- United States

- /

- Entertainment

- /

- NasdaqGS:WMG

Warner Music Group (WMG): Assessing Valuation After Recent Momentum Shifts

Reviewed by Simply Wall St

Warner Music Group (WMG) shares have had a mixed performance recently. The stock closed at $30.69 and showed small gains over the past week. However, there have been declines over the past month and the past three months. Investors may be weighing the impact of recent industry developments on the company’s outlook.

See our latest analysis for Warner Music Group.

After a solid run in prior years, Warner Music Group’s momentum has cooled. The stock is nearly flat year-to-date and its 1-year total shareholder return of -1.3% suggests recent price moves reflect shifting investor risk appetite rather than renewed growth conviction.

If you’re watching changes in momentum, now is a smart time to broaden your scope and discover fast growing stocks with high insider ownership

With shares trading at a modest discount to analyst price targets and fundamentals showing steady progress, the key question for investors is whether Warner Music Group is now undervalued or if the market has already factored in its future growth potential.

Most Popular Narrative: 19.2% Undervalued

With shares recently closing at $30.69 and the most popular narrative assigning a fair value meaningfully higher, analysts see notable potential upside from current levels. The following insight captures a core catalyst supporting this viewpoint.

"Expansion in high-growth regions and digital innovation are boosting streaming adoption and opening new revenue sources for sustained growth. Strategic cost reductions, catalog acquisitions, and AI-driven marketing enhance efficiency, margin expansion, and market share."

Craving the inside story behind this bullish pricing? The narrative is built on aggressive growth forecasts and bold profitability targets. Curious what financial leaps the consensus believes this company can pull off to claim such a premium?

Result: Fair Value of $38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Warner Music Group faces risks. These include heavy investment spending and a concentrated revenue base, which could constrain future cash flow and earnings growth.

Find out about the key risks to this Warner Music Group narrative.

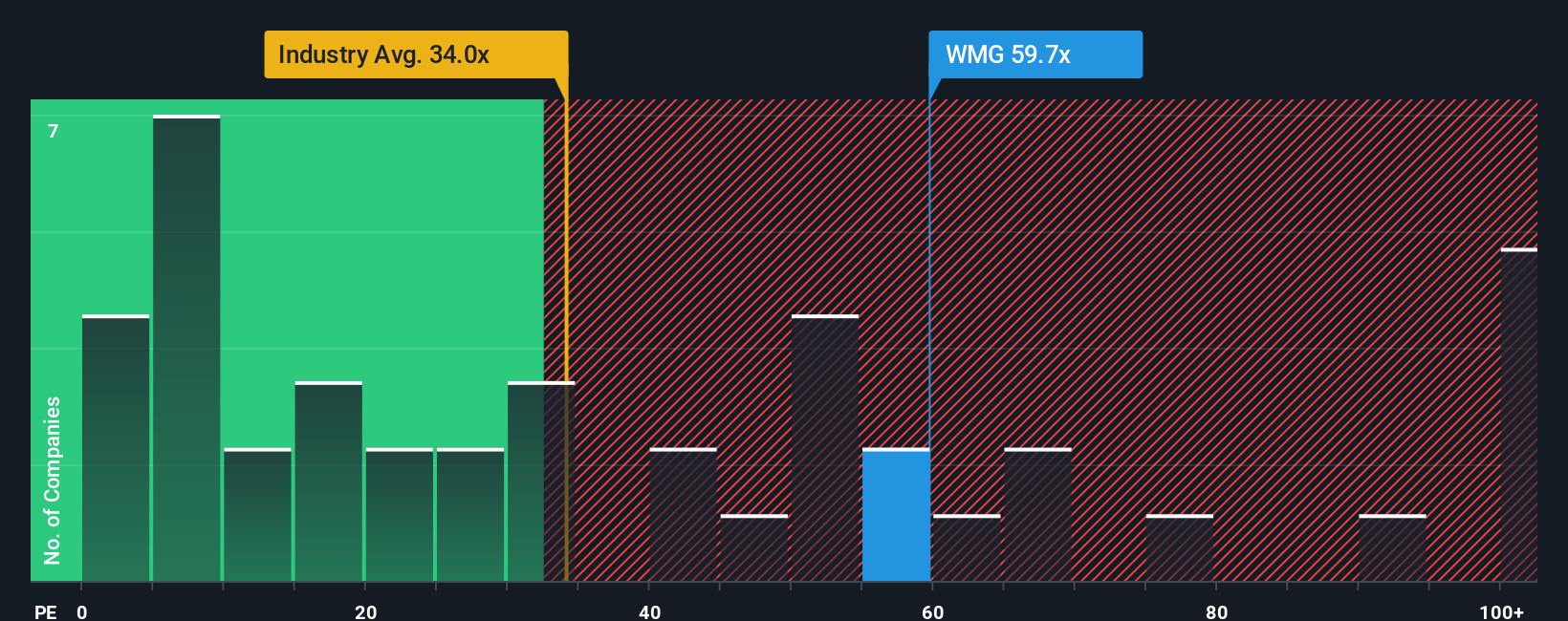

Another View: Market Multiples Tell a Different Story

While the fair value estimate suggests Warner Music Group is undervalued, looking at its price-to-earnings ratio reveals a higher hurdle. The current P/E stands at 43.9x, which is much steeper than both the US Entertainment industry’s average of 19.5x and the fair ratio of 28.3x. This wide gap signals that investors are already baking in strong future growth, leaving less margin for error if expectations fall short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Warner Music Group Narrative

If these perspectives do not fit your investment style or you would rather draw your own conclusions, you can build your own view in just a few minutes, so why not Do it your way

A great starting point for your Warner Music Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the best opportunities slip by. Head over to our expert screeners that spotlight high-potential stocks you might not have considered yet.

- Capture robust cash flow returns and growth stories by checking out these 917 undervalued stocks based on cash flows.

- Explore cutting-edge breakthroughs and potential market leaders in artificial intelligence through these 25 AI penny stocks.

- Tap into recurring income and build your wealth with these 17 dividend stocks with yields > 3% offering strong yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warner Music Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WMG

Warner Music Group

Operates as a music entertainment company in the United States, the United Kingdom, Germany, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives