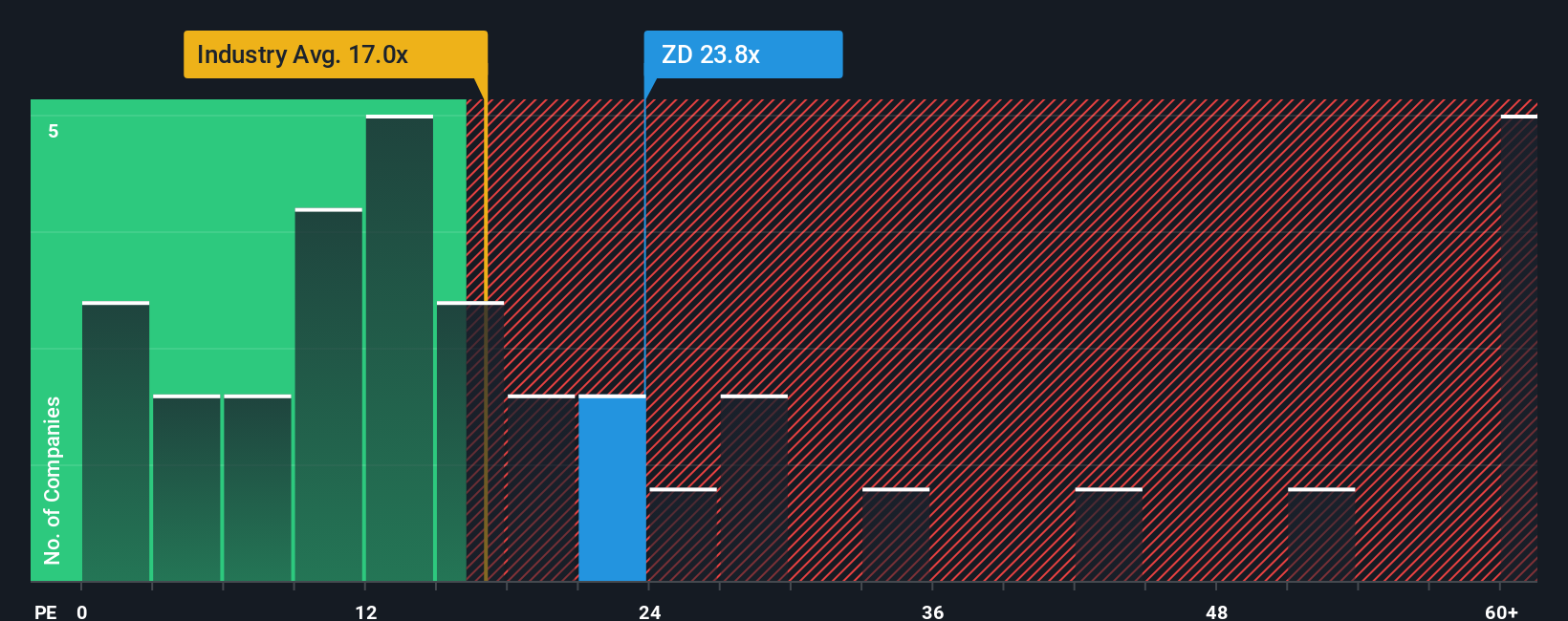

Another View: The Market Ratio Perspective

While the narrative points to undervaluation based on growth and cash flows, the price-to-earnings ratio tells a more complex story. Ziff Davis trades at 23.4x earnings, well above the industry’s 15.5x and not far from its fair ratio of 24.7x. This premium suggests investors are paying up for perceived potential, but may also introduce valuation risk if growth falls short. Could sentiment be ahead of the fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ziff Davis Narrative

If you see things differently or want to dig into the figures yourself, you can craft your own take on Ziff Davis in just minutes. Do it your way

A great starting point for your Ziff Davis research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit their view. Use the Simply Wall Street Screener to find unique opportunities others might miss and power up your watchlist today.

- Unlock potential by scouting these 876 undervalued stocks based on cash flows, trading below their real worth but poised for growth.

- Capitalize on technology breakthroughs by targeting these 27 AI penny stocks, which are shaking up entire industries and reshaping the future.

- Make your money work harder with these 17 dividend stocks with yields > 3%, offering attractive yields and a track record of steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ziff Davis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZD

Ziff Davis

Operates as a digital media and internet company in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives