Stock Analysis

- United States

- /

- Media

- /

- NasdaqGM:WIMI

WiMi Hologram Cloud Inc.'s (NASDAQ:WIMI) Subdued P/S Might Signal An Opportunity

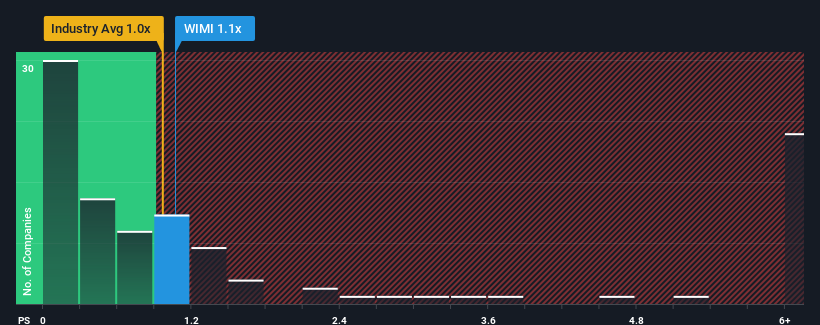

There wouldn't be many who think WiMi Hologram Cloud Inc.'s (NASDAQ:WIMI) price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S for the Media industry in the United States is similar at about 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for WiMi Hologram Cloud

How WiMi Hologram Cloud Has Been Performing

For example, consider that WiMi Hologram Cloud's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for WiMi Hologram Cloud, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For WiMi Hologram Cloud?

WiMi Hologram Cloud's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 27% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 114% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 3.2% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that WiMi Hologram Cloud is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does WiMi Hologram Cloud's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To our surprise, WiMi Hologram Cloud revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for WiMi Hologram Cloud (1 can't be ignored!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if WiMi Hologram Cloud might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:WIMI

WiMi Hologram Cloud

Provides augmented reality (AR) based holographic services and products in China.

Flawless balance sheet and good value.