- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

A Look At Take Two Interactive Software (TTWO) Valuation As Guidance Rises On Improving Sales And Narrowing Losses

Take-Two Interactive Software (TTWO) shares were in focus after the company reported third quarter and nine month results showing higher sales and revenue, narrower net losses, and an increased earnings outlook for fiscal 2026.

See our latest analysis for Take-Two Interactive Software.

The third quarter update and higher earnings outlook arrive after a tough stretch for the share price, with a 30 day share price return of 22% and a year to date share price return of 22.3%. The 3 year total shareholder return of 76.1% shows longer term holders have still seen strong gains despite a 6.3% total shareholder return decline over the last year.

If this earnings news has you thinking more broadly about gaming and digital entertainment, it could be worth scanning 56 profitable AI stocks that aren't just burning cash as a starting point for other potential ideas linked to content and technology trends.

With revenue rising, losses narrowing and the shares still showing a 1 year total return decline, is Take-Two trading at a discount that reflects these improving numbers, or are markets already pricing in future growth?

Most Popular Narrative: 29.7% Undervalued

Compared to the most followed narrative fair value of $278.23, Take-Two’s last close at $195.59 sits well below that estimate and puts the focus firmly on what is driving those higher assumptions.

Strategic investments in technology, AI, and content pipeline efficiency, alongside a strong release slate with multiple high-profile launches (including Borderlands 4, NBA 2K26, and Mafia: The Old Country), undergird management's outlook for record net bookings and enhanced profitability in the coming years.

Want to see what sits behind that fair value gap? The narrative leans on faster top line growth, a sharp margin shift, and a future earnings multiple usually reserved for market favorites. Curious which specific earnings and revenue paths need to line up to support that view?

Result: Fair Value of $278.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on key risks, including reliance on a few blockbuster franchises and rising development and marketing costs that could pressure margins if titles underperform.

Find out about the key risks to this Take-Two Interactive Software narrative.

Another View: High Sales Multiple Raises Questions

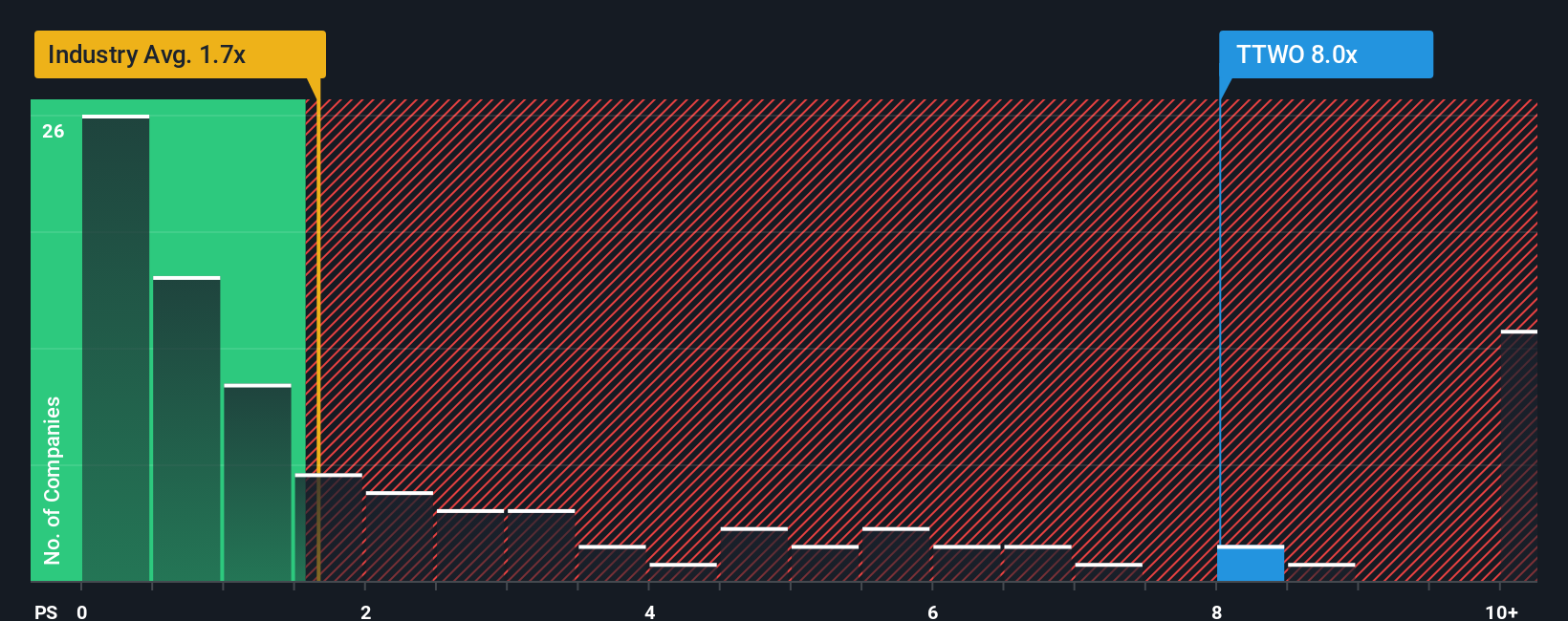

There is a twist when you look at Take-Two through its sales multiple. The shares trade on a P/S of 5.5x, while the fair ratio is 3.9x, peers average 4.6x, and the broader US entertainment group sits at 1.4x. That premium points to higher valuation risk if growth or margins fall short. Does that still line up with your own expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Take-Two Interactive Software Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a complete Take Two thesis in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Take-Two Interactive Software.

Looking for more investment ideas?

If Take Two has sharpened your focus on quality, do not stop here. Use targeted stock lists to pressure test your next moves and avoid missing fresh opportunities.

- Target reliable cash generators by scanning 14 dividend fortresses that can potentially add income strength to your portfolio mix.

- Hunt for potential mispriced names with 52 high quality undervalued stocks that line up cash flows, balance sheets and price in one clear view.

- Prioritise resilience first with 82 resilient stocks with low risk scores so you are not relying on a single stock to carry your long term plans.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.