- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:VMEO

Vimeo (VMEO): Exploring Valuation After 90% Share Price Rally This Quarter

Reviewed by Simply Wall St

See our latest analysis for Vimeo.

After a long stretch of mixed sentiment, Vimeo’s recent share price return of over 90% in the past quarter reflects renewed optimism and upward momentum. This is especially notable considering its 65% total shareholder return over the past year. While the company has been rolling out product updates and refining its strategic focus, investors appear to be rewarding improving growth and better-than-expected performance.

If you are keeping an eye on fast-rising names like Vimeo, there is no better moment to broaden your search and discover fast growing stocks with high insider ownership

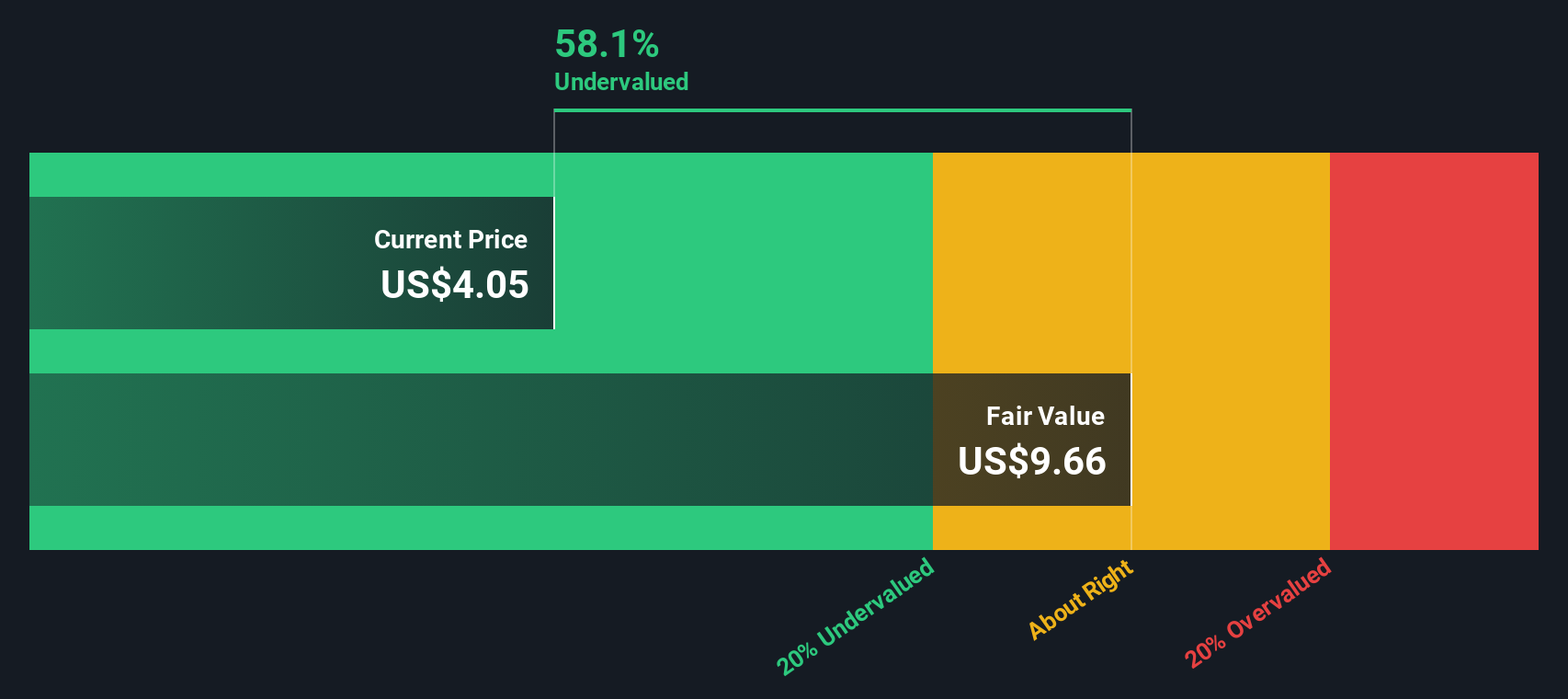

With shares rallying higher and annual growth metrics improving, the key question becomes whether Vimeo’s recent success is still undervalued or if the market has already factored in its growth prospects. This could leave little room for further upside.

Most Popular Narrative: 8% Overvalued

Vimeo’s most popular narrative points to a fair value below the last close of $7.80, suggesting the recent rally has pushed shares ahead of fundamentals. The narrative’s pricing is built on expectations for stronger earnings and higher future profit multiples, which puts a spotlight on what is driving analyst optimism.

*Strategic focus on integrating with major workflow tools (like Zoom) and adding highly requested capabilities (e.g., Workspaces for secure departmental video management) positions Vimeo as a critical SaaS provider for businesses increasingly reliant on video for communication and collaboration. This broadens the addressable market and supports recurring revenue streams.*

Want to know why analysts are betting on premium pricing and recurring revenue for Vimeo? The full story links rising adoption rates to ambitious profit forecasts and a rich multiple. Ready to peel back the layers and see which blockbuster assumptions are fueling this valuation?

Result: Fair Value of $7.23 (OVERVALUEED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent subscriber declines and increased competition in bandwidth add-ons could quickly challenge Vimeo's current growth trajectory and optimistic forecasts.

Find out about the key risks to this Vimeo narrative.

Another View: Discounted Cash Flow Perspective

Looking at Vimeo through the lens of our DCF model provides a very different perspective. The SWS DCF model estimates a fair value of $10.47, which is well above recent prices. This suggests the market could be undervaluing future cash flow potential based on current fundamentals. Could the DCF case outweigh analyst caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vimeo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vimeo Narrative

If you are looking to dig deeper or have a different perspective, explore the data firsthand and shape your own story in just a few minutes with Do it your way.

A great starting point for your Vimeo research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Enhance your investing strategy by tapping into handpicked stock ideas that target real growth, income, and innovation. Act now before the next big trend leaves you behind.

- Uncover potential market breakthroughs with these 27 quantum computing stocks to spot companies at the forefront of transformative computing technology.

- Strengthen your portfolio’s resilience by selecting from these 17 dividend stocks with yields > 3% to help ensure reliable income even during market shifts.

- Capitalize on hidden value by targeting these 868 undervalued stocks based on cash flows, which meet rigorous cash flow criteria and could be tomorrow’s top performers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VMEO

Vimeo

Provides video software solutions in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives