- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TBLA

Investors Holding Back On Taboola.com Ltd. (NASDAQ:TBLA)

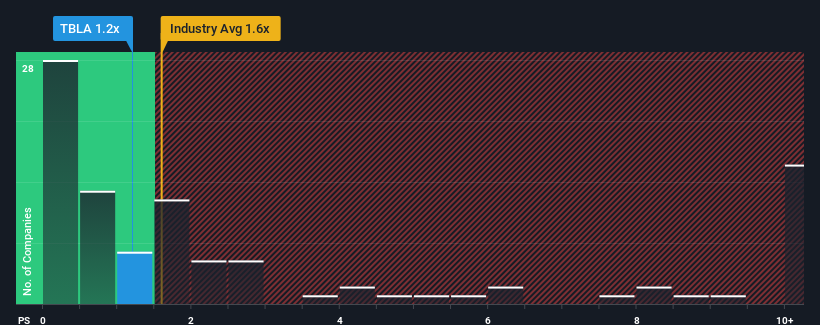

With a median price-to-sales (or "P/S") ratio of close to 1.6x in the Interactive Media and Services industry in the United States, you could be forgiven for feeling indifferent about Taboola.com Ltd.'s (NASDAQ:TBLA) P/S ratio of 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Taboola.com

What Does Taboola.com's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Taboola.com's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Taboola.com.Is There Some Revenue Growth Forecasted For Taboola.com?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Taboola.com's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.2%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 17% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 22% per annum as estimated by the six analysts watching the company. With the industry only predicted to deliver 12% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Taboola.com's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Taboola.com's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Taboola.com's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Taboola.com with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Taboola.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TBLA

Taboola.com

Operates an artificial intelligence-based algorithmic engine platform in Israel, the United States, the United Kingdom, Germany, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives