- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TRIP

What Tripadvisor (TRIP)'s ChatGPT Integration Means for Shareholders

Reviewed by Sasha Jovanovic

- Tripadvisor recently launched a ChatGPT-enabled app, allowing users to access reviews, ratings, and travel images directly within their chat for a more personalized trip planning experience.

- This move signals Tripadvisor's emphasis on blending its extensive proprietary data with advanced AI to deliver highly tailored travel guidance and position itself at the forefront of AI-powered travel technology.

- We'll now examine how Tripadvisor's deeper integration of AI, especially through ChatGPT, could reshape its long-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Tripadvisor Investment Narrative Recap

For shareholders, the core narrative centers on Tripadvisor’s ability to reignite user growth and deepen engagement through AI-driven personalization. While the ChatGPT-enabled app signals progress, its immediate impact on Tripadvisor’s most urgent challenge, reversing free traffic declines, remains limited, and competitive threats from larger platforms persist as a primary risk. The importance of capturing sustainable, higher-margin user activity outweighs short-term technology buzz as Tripadvisor seeks to stabilize its revenue base.

Among recent announcements, the company’s new partnership with Perplexity to boost AI-powered search stands out as a meaningful development. This collaboration ties directly to Tripadvisor’s need for smarter, more efficient content discovery, key to improving user experience and potentially tapering its reliance on expensive paid marketing channels as it faces growing industry competition.

But in contrast, investors should also be mindful of ongoing headwinds in organic traffic acquisition, which could put net margins at risk if current pressures continue...

Read the full narrative on Tripadvisor (it's free!)

Tripadvisor is expected to reach $2.3 billion in revenue and $144.6 million in earnings by 2028. This projection relies on annual revenue growth of 7.1% and an increase in earnings of about $79.6 million from the current $65.0 million.

Uncover how Tripadvisor's forecasts yield a $18.16 fair value, a 12% upside to its current price.

Exploring Other Perspectives

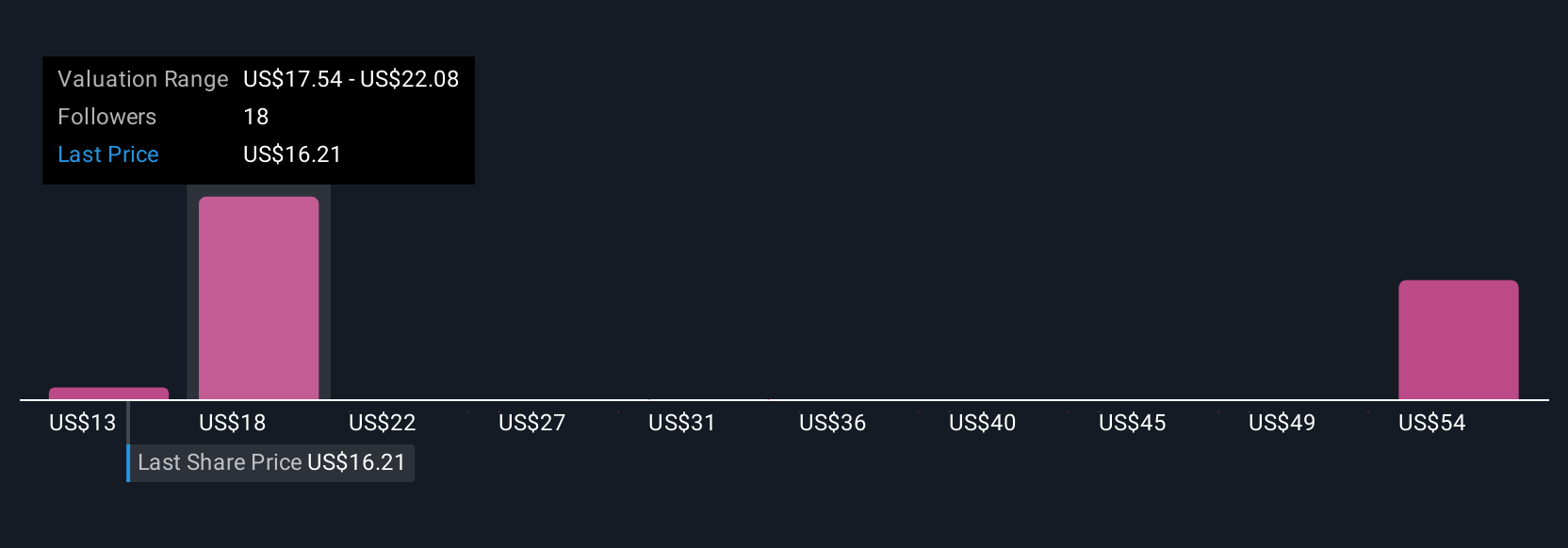

Simply Wall St Community members’ fair value estimates for Tripadvisor stretch from US$13.50 to US$38.73, with eight distinct perspectives represented. While many see potential for profit growth from AI integration, persistent traffic and margin risk continues to shape sentiment, reminding you to weigh diverse community views on the company’s future direction.

Explore 8 other fair value estimates on Tripadvisor - why the stock might be worth over 2x more than the current price!

Build Your Own Tripadvisor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tripadvisor research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tripadvisor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tripadvisor's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tripadvisor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIP

Tripadvisor

TripAdvisor, Inc., an online travel company, engages in the provision of travel guidance products and services worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion