- United States

- /

- Media

- /

- NasdaqCM:THRY

Thryv (THRY) Losses Widen 64.5% Per Year, Reinforcing Bearish Profitability Narratives

Reviewed by Simply Wall St

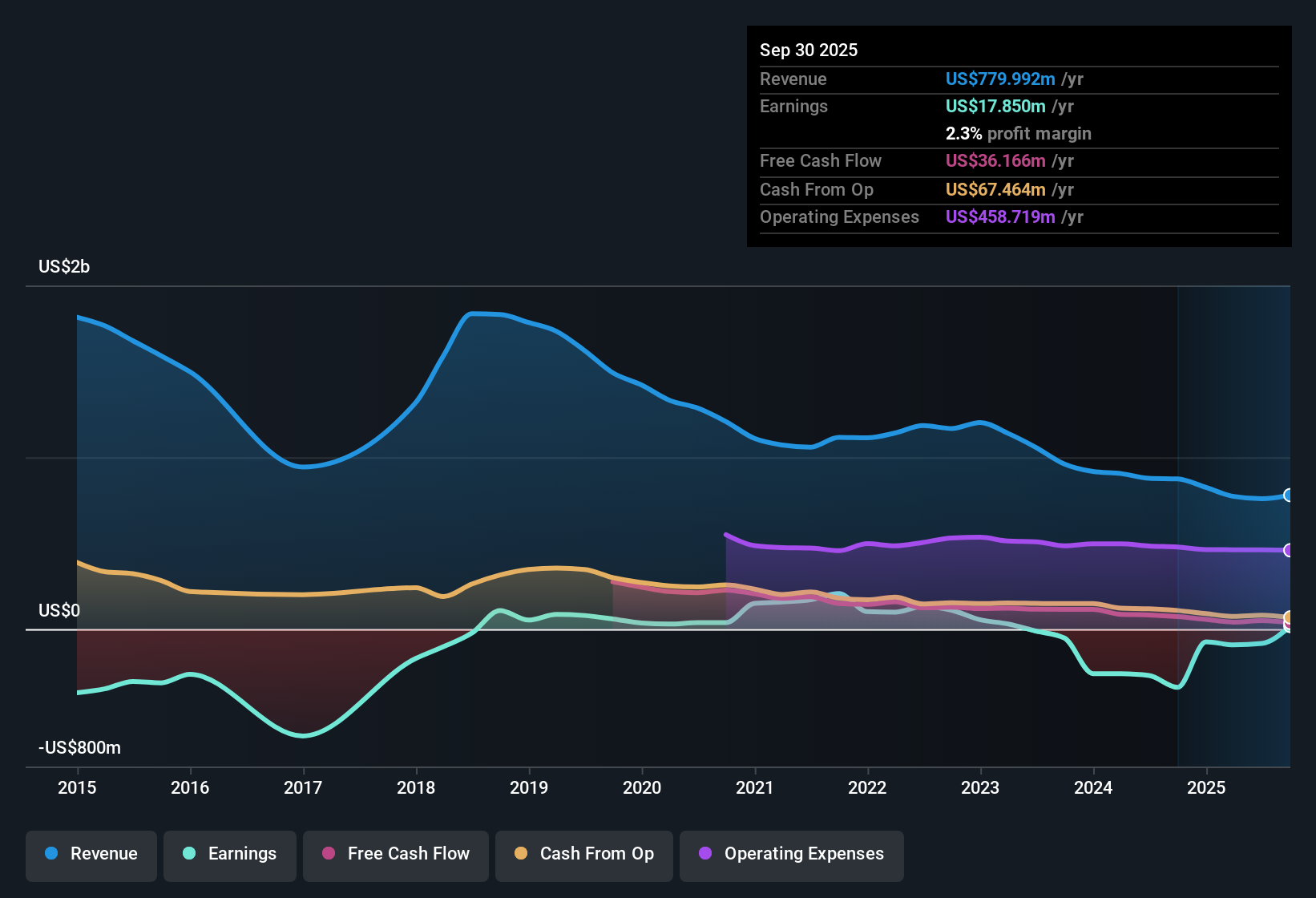

Thryv Holdings (THRY) remains in the red, with losses escalating at an average annual rate of 64.5% over the past five years. The company’s net profit margin shows no signs of recovery, and this sustained unprofitability continues to cast a shadow over its latest earnings picture. While shares sit at $8.17, well below an estimated fair value of $19.68, the main silver lining is Thryv’s relatively low valuation compared to peers. This offers an intriguing setup for value-driven investors, set against a backdrop of ongoing bottom-line struggles.

See our full analysis for Thryv Holdings.The next step is to stack these latest numbers up against the prevailing investor narratives. Some storylines may be reinforced, while others could face tough questions.

See what the community is saying about Thryv Holdings

SaaS Revenue Grows 25%, Legacy Print Declines Loom

- Thryv's SaaS business is showing strong traction, with year-over-year SaaS revenue up 25%. However, this growth is partially counterbalanced by managed and persistent declines in their legacy Marketing Services (print and directories), which are expected to sunset by 2028.

- According to analysts' consensus view, multiproduct SaaS adoption and ecosystem upgrades are helping to boost customer retention, recurring revenue, and profitability through a 103% net revenue retention rate.

- However, the transition to SaaS is masking flat subscriber growth and ongoing subscriber losses, raising concerns about whether higher average revenue per user (ARPU) can offset long-term churn.

- Analysts flag that the shrinking revenue base from legacy print could become a margin headwind as these higher-margin revenues run off. This increases pressure on SaaS segments to deliver steady new client acquisition.

- Consensus narrative highlights that while digital transformation supports recurring revenue, dependence on existing customer upsells over new client growth exposes Thryv to risk if competitive threats intensify or integration challenges such as slow synergy capture from the Keep acquisition persist.

- What’s particularly important is that the company’s recurring revenue stability hinges on executing this SaaS transition swiftly. Delays or continued subscriber churn could threaten revenue durability.

- Analysts point out that investment capacity unlocked by debt reduction and lower amortization could help close the gap, but only if R&D and go-to-market spend are accelerated enough to keep pace with larger software competitors.

Margins Set for Wild Swing: From -11.1% to 25.6%?

- Analysts are projecting a dramatic shift in profitability, with net profit margins expected to rise from -11.1% today to 25.6% in three years, powered by potential upsell leverage and operational improvements.

- Consensus narrative makes the case that cross-sell initiatives and higher net revenue retention rates could translate into sustained margin recovery.

- Still, critics highlight ongoing reliance on ARPU growth while subscriber numbers stagnate, warning it may overstate how quickly margins can reach positive territory.

- The narrative is that if subscriber acquisition does not rebound fast enough, these margin targets could be at risk, especially as competitors are intensifying efforts in cloud-based SMB solutions.

Valuation Discount: 0.5x Sales Ratio and $8.17 Price

- Thryv’s shares currently trade at $8.17, which is substantially below the DCF fair value of $19.68 and the analyst price target of $21.00. Its 0.5x price-to-sales multiple sits well below the US Media industry’s 1.0x and peer average of 0.9x.

- The consensus narrative underlines that this deep discount, when weighed against the long-term SaaS potential and profitability trajectory, is the main positive catalyst for value-focused investors.

- The catch is that analysts expect Thryv's revenue to decline by 5.8% annually over the next three years, so this low multiple partially reflects cautious forecasts for the top line.

- While bulls argue that debt reduction and an upcoming industry reclassification could eventually trigger a market re-rating, the valuation gap will only close if execution on new client growth and SaaS delivery meets expectations.

- Bulls and bears are divided on whether the depressed valuation is a bargain or a sign of deeper business challenges; see the full consensus view and how it frames the opportunity versus risk in the current setup. 📊 Read the full Thryv Holdings Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Thryv Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a distinct take on these figures? In just a few minutes, you can craft your own outlook and turn your insights into a fresh narrative. Do it your way

A great starting point for your Thryv Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Thryv’s cost-cutting and SaaS push are notable, declining revenues and uncertain subscriber growth signal that stable expansion may remain elusive.

If you value consistent results, our stable growth stocks screener (2113 results) highlights companies delivering steady earnings and revenue across cycles so you can pursue more predictable opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thryv Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:THRY

Thryv Holdings

Provides digital marketing solutions and cloud-based tools to the small-to-medium-sized businesses in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives