- United States

- /

- Media

- /

- NasdaqGS:SIRI

How Subscriber Declines and Weak Demand at Sirius XM (SIRI) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Earlier in October 2025, Sirius XM Holdings reported ongoing declines in core subscribers and overall weak demand, highlighting pressures from increased competition and market saturation.

- An important factor is that despite management's optimism about rising free cash flow, the company is seeing downward trends in profitability and diminished opportunities for growth.

- We'll look at how subscriber losses and weakened demand are shaping Sirius XM's longer-term investment narrative and outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Sirius XM Holdings Investment Narrative Recap

To be a Sirius XM Holdings shareholder today, you need to believe that its established subscriber base and exclusive content can ultimately offset pressures from falling demand and fierce competition, particularly from streaming services. The recent report of ongoing subscriber declines and lagging market returns is material, as it directly challenges the most important short-term catalyst: the company's ability to stabilize and grow its core user base. The biggest risk right now remains sustained weakness in customer additions alongside eroding profitability metrics.

Of the recent company announcements, the July debut of the low-cost, ad-supported SiriusXM Play plan is most relevant. This move directly addresses ongoing subscriber losses by targeting price-sensitive listeners, aiming to reenergize growth potential and broaden the customer base, key factors in the company’s near-term narrative and response to competitive threats.

On the other hand, investors should be aware that continued shrinkage in Sirius XM's core subscribers could quickly expose...

Read the full narrative on Sirius XM Holdings (it's free!)

Sirius XM Holdings' outlook anticipates $8.6 billion in revenue and $1.1 billion in earnings by 2028. This scenario is based on a yearly revenue decline of 0.1% and an earnings increase of $2.9 billion from the current earnings of -$1.8 billion.

Uncover how Sirius XM Holdings' forecasts yield a $23.64 fair value, a 9% upside to its current price.

Exploring Other Perspectives

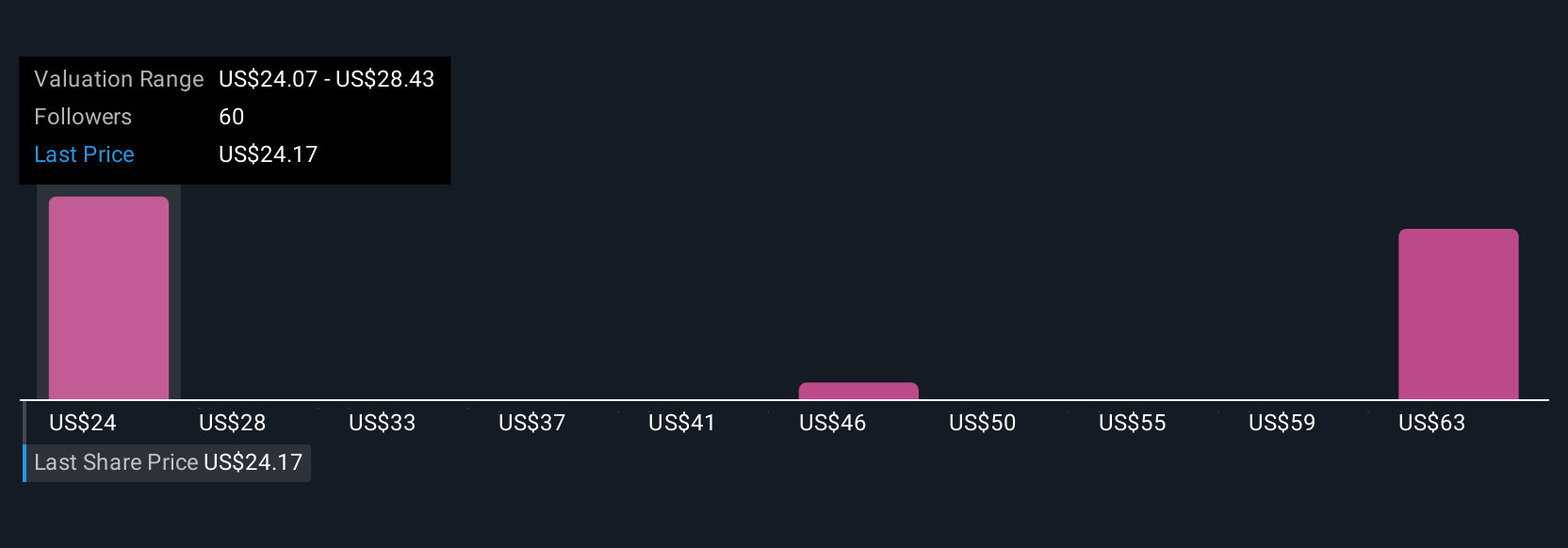

Six individual fair value estimates from the Simply Wall St Community range from US$23.64 to US$66.30 per share, illustrating sharply different personal outlooks. With persistent subscriber declines and weak demand recently reported, it is clear the broader outlook for Sirius XM remains deeply divided, review more perspectives before deciding where you stand.

Explore 6 other fair value estimates on Sirius XM Holdings - why the stock might be worth just $23.64!

Build Your Own Sirius XM Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sirius XM Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sirius XM Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sirius XM Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIRI

Sirius XM Holdings

Operates as an audio entertainment company in North America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives