- United States

- /

- Media

- /

- NasdaqGM:TTD

Trade Desk (TTD): Evaluating Valuation as Amazon Intensifies Competition in Digital Advertising

Reviewed by Simply Wall St

Trade Desk (TTD) shares slipped 3% after reports that Amazon is offering agencies a chance to test its demand-side platform against competitors for free, including covering associated costs. This initiative highlights the competitive pressures in digital advertising.

See our latest analysis for Trade Desk.

This latest move from Amazon lands just as Trade Desk’s momentum had started to pick up again. A 13.7% gain in its 1-month share price return offers a welcome rebound after months of steep losses. Even so, the 1-year total shareholder return remains sharply negative at -54.9%, reflecting ongoing competitive pressures and renewed concerns over the digital ad market’s shifting landscape.

If you’re looking for fresh opportunities beyond digital ad tech, now is a perfect chance to broaden your scope and discover fast growing stocks with high insider ownership

With shares still down significantly over the past year but trading at a notable discount to some analyst targets, the key question becomes whether Trade Desk is undervalued at current levels or if the market is already pricing in renewed growth.

Most Popular Narrative: 22.9% Undervalued

The most widely followed narrative places Trade Desk's fair value well above its last closing price, highlighting a strong perceived value gap that has sparked considerable attention from investors. This valuation provides important context for a potential turning point that supporters believe could reshape Trade Desk's growth story.

The continued rapid shift of ad spend from linear TV to connected TV (CTV) is driving significantly faster growth for Trade Desk's highest-margin channel. Deepened relationships with leading CTV and streaming content partners (Disney, Netflix, Roku, LG, etc.) position Trade Desk to capture an outsized share of the expanding premium digital video ad market, which could accelerate revenue and earnings growth as CTV penetration increases globally.

Want to know what’s fueling Trade Desk’s bullish valuation? The narrative is built on ambitious assumptions about growth, margin expansion, and a premium future earnings multiple. This is not your average projection. Find out which key financial forecasts are driving the storyline and what could make the difference in years ahead.

Result: Fair Value of $69.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on major clients and rising competition from dominant platforms could quickly challenge even the most optimistic growth assumptions.

Find out about the key risks to this Trade Desk narrative.

Another View: Premium Valuation Signals Caution

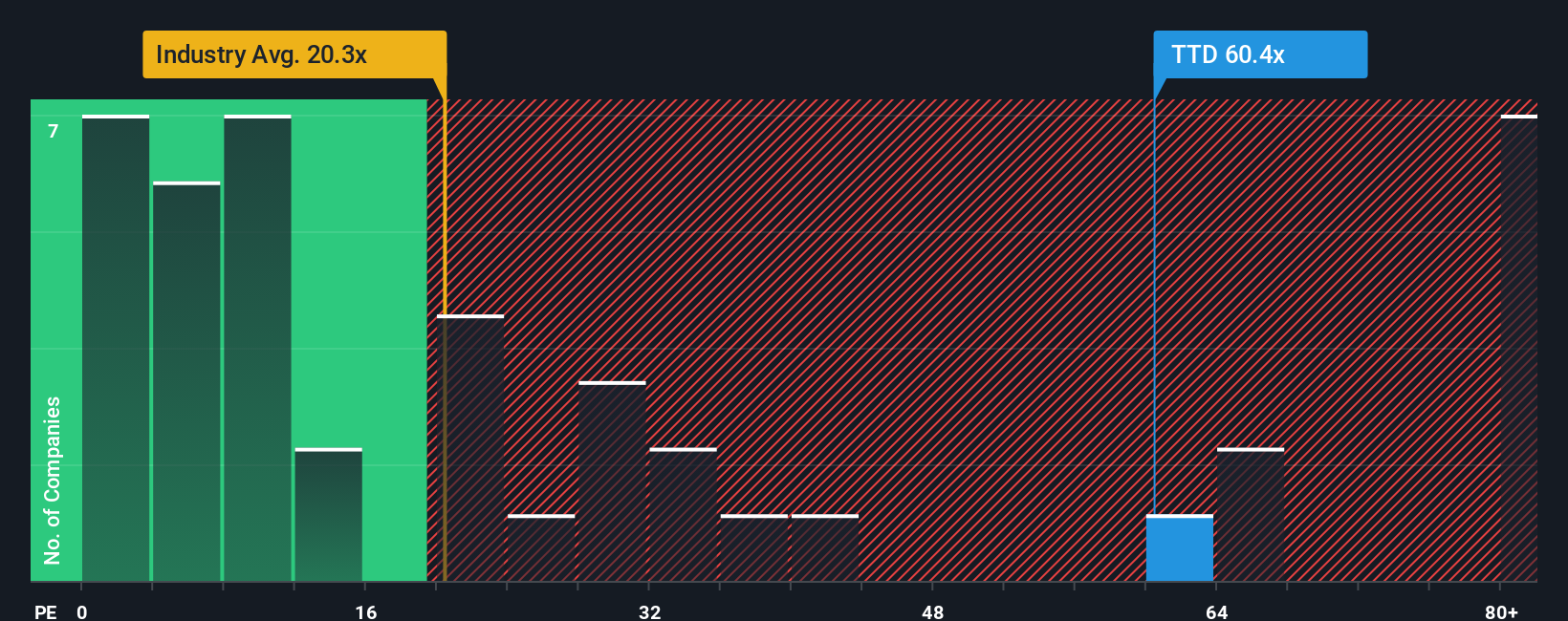

From the market’s perspective, Trade Desk trades at a price-to-earnings ratio of 62.8x, which is significantly higher than both the US Media industry average of 19.6x and its peer group’s 34.3x. This ratio is also double its fair ratio of 30.8x. Such a substantial premium raises questions about whether current optimism is outpacing the company’s fundamentals. Is the current price justified, or does it create a higher hurdle for future results?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trade Desk Narrative

If you see things differently or would rather rely on your own independent dive into the numbers, you can build a fresh storyline that reflects your perspective in just a few minutes, with Do it your way.

A great starting point for your Trade Desk research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss out on stocks making big moves in emerging sectors, income opportunities, or under-the-radar breakthroughs. Let Simply Wall Street’s free research tools work harder for you.

- Explore unrivaled growth potential by tracking these 875 undervalued stocks based on cash flows, which offers attractive entry points and potential future upside that others might overlook.

- Unlock regular income by evaluating these 19 dividend stocks with yields > 3%, featuring strong yields above 3% for a smarter addition to your portfolio.

- Seize the future of healthcare with these 34 healthcare AI stocks, where innovation and AI are transforming medical solutions and supporting new growth stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives