- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TRIP

Tripadvisor (TRIP): Exploring Valuation Following Strong Earnings Growth and Updated Revenue Guidance

Reviewed by Simply Wall St

Tripadvisor (TRIP) just released its latest financial results, highlighting stronger year-over-year growth in revenue and net income. In addition to the earnings update, the company also set expectations for continued moderate revenue gains into next year.

See our latest analysis for Tripadvisor.

Tripadvisor’s latest earnings have been met with some skepticism by investors, as reflected in a 90-day share price return of -15.1%. While short-term momentum has faded, the 1-year total shareholder return is still a positive 7.3%. This mix of cautious optimism and recent pullback suggests the market is weighing the company’s moderate growth guidance against past volatility and new leadership changes.

If today’s travel sector volatility has you curious, it might be the perfect time to branch out and discover fast growing stocks with high insider ownership

With shares still trading at a meaningful discount to analyst price targets and recent earnings momentum, the question now is whether Tripadvisor is undervalued or if the market has already factored in its future growth potential.

Most Popular Narrative: 17.6% Undervalued

Tripadvisor’s most widely followed stock narrative points to significant upside compared to its last close of $14.96, based on a higher fair value estimate and strong growth levers that command attention.

Tripadvisor's focus on scaling its experiences marketplace (Viator and TheFork) takes advantage of global consumer shifts toward experiential travel. Rising international leisure travel from the expanding middle class and a preference for unique experiences are both enlarging the company's addressable market and supporting sustainable, above-industry growth rates. These factors positively impact long-term revenue and gross profit.

Want to peek behind the curtain of this optimistic outlook? The mechanics of this narrative rely on bolder revenue expansion and juicier profit margins than you might expect. Curious which financial levers and future milestones push the fair value well past today’s price? The full narrative reveals the building blocks behind the valuation surge.

Result: Fair Value of $18.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in organic traffic and fierce competition from larger players could still disrupt Tripadvisor’s path to sustainable growth and profitability.

Find out about the key risks to this Tripadvisor narrative.

Another View: Is the Market Already Pricing In Growth?

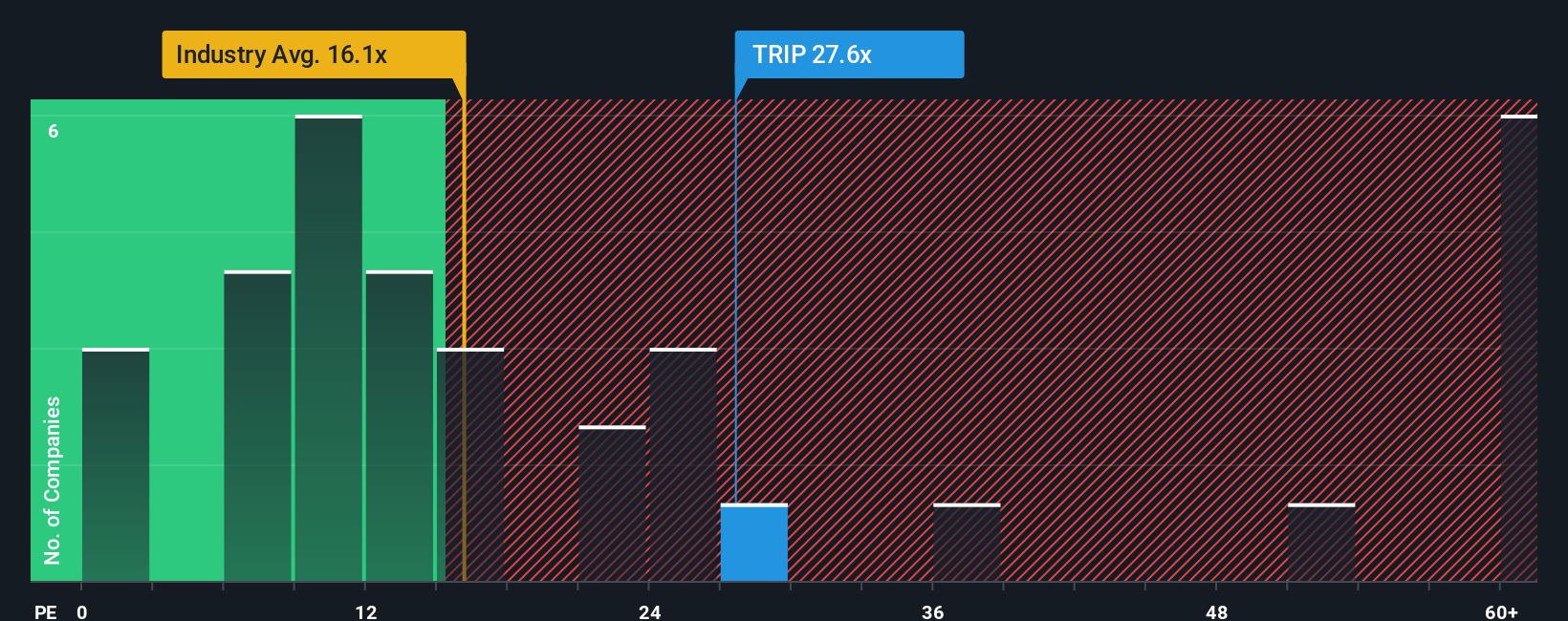

While some see Tripadvisor's stock as undervalued, a look at its price-to-earnings ratio raises caution. At 22.1x, it is higher than the industry average of 16.8x, the peer average of 18.9x, and even our calculated fair ratio of 20x. This premium suggests investors may already be paying up for future gains, posing potential valuation risk if growth does not accelerate as expected. Is the upside real or already reflected in today's price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tripadvisor Narrative

If you want a fresh perspective or simply trust your own analysis, you can easily shape a custom Tripadvisor story in minutes: Do it your way

A great starting point for your Tripadvisor research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t let your next great investment pass you by. Take charge by checking out some compelling opportunities other investors are watching right now. Your future self will thank you.

- Boost your income potential by starting with these 16 dividend stocks with yields > 3%, which offers strong yields above 3% and a robust dividend history.

- Stay ahead in technology by targeting innovation leaders through these 25 AI penny stocks, which are at the forefront of artificial intelligence advancements.

- Capitalize on value by acting on these 879 undervalued stocks based on cash flows, identified as having promising upside based on discounted cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tripadvisor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIP

Tripadvisor

TripAdvisor, Inc., an online travel company, engages in the provision of travel guidance products and services worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives