- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TBLA

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet over the past 12 months, it has risen by an impressive 24%, with earnings forecasted to grow by 15% annually. In this environment of robust growth potential, identifying high-growth tech stocks that align with these promising trends could be key for investors seeking opportunities in January 2025.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.36% | 24.28% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Bitdeer Technologies Group | 51.06% | 122.94% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.37% | 56.70% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Grid Dynamics Holdings (NasdaqCM:GDYN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grid Dynamics Holdings, Inc. offers technology consulting, platform and product engineering, and analytics services across North America, Europe, and internationally with a market capitalization of approximately $1.80 billion.

Operations: Grid Dynamics Holdings generates revenue primarily from its computer services segment, totaling $328.36 million. The company's operations span North America, Europe, and other international markets, focusing on technology consulting and engineering solutions.

Grid Dynamics Holdings has demonstrated a robust approach to innovation, particularly with its recent launch of the Visual Process Monitoring starter kit, which simplifies visual analytics projects significantly. This development, coupled with their inclusion in multiple S&P indices such as the S&P 1000 and S&P 600 Information Technology Sector, underscores their growing influence in tech. Financially, GDYN has turned profitable this year with a notable increase in quarterly sales from $77.42 million to $87.44 million and a leap in net income from $0.676 million to $4.28 million year-over-year for Q3 2024. These achievements highlight Grid Dynamics' potential amidst competitive tech landscapes and suggest promising avenues for future growth driven by strategic innovations and market recognition.

- Click to explore a detailed breakdown of our findings in Grid Dynamics Holdings' health report.

Assess Grid Dynamics Holdings' past performance with our detailed historical performance reports.

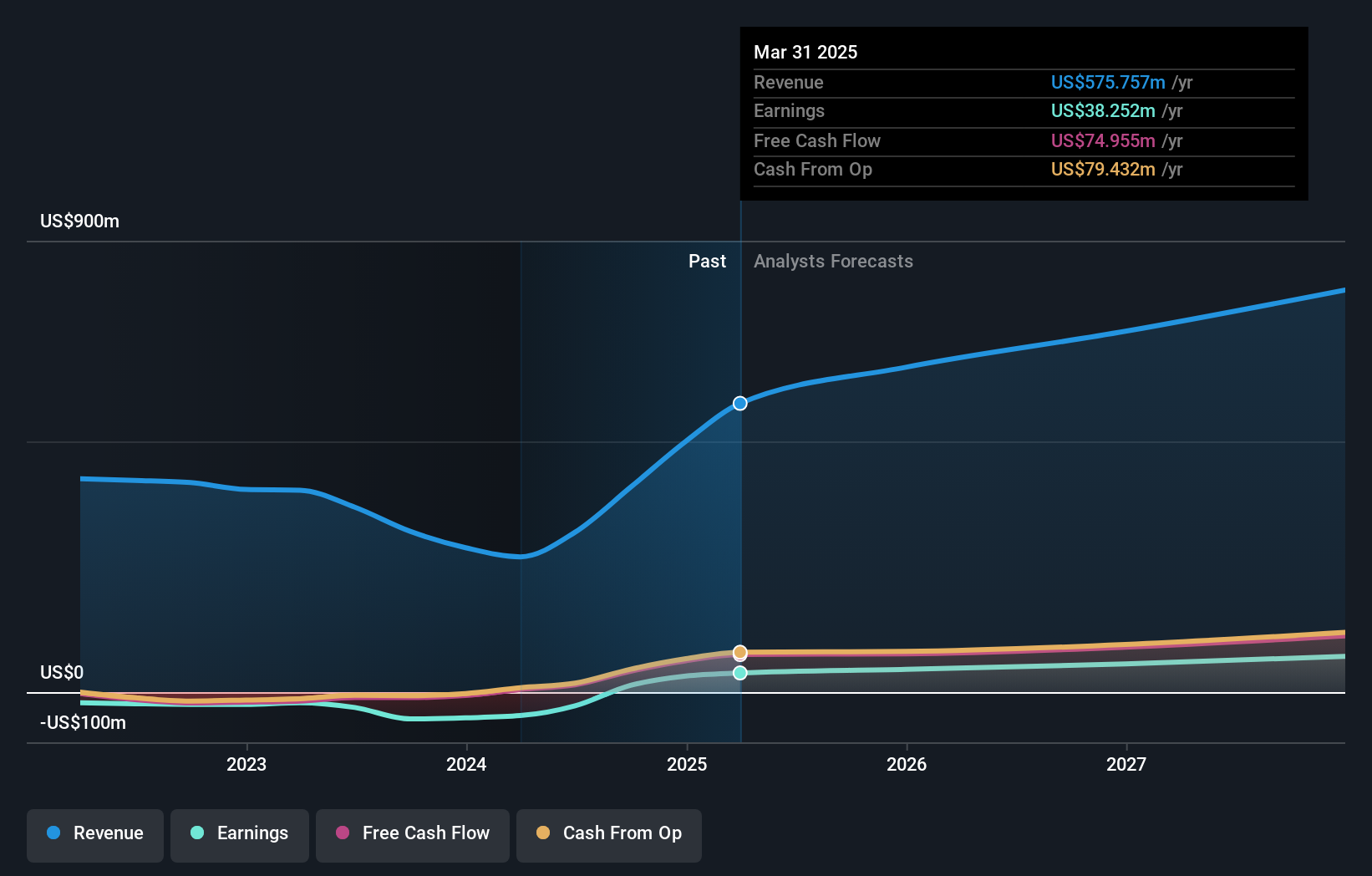

EverQuote (NasdaqGM:EVER)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EverQuote, Inc. operates an online marketplace for insurance shopping in the United States with a market cap of $723.64 million.

Operations: The company generates revenue primarily from its role as an Internet Information Provider, totaling $408.44 million. It facilitates insurance shopping through its online marketplace, connecting consumers with insurance providers across the United States.

With its recent transition to profitability and a striking 140% year-over-year revenue growth forecast for Q4 2024, EverQuote exemplifies dynamic expansion in the tech sector. At recent industry conferences, the company highlighted strategic initiatives poised to capitalize on this momentum. Impressively, EverQuote has turned a significant corner financially; from a net loss of $29.22 million to a net income of $11.55 million in Q3 2024 alone. This financial rebound is underscored by an annual earnings growth forecast of 24.1%, signaling robust future prospects in an increasingly competitive digital marketplace.

- Dive into the specifics of EverQuote here with our thorough health report.

Gain insights into EverQuote's past trends and performance with our Past report.

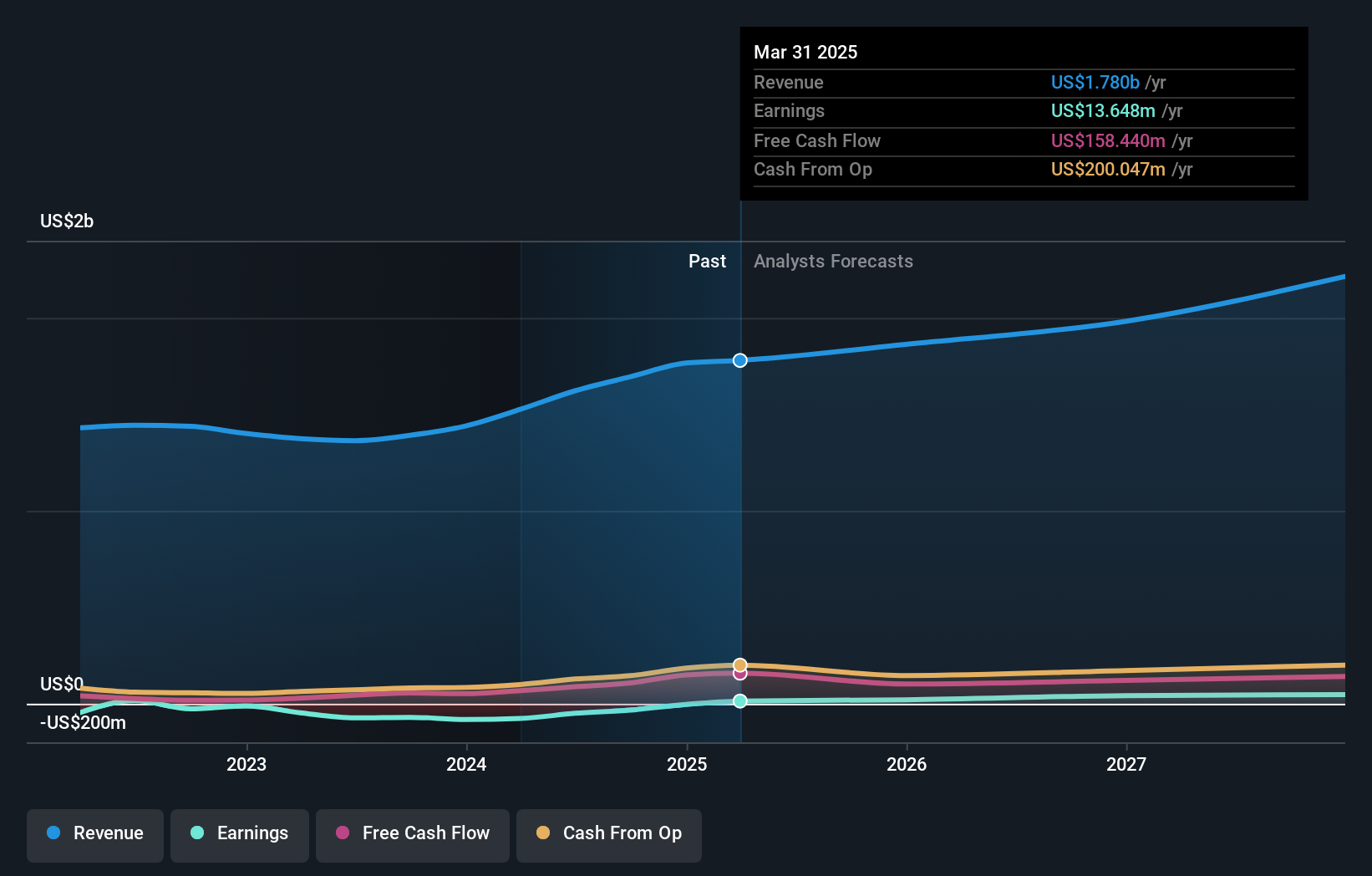

Taboola.com (NasdaqGS:TBLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taboola.com Ltd. operates an artificial intelligence-based algorithmic engine platform across various international markets, with a market cap of $1.28 billion.

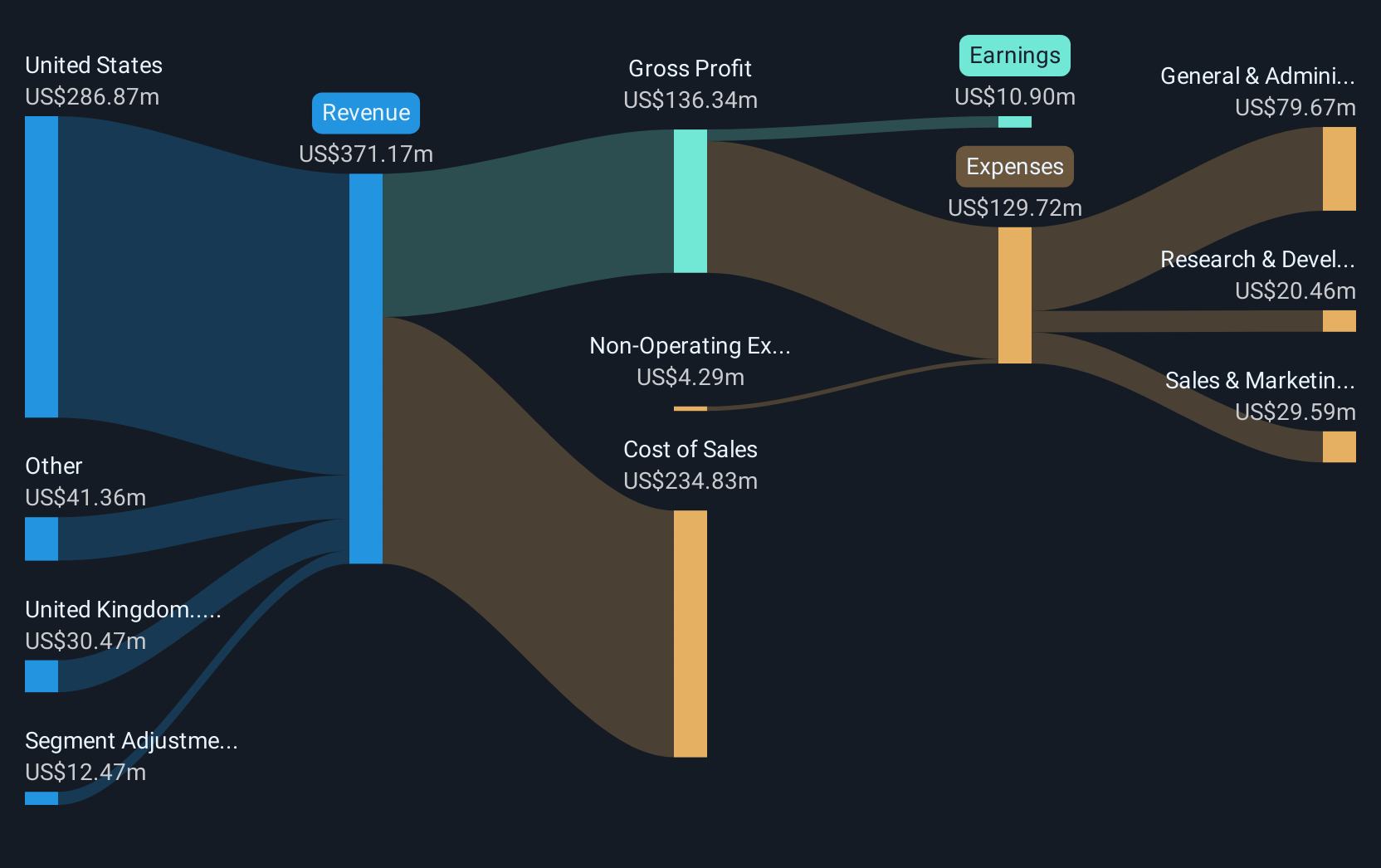

Operations: The company generates revenue primarily through its advertising segment, which amounts to $1.69 billion. Operating in multiple international regions, it leverages an AI-driven platform to deliver targeted advertising solutions.

Taboola.com Ltd. is carving out a strong position in the digital advertising space, recently renewing significant partnerships and projecting robust revenue growth. With a forecasted increase in revenues to between $1.735 billion and $1.765 billion for 2024, the company's strategic engagements at key industry conferences underscore its commitment to leveraging its extensive network, including high-profile clients like The Weather Company and Reach PLC. These collaborations are vital as they utilize Taboola’s advanced recommendation tools to enhance user engagement and monetization across various platforms, demonstrating an effective blend of technology deployment and partnership strategy in action. This approach not only solidifies Taboola’s market presence but also aligns with industry trends towards more personalized digital content delivery systems, marking it as a noteworthy entity in the tech landscape with promising prospects for escalating its market influence.

- Navigate through the intricacies of Taboola.com with our comprehensive health report here.

Examine Taboola.com's past performance report to understand how it has performed in the past.

Make It Happen

- Click this link to deep-dive into the 231 companies within our US High Growth Tech and AI Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taboola.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TBLA

Taboola.com

Operates an artificial intelligence-based algorithmic engine platform in Israel, the United States, the United Kingdom, Germany, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives