- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Take-Two Interactive (TTWO): Revisiting Valuation as GTA VI Hype and Analyst Optimism Lift Long-Term Growth Expectations

Reviewed by Simply Wall St

Take-Two Interactive Software (TTWO) is back in the spotlight after fresh commentary around Grand Theft Auto VI and a packed release slate reignited interest in the stock and its long term earnings trajectory.

See our latest analysis for Take-Two Interactive Software.

That backdrop helps explain why the share price, now at $248.58, has delivered a robust year to date share price return, while the three year total shareholder return suggests momentum is still very much building around the GTA VI cycle.

If this kind of franchise driven story has your attention, it could be a good moment to see what other gaming and platform names are showing up in high growth tech and AI stocks.

With the share price already up strongly and analysts largely bullish, investors face a familiar dilemma: is Take-Two still trading below its long term potential, or is the GTA VI boom already fully priced in?

Most Popular Narrative Narrative: 10.4% Undervalued

With the shares last closing at $248.58 against a narrative fair value near $277.40, the spotlight shifts to how future earnings power might bridge that gap.

Strategic investments in technology, AI, and content pipeline efficiency, alongside a strong release slate with multiple high profile launches (including Borderlands 4, NBA 2K26, and Mafia: The Old Country), undergird management's outlook for record net bookings and enhanced profitability in the coming years.

Want to see what is hiding behind that confidence spike? The narrative focuses on aggressive margin expansion and earnings power that rivals market darlings. Curious which growth and profitability bets have to succeed for this valuation to hold up?

Result: Fair Value of $277.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside leans heavily on strong execution, and any GTA VI delay or weaker mobile monetization could potentially undermine those aggressive margin and earnings assumptions.

Find out about the key risks to this Take-Two Interactive Software narrative.

Another Angle on Valuation

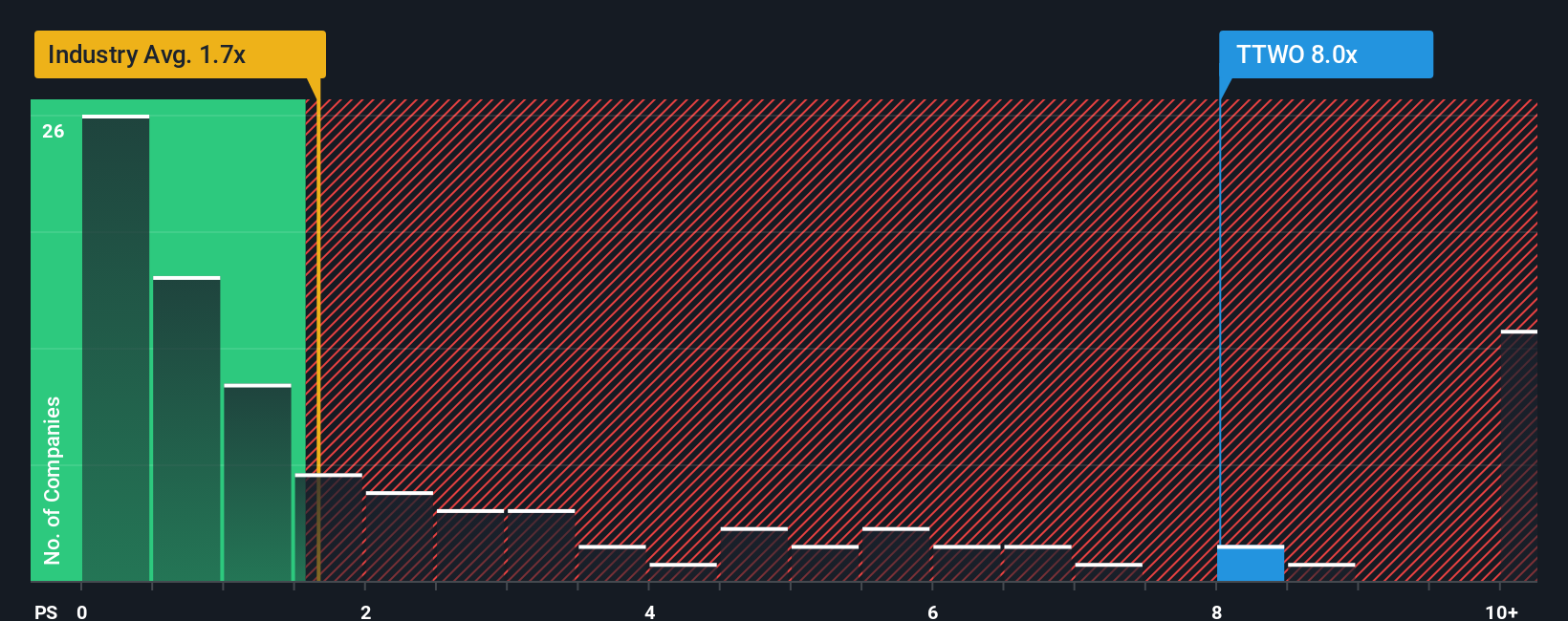

On our price to sales view, the story looks very different. TTWO trades at about 7.4 times sales, versus 1.3 times for the US entertainment sector and a peer average near 5.6 times, and above a fair ratio closer to 4.6 times, raising the risk that sentiment, not fundamentals, is doing most of the work here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Take-Two Interactive Software Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a full narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Take-Two Interactive Software.

Ready for more investment ideas?

Before the next big move catches you off guard, use the Simply Wall St Screener to line up your next opportunities and stay ahead of the crowd.

- Target steady income by reviewing these 10 dividend stocks with yields > 3% that could strengthen your portfolio with reliable cash flow.

- Capture high potential growth by scanning these 24 AI penny stocks at the forefront of artificial intelligence innovation.

- Lock in value early by focusing on these 899 undervalued stocks based on cash flows that the market may be mispricing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion