- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Did the Borderlands 4 Delay Reveal a Shift in Take-Two's (TTWO) Blockbuster Release Strategy?

Reviewed by Sasha Jovanovic

- Earlier this week, Take-Two Interactive announced a delay in the release of "Borderlands 4" for the Nintendo Switch 2, citing a need for further development to ensure quality and implement cross-save features, which resulted in the cancellation of all pre-orders for the title on that platform.

- This postponement highlights the significant influence that major franchise launches hold over Take-Two's operational plans and investor expectations, as well as the importance of seamless feature integration for new hardware cycles.

- We'll examine how the decision to delay a major launch could affect Take-Two's analyst-backed growth strategy and reliance on blockbuster releases.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Take-Two Interactive Software Investment Narrative Recap

Shareholders in Take-Two Interactive are typically betting on the long-term potential of blockbuster franchises like Grand Theft Auto and NBA 2K, as well as the company's efforts to broaden its audience through new platform launches. The recent "Borderlands 4" delay for Nintendo Switch 2 does not materially impact the short-term growth catalysts, but it does underscore the risk of project execution timelines and dependence on major releases.

Most relevant to this event is the company's announcement last June of "Borderlands 4" for a September release, which had been positioned as a key addition to its strong release pipeline. While delays can disrupt momentum, Take-Two’s recently raised full-year revenue guidance and continued investment in major titles suggest that management is focused on supporting its broader growth narrative.

Yet, in contrast to the company’s confidence, investors should be aware that reliance on a handful of series means any underperformance or delay could lead to ...

Read the full narrative on Take-Two Interactive Software (it's free!)

Take-Two Interactive Software's outlook calls for $8.8 billion in revenue and $1.1 billion in earnings by 2028. This scenario depends on an annual revenue growth rate of 14.8% and a $5.3 billion improvement in earnings from the current loss of $4.2 billion.

Uncover how Take-Two Interactive Software's forecasts yield a $262.02 fair value, in line with its current price.

Exploring Other Perspectives

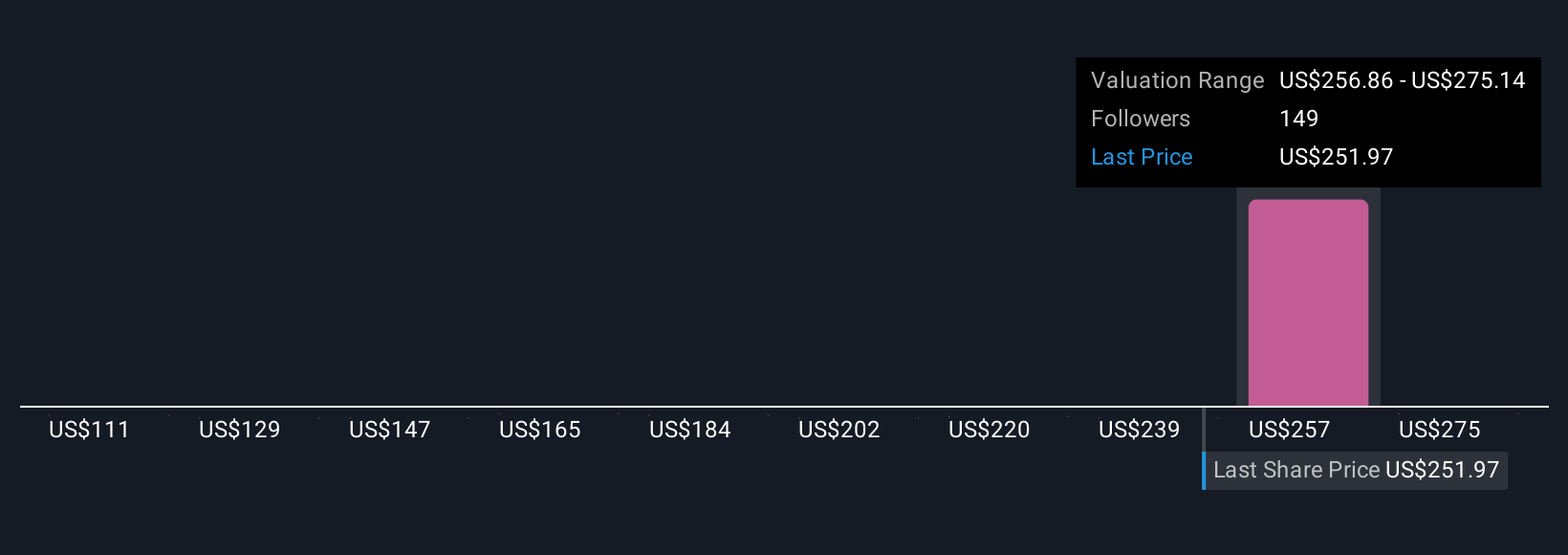

Community estimates for Take-Two’s fair value span from US$110.67 to US$289.93, reflecting 11 different viewpoints from the Simply Wall St Community. With blockbuster launch timing a key short-term swing factor, you can see how opinions on future performance cover a broad spectrum.

Explore 11 other fair value estimates on Take-Two Interactive Software - why the stock might be worth as much as 13% more than the current price!

Build Your Own Take-Two Interactive Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Take-Two Interactive Software research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Take-Two Interactive Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Take-Two Interactive Software's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion