- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Take-Two Interactive (TTWO): Assessing Valuation After Strong 57% One-Year Return

Take-Two Interactive Software (TTWO) shares have edged higher recently, supported by steady gaming industry demand and moderate financial gains. Some investors are eyeing its one-year return of 57% and considering whether current trends could continue.

See our latest analysis for Take-Two Interactive Software.

Over the past year, Take-Two’s total shareholder return of nearly 57% has certainly turned heads. The most recent 90-day share price return of 16% also hints that momentum remains firmly on the company’s side. This blend of steady industry tailwinds and upbeat investor sentiment suggests confidence in both near-term execution and long-term growth potential.

If you’re looking to spot what else might be gaining traction, now could be a perfect time to discover fast growing stocks with high insider ownership.

With shares just shy of analyst targets and impressive recent gains, investors must ask if Take-Two still has more room to run or if the market has already factored in the company’s potential upside.

Most Popular Narrative: 5% Undervalued

The most widely followed narrative puts Take-Two Interactive Software’s fair value estimate at $270 per share, a modest premium versus the last close at $256.37. With expectations set by upcoming franchise launches and steady momentum, the scene is set for bold valuation drivers.

Strategic investments in technology, AI, and content pipeline efficiency, alongside a strong release slate with multiple high-profile launches (including Borderlands 4, NBA 2K26, and Mafia: The Old Country), undergird management's outlook for record net bookings and enhanced profitability in the coming years.

Curious what powers this valuation? The narrative’s case hinges on aggressive profit turnaround, ambitious margin expansion, and a future valuation multiple rarely seen outside market darlings. Want to know what bold financial figures mark the path to that target? Uncover the numbers and debates behind the story by tapping into the full narrative now.

Result: Fair Value of $270 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising development costs and a heavy reliance on blockbuster releases still threaten Take-Two’s margin growth and revenue stability if expectations are not met.

Find out about the key risks to this Take-Two Interactive Software narrative.

Another View: Multiples Tell a Cautionary Story

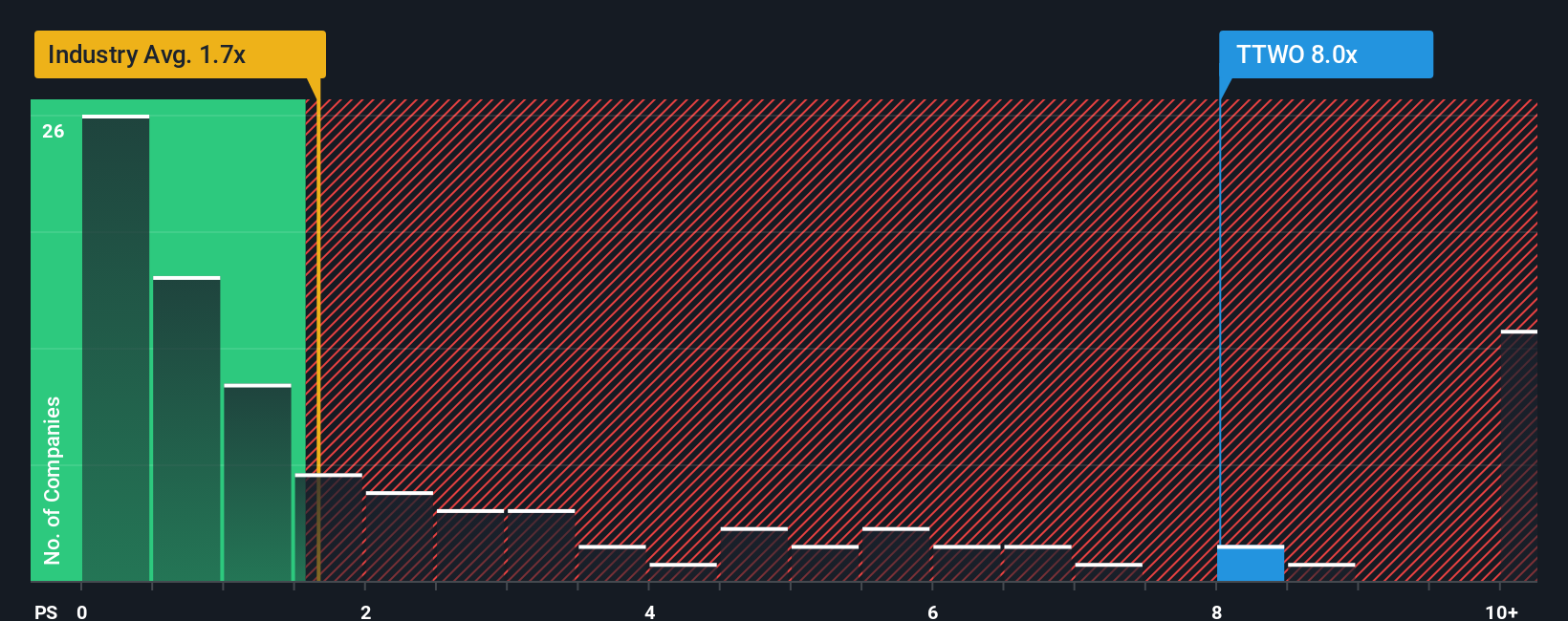

Looking through the lens of its price-to-sales ratio, Take-Two trades at 8.2 times sales, well above both industry peers at 6.7x and the broader US Entertainment industry at just 1.6x. The fair ratio, based on sector trends, is estimated at 5x. This premium may signal optimism, but it raises the bar for future growth. Will investors continue to pay up if growth wobbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Take-Two Interactive Software Narrative

If you’d rather form your own perspective or want to dive deeper into the data yourself, you can shape an independent view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Take-Two Interactive Software.

Looking for more investment ideas?

Don’t let fresh opportunities slip away. Use the Simply Wall Street Screener to quickly uncover stocks tailored to trends, growth, and income potential.

- Unlock high-yield potential and secure steady income by checking out these 22 dividend stocks with yields > 3%, which consistently outperform with yields above 3%.

- Spot market disruptors by following these 26 AI penny stocks, as these companies are making waves with AI-driven breakthroughs and powerful data-driven business models.

- Seize undervalued gems early by tracking these 832 undervalued stocks based on cash flows, which could offer attractive upside based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Why I invest in Sofina (Dividend growth)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion