- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Take-Two Interactive Software (NasdaqGS:TTWO) Announces Mafia: The Old Country Release This August

Reviewed by Simply Wall St

Take-Two Interactive Software (NasdaqGS:TTWO) saw its share price rise 24% over the last quarter, a period marked by the unveiling of "Mafia: The Old Country" by its subsidiary, 2K and Hangar 13. The game’s release slated for August 2025, alongside innovative features like its Unreal Engine 5 usage, likely bolstered investor sentiment. While the broader market climbed 8% over the past year, the specific buzz around this game combined with favorable tech market sentiment, driven by factors such as the U.S. trade agreement with the U.K., likely added weight to the company's stock price appreciation.

The recent unveiling of "Mafia: The Old Country" by Take-Two Interactive Software has the potential to bolster investor sentiment and contribute to a favorable outlook for the company. This aligns with the planned release of highly anticipated titles like Grand Theft Auto VI, expected to drive growth in net bookings and cash flows into fiscal 2026. Over the past three years, Take-Two's total return, including share price and dividends, was 115.03%. This indicates robust performance relative to the broader market's 7.7% climb over the past year, underscoring Take-Two's success in capturing investor interest and outperforming general market trends.

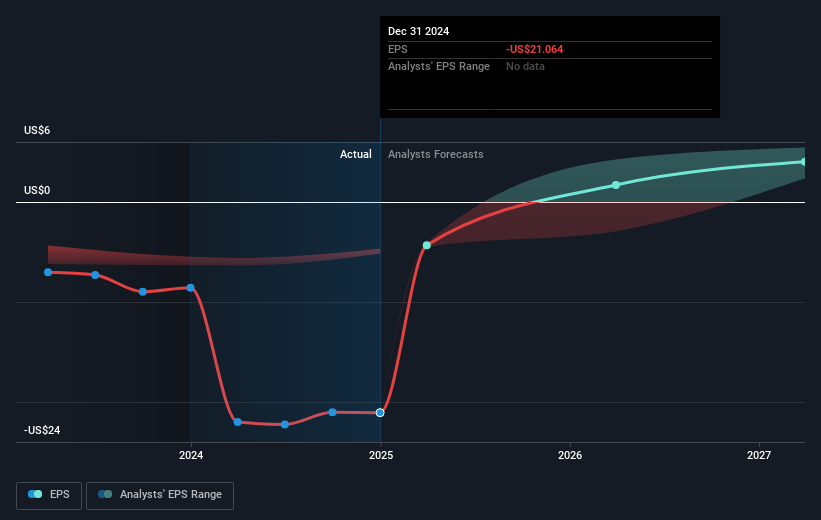

The company's impressive short-term gains can be seen in the context of the current share price of US$231.84, which remains slightly above the consensus analyst price target of US$223.96. However, the latest news could impact revenue and earnings forecasts positively, particularly with upcoming game releases expected to enhance operating margins and profitability. Analysts foresee these catalysts potentially driving revenue to US$8.6 billion by 2028 and earnings to US$732.7 million, albeit amidst differences in bullish and bearish expectations. Share prices are anticipated to align more closely with the consensus target if the forecasted earnings growth is realized, though the share price currently reflects some investor optimism beyond these expectations.

Review our growth performance report to gain insights into Take-Two Interactive Software's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion