- United States

- /

- Life Sciences

- /

- NasdaqGS:NAUT

Nautilus Biotechnology And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As major U.S. stock indexes continue to set fresh records, investors are closely watching the Federal Reserve's latest moves and the potential impact on market trends. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing investment area despite their somewhat outdated name. This article will explore three such stocks that stand out for their financial strength and potential to offer compelling opportunities in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.91 | $405.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.80 | $643.76M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.41 | $260.1M | ✅ 4 ⚠️ 2 View Analysis > |

| WM Technology (MAPS) | $1.12 | $203.51M | ✅ 4 ⚠️ 2 View Analysis > |

| GoodRx Holdings (GDRX) | $3.77 | $1.37B | ✅ 4 ⚠️ 2 View Analysis > |

| Sensus Healthcare (SRTS) | $3.26 | $54.91M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.01 | $25.24M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.9925 | $6.9M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.75 | $76.58M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 353 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Nautilus Biotechnology (NAUT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nautilus Biotechnology, Inc. is a development stage life sciences company focused on creating a platform technology to quantify and understand the complexity of the proteome, with a market cap of $154.09 million.

Operations: Currently, Nautilus Biotechnology does not report any revenue segments.

Market Cap: $154.09M

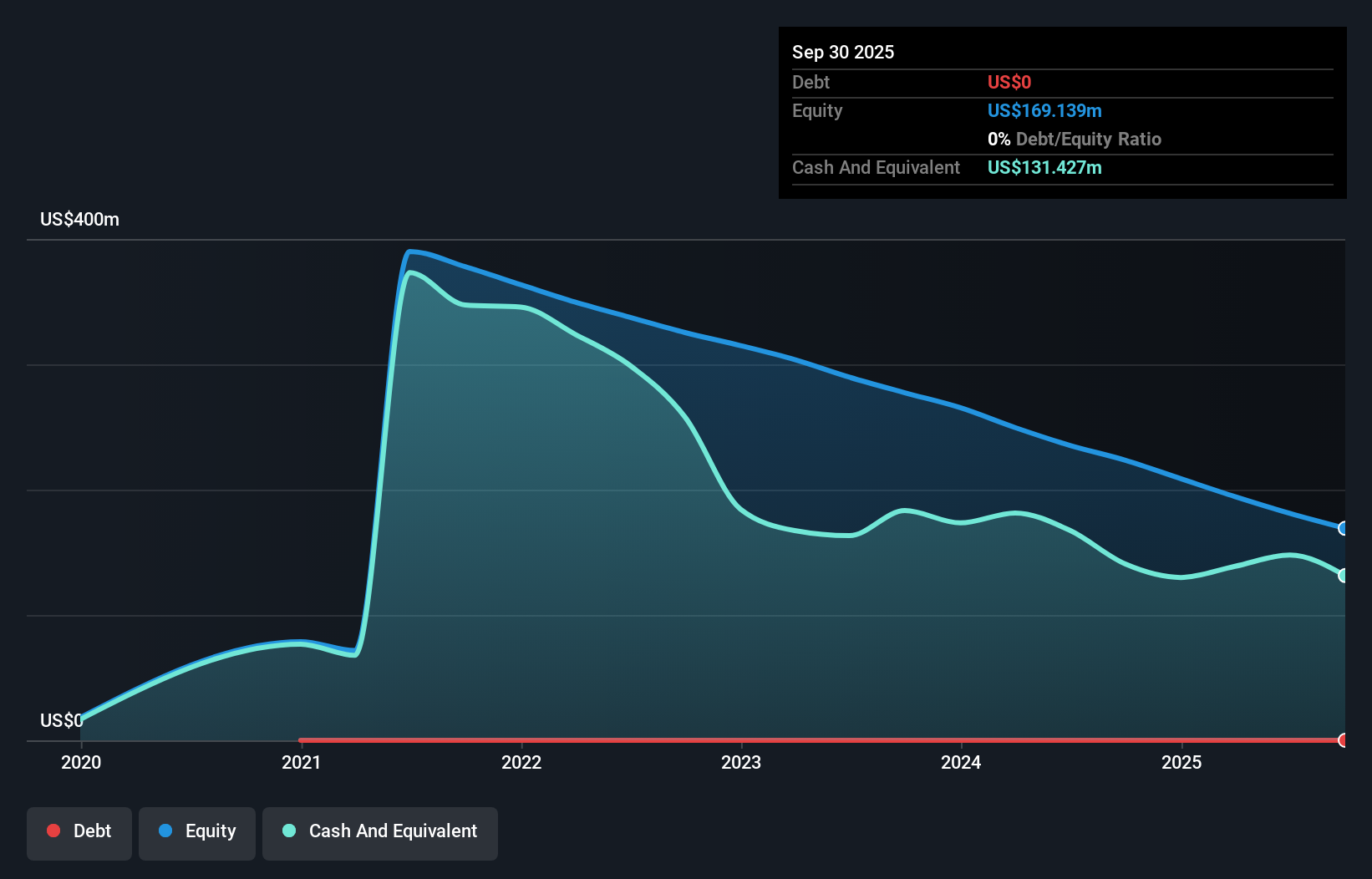

Nautilus Biotechnology, with a market cap of US$154.09 million, is a pre-revenue company in the life sciences sector. Despite no significant revenue streams, it remains debt-free and has a stable cash runway for over two years. The management and board are experienced with an average tenure of 4.3 years. Recent strategic alliances, such as with the Allen Institute to explore tau proteins' role in neurodegenerative diseases, highlight its innovative approach but also underscore its current unprofitability and forecasted earnings decline over the next three years by 8.2% annually. Share price volatility remains high amidst these developments.

- Click here and access our complete financial health analysis report to understand the dynamics of Nautilus Biotechnology.

- Explore Nautilus Biotechnology's analyst forecasts in our growth report.

trivago (TRVG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: trivago N.V. operates a hotel and accommodation search platform across various countries, including the United States, Germany, and Japan, with a market cap of approximately $0.22 billion.

Operations: trivago's revenue is primarily derived from three geographical segments: Developed Europe (€209.72 million), the Americas (€185.37 million), and the Rest of World (€105.61 million).

Market Cap: $216.31M

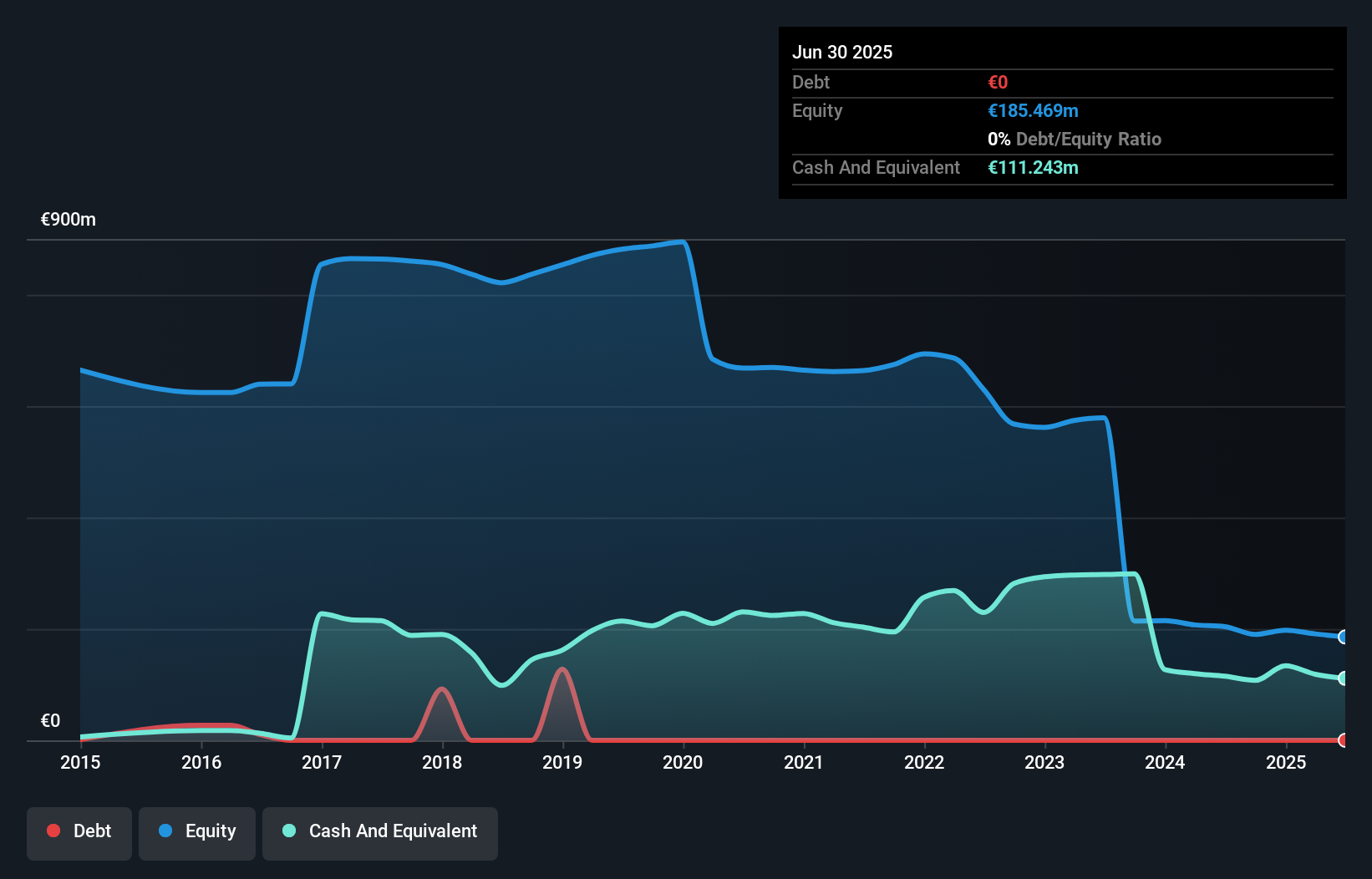

trivago N.V., with a market cap of approximately US$0.22 billion, operates in the hotel search platform industry and is currently unprofitable. Despite this, it trades at 70.3% below its estimated fair value and has reduced losses by 14.8% annually over the past five years while maintaining positive free cash flow. The company benefits from an experienced management team with a tenure of 2.4 years and sufficient cash runway for more than three years without debt concerns. Recent earnings guidance suggests continued double-digit revenue growth, albeit slower than previous quarters, highlighting potential recovery momentum.

- Jump into the full analysis health report here for a deeper understanding of trivago.

- Examine trivago's earnings growth report to understand how analysts expect it to perform.

NET Power (NPWR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NET Power Inc. is a U.S.-based energy technology company with a market cap of $802.36 million.

Operations: Currently, there are no reported revenue segments for NET Power Inc.

Market Cap: $802.36M

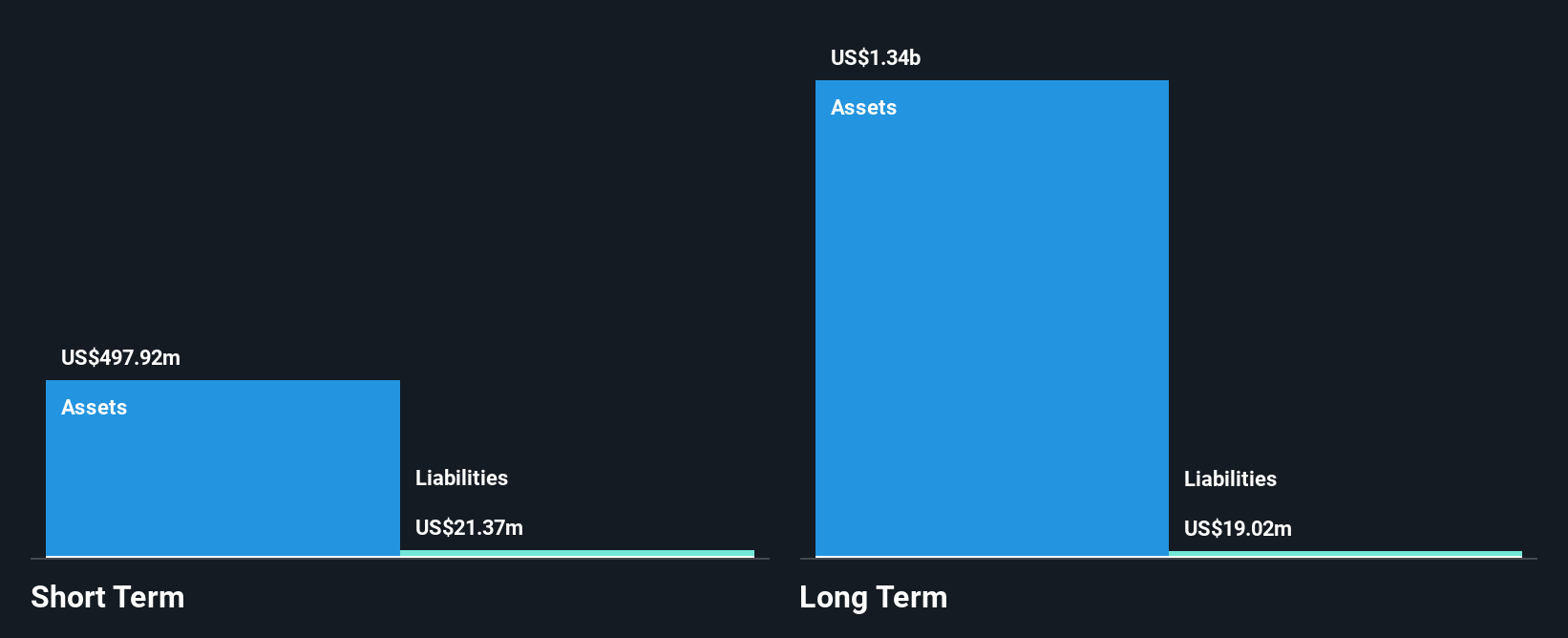

NET Power Inc., with a market cap of US$802.36 million, is pre-revenue, generating less than US$1 million annually. The company is debt-free but remains unprofitable, with increasing losses over the past five years at 23.4% per year and reported a significant net loss of US$147.49 million for the first half of 2025. Despite having sufficient cash runway for more than three years based on current free cash flow, its management team and board are relatively inexperienced, averaging tenures of 1.1 and 2.3 years respectively, while its share price has been highly volatile recently.

- Dive into the specifics of NET Power here with our thorough balance sheet health report.

- Understand NET Power's earnings outlook by examining our growth report.

Key Takeaways

- Click this link to deep-dive into the 353 companies within our US Penny Stocks screener.

- Seeking Other Investments? The end of cancer? These 27 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nautilus Biotechnology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NAUT

Nautilus Biotechnology

A development stage life sciences company, engages in creating a platform technology for quantifying and unlocking the complexity of the proteome.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives