- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Assessing Take Two Interactive Software (TTWO) Valuation As Grand Theft Auto VI And Recurring Revenue Gain Focus

Take-Two Interactive Software (TTWO) is back in focus as investors weigh the upcoming November 19, 2026 launch of Grand Theft Auto VI, alongside the company’s shift toward cash flow and recurring, Zynga supported mobile and live services.

See our latest analysis for Take-Two Interactive Software.

Despite the excitement around Grand Theft Auto VI and growing interest in Take-Two’s higher share of recurring bookings, the share price has recently pulled back, with a 1-day share price return of 7.93% decline, 30-day share price return of 13.96% decline, and year to date share price return of 12.44% decline, while the 1-year total shareholder return of 18.75% and 3-year total shareholder return of about 2x suggest longer term holders have still seen positive outcomes.

If big franchise launches are on your radar, this could be a good moment to scan for other gaming and software names using our high growth tech and AI stocks as a starting point.

With Grand Theft Auto VI on the horizon and analysts setting higher price targets than the current US$220.30 share price, the key question is simple: is Take-Two still mispriced, or is the market already baking in the next leg of growth?

Most Popular Narrative: 20.6% Undervalued

With Take-Two Interactive Software last closing at $220.30 against a most-followed fair value of about $277.40, the current gap reflects a valuation built around future growth in mobile and live services, not just the Grand Theft Auto VI launch.

Take-Two's mobile portfolio is experiencing outsized growth through direct-to-consumer initiatives, enhanced personalization, new event-driven features, and benefits from broader access provided by high-speed internet and mobile penetration, likely lifting both net revenue and margins as distribution costs decline.

Curious how this mobile shift and rising recurring spending feed into that higher fair value, including revenue growth, margin expansion, and future earnings assumptions? The full narrative joins those moving pieces into one clear earnings story.

Result: Fair Value of $277.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on major franchises like Grand Theft Auto and NBA 2K delivering as hoped, and on mobile titles avoiding a sharper slowdown than management anticipates.

Find out about the key risks to this Take-Two Interactive Software narrative.

Another View: Rich on Sales, Even if Earnings Catch Up

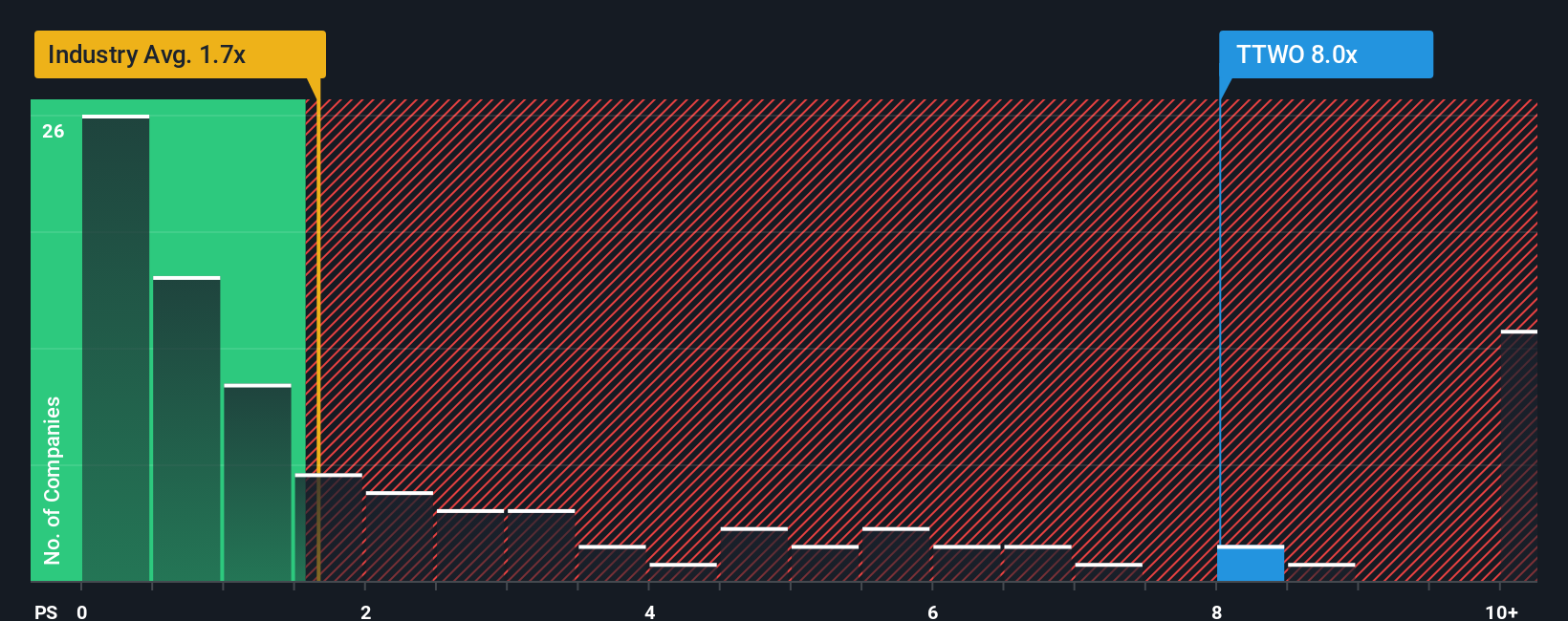

That 20.6% gap to fair value sits alongside a very different message from the market. On a P/S of 6.5x, Take-Two trades well above the US Entertainment average of 1.5x and above its own fair ratio of 4.4x, which raises a simple question: how much future success is already in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Take-Two Interactive Software Narrative

If you see the story differently or prefer to weigh the assumptions yourself, use the same data, reshape the inputs and Do it your way in just a few minutes.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Take-Two Interactive Software.

Looking for more investment ideas?

If you are serious about finding your next move, do not stop at one stock. Let the data point you toward other opportunities worth your attention.

- Spot potential value by hunting for companies priced below their cash flow estimates using these 868 undervalued stocks based on cash flows as your first filter.

- Tap into the growth story around artificial intelligence by scanning these 25 AI penny stocks for names already building real products and traction.

- Strengthen your income side by searching through these 14 dividend stocks with yields > 3% that combine yield above 3% with listed financial fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Otokar is the first choice for tactical armored land vehicles to meet Europe's defense industry needs.

Palantir: Redefining Enterprise Software for the AI Era

Microsoft - A Fundamental and Historical Valuation

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

MPAA often has inventory and core-related timing issues. While this quarter’s problems may ease, similar issues have recurred historically and can persist for several quarters. It's not a one-off, it's a structural part of their business. Core returns are simply estimates: How many customers will actually return the original part; how quickly they'll do so; how many are useable; what they're worth, etc. MPAA predicts X sales in a quarter and Y core returns and its reserves, inventory values, etc. are based on that. If they expect a 90% core return rate and only 80% come back it doesn't change cash but they have to write down inventory and increase cost of goods sold which impacts EPS. They've also cited inventory buildup at key customers multiple times in the past. The assumption the latest backlog will all shift into future quarters this year with no impact on pricing, etc. seems more like wishful thinking. Retailer X was slated to buy $10m in parts this quarter but finds they have a lot more inventory on hand than they anticipated so they pushed the order. Realistically there are likely to be SKU cuts, reduction in safety stock on others, etc. Assuming that all $10m will come in this year plus the regular replenishment seems pretty unrealistic. MPAA also has a shaky track record when it comes to new lines and the supposed impact on business. If you look at the EV testing solutions hype back around 2020 that was supposed to diversify them beyond traditional reman and be a higher margin business that would grow with EV adoption. But it has never turned into a material contributor. The debt reduction and stock buy backs are meaningful but IMHO this narrative takes a very optimistic view of things.