- United States

- /

- Media

- /

- NasdaqGM:TTD

Trade Desk (TTD) Is Down 6.6% After Posting Strong Results Amid Amazon Competition and Platform Delays

Reviewed by Sasha Jovanovic

- The Trade Desk reported third-quarter 2025 results with revenue rising to US$739.43 million and net income of US$115.55 million, along with strong fourth-quarter guidance and completion of a buyback program totaling nearly US$1.91 billion.

- Despite these robust financials, analysts and investment funds have highlighted concerns that competitive pressure from Amazon and the delayed rollout of Trade Desk’s Kokai platform are weighing on future growth expectations.

- We'll examine how competition from Amazon’s advertising platform and recent leadership in innovation shape Trade Desk's overall investment narrative.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Trade Desk Investment Narrative Recap

To own Trade Desk stock, an investor needs to have conviction in the long-term shift of ad budgets to open internet and data-driven programmatic advertising, despite intensifying competition and short-term disruption. The recent quarterly results, which beat expectations and were paired with strong fourth-quarter guidance, reaffirm the company's execution on key growth catalysts; however, the biggest near-term risk remains Amazon's rapid progress in digital advertising and the potential impact of slower Kokai platform adoption on growth acceleration. In context, these results do not fundamentally change the most critical catalysts or risks for the business right now.

Of the recent company announcements, the completion of a US$1.91 billion share buyback program stands out as most relevant, signaling sustained capital discipline during a period of share price weakness and macro uncertainty. This action is particularly interesting as it coincides with questions about the pace of innovation and the timing of growth inflection as Kokai's full rollout progresses.

By contrast, investors should be mindful that while Trade Desk remains a product leader, the rising power of walled gardens like Amazon may pose...

Read the full narrative on Trade Desk (it's free!)

Trade Desk's narrative projects $4.3 billion in revenue and $823.2 million in earnings by 2028. This requires 17.1% yearly revenue growth and a near doubling of earnings, up $406 million from $417.2 million today.

Uncover how Trade Desk's forecasts yield a $68.97 fair value, a 61% upside to its current price.

Exploring Other Perspectives

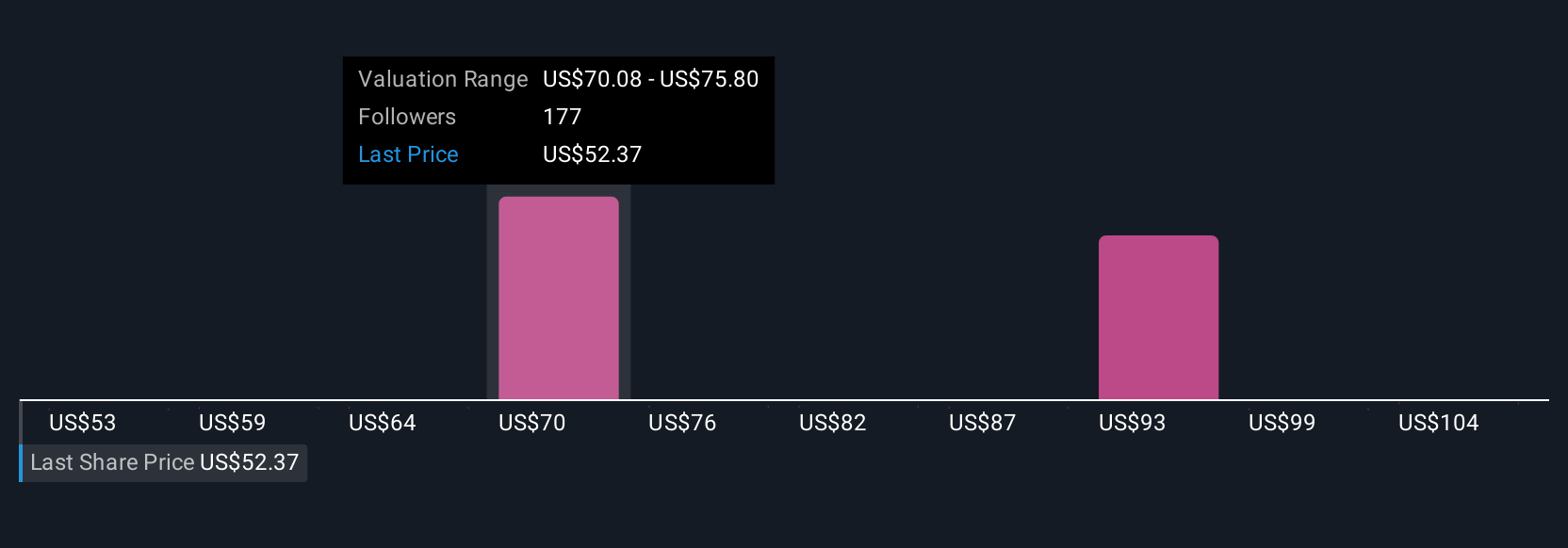

Community fair value estimates for Trade Desk range widely from US$39.48 to US$111.31 across 39 member views on Simply Wall St. While most see robust long-term growth potential, concerns about Amazon’s growing influence in digital ads continue to shape sentiment and outlook for future performance.

Explore 39 other fair value estimates on Trade Desk - why the stock might be worth 8% less than the current price!

Build Your Own Trade Desk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trade Desk research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Trade Desk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trade Desk's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives