- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:WBTN

WEBTOON Entertainment (WBTN): Evaluating Valuation Following Strong Revenue Growth and Investor Optimism

Reviewed by Simply Wall St

Recent market coverage of WEBTOON Entertainment (WBTN) centers on its 7.5% annual revenue growth and impressive gains in earnings per share. These results reflect accelerated demand expectations and signal a positive outlook for shareholders.

See our latest analysis for WEBTOON Entertainment.

WEBTOON Entertainment’s recent numbers have grabbed attention, but the market’s been noticing for a while. The company’s share price has climbed 77.8% in the past 90 days and delivered an impressive 62.97% total shareholder return over the last year, underscoring strong momentum and renewed confidence in its long-term story.

If WEBTOON’s surge has you thinking about the broader market, this could be the perfect moment to discover fast growing stocks with high insider ownership.

With shares already rising nearly 80% in just three months, investors are left to wonder whether WEBTOON Entertainment still has more room to run, or if the recent rally means future growth is already reflected in the price.

Most Popular Narrative: 4% Undervalued

WEBTOON Entertainment's most tracked narrative puts fair value at $19.00, a touch above its $18.22 last close, suggesting market optimism is meeting analyst conviction head-on.

The recently announced multi-year collaboration with Disney (encompassing Marvel, Star Wars, and 20th Century Studios IPs) is expected to accelerate new user acquisition and engagement, especially among younger, mobile-native demographics. This should drive strong top-line revenue and expand the monetizable user base in the mid to long term.

Want to know what’s fueling WEBTOON’s hefty valuation ambition? At the heart of this story: a game-changing partnership, bold profit forecasts, and audacious revenue expectations. The bullish scenario banks on growth rates and margins usually seen among the hottest names in digital media. Which one number stands out in the narrative’s math? Venture further to discover the assumptions that may surprise even seasoned market-watchers.

Result: Fair Value of $19.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, user growth has slowed and competition remains fierce. Either of these factors could quickly challenge the bullish narrative surrounding WEBTOON Entertainment's valuation.

Find out about the key risks to this WEBTOON Entertainment narrative.

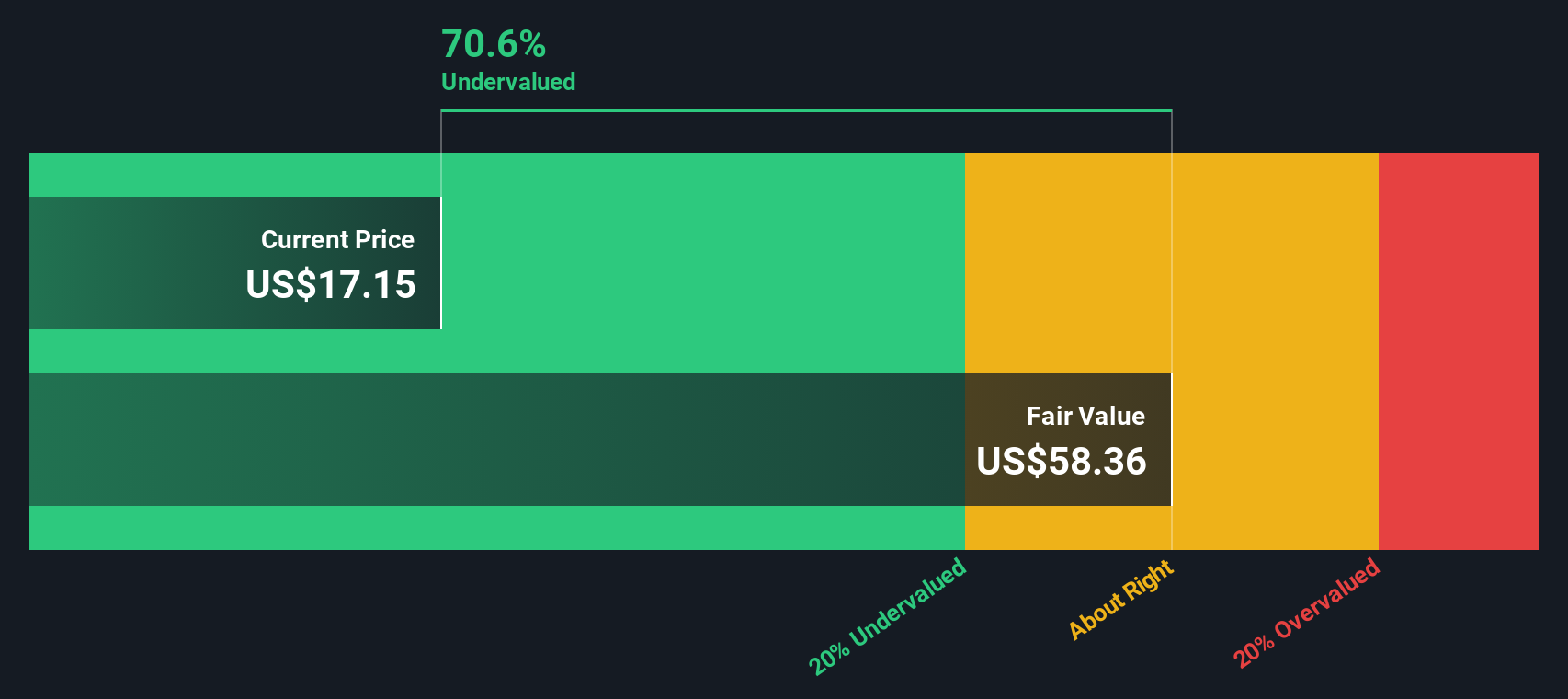

Another View: Discounted Cash Flow Perspective

Switching gears, the SWS DCF model offers a strikingly different take by calculating WEBTOON Entertainment's fair value at $67.23 per share, which is far above its current price. This suggests an undervalued opportunity much greater than what the price-based valuation implies. Is the real upside that big, or is the DCF painting too rosy a picture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own WEBTOON Entertainment Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own scenario from scratch in just minutes. Do it your way

A great starting point for your WEBTOON Entertainment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let standout opportunities in the market pass you by. Now is your chance to pinpoint stocks with huge growth potential using the Simply Wall Street Screener.

- Spot potential multi-baggers by checking out these 3565 penny stocks with strong financials in emerging industries and high-growth markets.

- Unlock stocks at compelling prices and seize bargains with these 880 undervalued stocks based on cash flows that meet strict value criteria.

- Target high-yield potential by exploring these 17 dividend stocks with yields > 3% offering strong returns for income-focused portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEBTOON Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WBTN

WEBTOON Entertainment

Operates a storytelling platform in the United States, Korea, Japan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives