- United States

- /

- Media

- /

- NasdaqGM:TTD

How the Latest 8% Drop and Partnership News Are Shaping Trade Desk’s Value in 2025

Reviewed by Bailey Pemberton

- Wondering if Trade Desk stock is a hidden bargain or just riding the hype? You are not alone. Let us break down what the numbers really say about its current value.

- Despite lots of investor debate, Trade Desk shares have dropped sharply, falling 8.2% over the last week and sliding 62.8% year-to-date, which has caught the attention of value-focused buyers and skeptics alike.

- Recent headlines have been swirling about Trade Desk's shifting partnerships with key advertising platforms and evolving data-privacy policies. This combination has fueled uncertainty and spurred these rapid price swings. Reports around major industry shifts in digital ad targeting add important context to what is unfolding in the stock price right now.

- When it comes to our numerical valuation checkup, Trade Desk currently scores a 2 out of 6 for being undervalued. We are about to dive deeper into different methods to assess its fair value, but keep reading for a smarter, more holistic approach at the end of the article.

Trade Desk scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Trade Desk Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a staple of valuation analysis for companies like Trade Desk. This approach estimates a company's worth by projecting its expected future cash flows based on available data, then discounting those projections back to today's dollars to find their present value.

Currently, Trade Desk reported Free Cash Flow (FCF) for the latest year of $722.5 million. Analyst forecasts show this figure climbing substantially, with projections reaching as high as $1.56 billion by the end of 2029. Analysts typically provide detailed estimates for up to five years, so long-term numbers are extrapolated trends. The DCF model used here is a two-stage version, which means it incorporates both analyst forecasts and more general growth assumptions beyond that period.

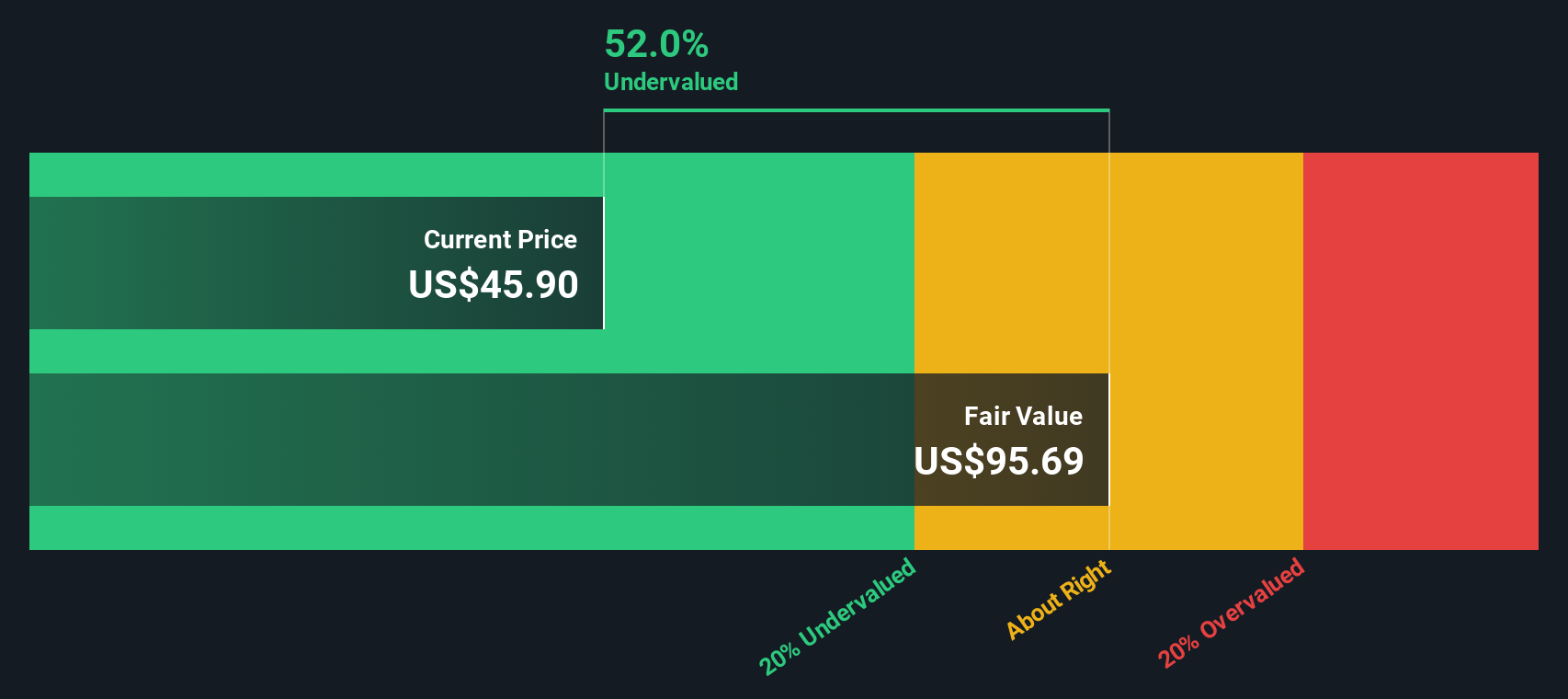

According to this DCF model, the estimated intrinsic fair value for Trade Desk shares is $92.65. Based on recent stock prices, this represents a 52.7% discount to what the model suggests is fair value, implying that the company could be undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Trade Desk is undervalued by 52.7%. Track this in your watchlist or portfolio, or discover 865 more undervalued stocks based on cash flows.

Approach 2: Trade Desk Price vs Earnings

The Price-to-Earnings (PE) ratio is widely considered the preferred valuation metric for profitable companies like Trade Desk, as it provides a straightforward way to compare the market’s valuation of a dollar of earnings across different businesses. For companies with stable profits, the PE ratio helps investors get a quick read on how much they are paying for each dollar of current earnings.

When evaluating what a “normal” PE ratio should be, it is important to remember that companies expected to grow earnings faster will often command higher PE ratios, while riskier or slower-growth firms usually trade at lower multiples. In essence, a higher PE can be justified if future earnings growth is strong and the risks are low.

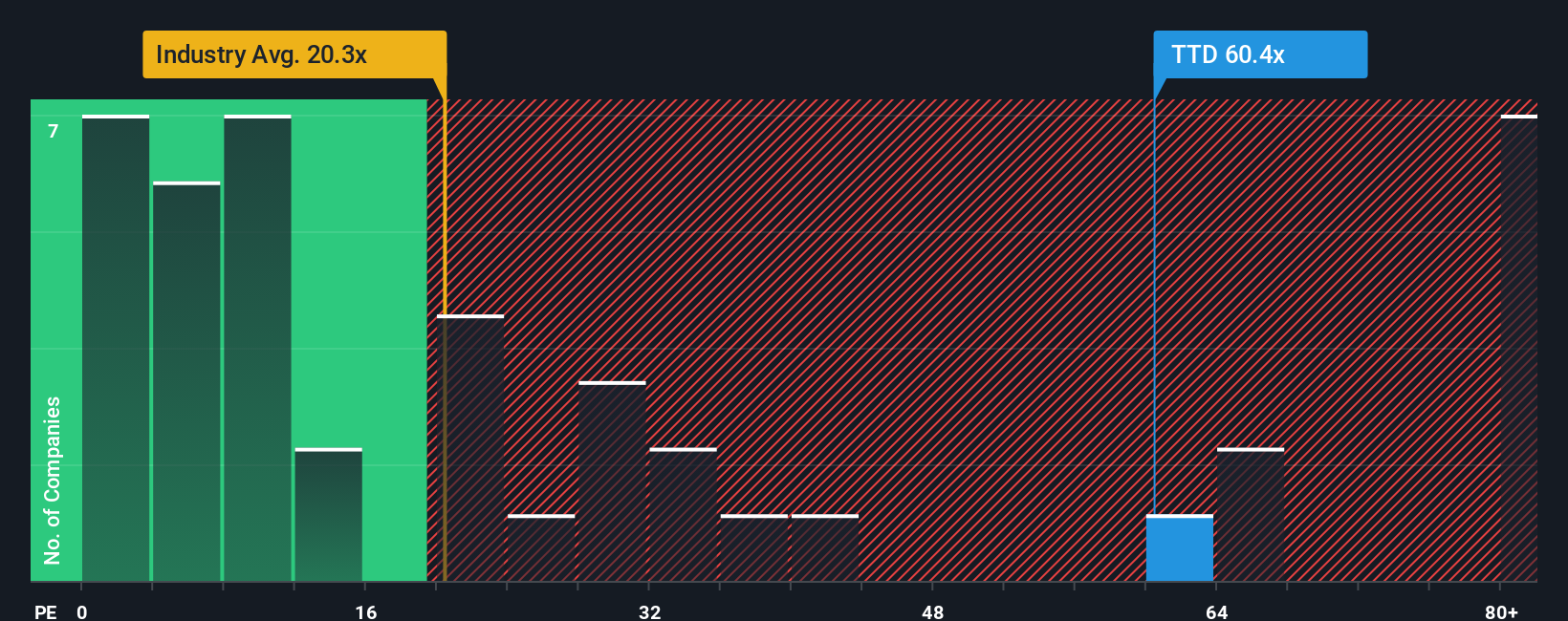

Trade Desk currently trades at a PE ratio of 48.3x. For context, this is much higher than the Media industry average of 16.9x, and also well above the 25.2x average for its peer group. While high growth might make a high PE ratio seem reasonable, a more nuanced view considers several factors, including growth, profit margins, the company's specific risk profile, industry positioning, and market capitalization.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio is a tailored benchmark that suggests a suitable PE multiple for a company, after factoring in its growth trajectory, risk, profitability, industry landscape, and size. Unlike generic peer or industry comparisons, the Fair Ratio presents a more context-driven estimate of what represents fair value for the stock.

For Trade Desk, the Fair Ratio is calculated at 29.3x. By comparing the current PE of 48.3x to this Fair Ratio, it is evident that the stock is trading at a significant premium. This signals that, even after accounting for growth and profitability, Trade Desk may be overvalued when measured on a PE basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1370 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Trade Desk Narrative

Earlier in the article, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives.

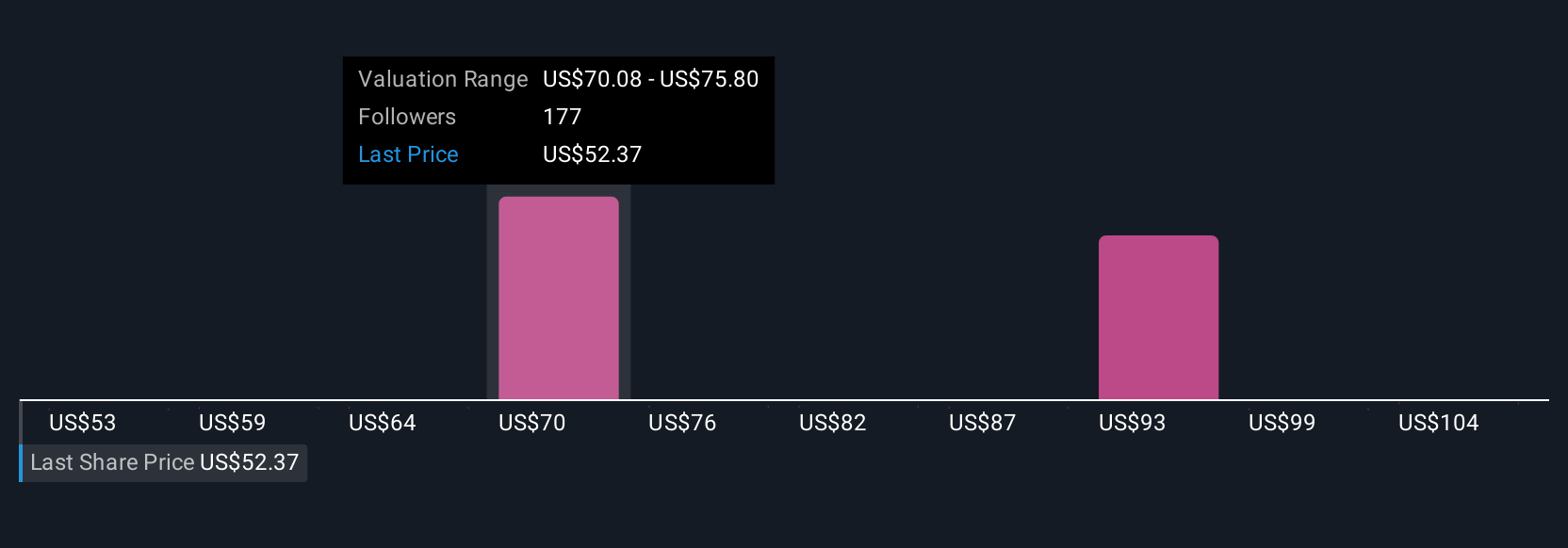

A Narrative is your unique story about a company, built by connecting what you believe about its business, industry trends, risks, and opportunities to actual forecasts for future revenue, earnings, and profit margins. Instead of just relying on numbers or generic ratios, Narratives empower you to clarify your own assumptions, translate them into a financial forecast, and see what fair value you would personally assign to the stock.

Narratives make this process easy and approachable on Simply Wall St's platform, which is used by millions of investors. On the Community page, you can quickly create, read, and update investment stories for Trade Desk and thousands of other companies. By comparing each Narrative's Fair Value with the current market price, investors can clearly see if a stock looks like a buy, hold, or sell based on their view of the future, not just the past.

Crucially, Narratives are dynamic. When news breaks or new earnings results arrive, the numbers, risks, and your estimates all update automatically, so your investment thesis stays fresh and relevant. For example, some Trade Desk Narratives highlight long-term AI-driven revenue upside and give fair values over $135, while others focus on competition and project far lower values, even as low as $34.

Do you think there's more to the story for Trade Desk? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives