- United States

- /

- Media

- /

- NasdaqGS:SATS

Is EchoStar’s 350.9% Surge in 2025 Still Justified After Recent Integration Moves?

Reviewed by Bailey Pemberton

- If you are wondering whether EchoStar’s explosive run still has room to continue, or if the market has already priced in the story, you are not alone. This is exactly where a closer look at valuation comes in.

- After a massive 350.9% year to date gain and 353.7% rise over the last year, the stock has recently cooled off a bit, with a 1.7% pullback over the past week. This could signal either a healthy breather or early profit taking.

- Recent headlines have focused on EchoStar’s strategic positioning in satellite communications and its integration efforts following high profile corporate moves, sharpening investor focus on how its network assets and spectrum might be monetized. At the same time, growing attention on connectivity demand and industry consolidation has added fuel to the debate about what this business should actually be worth.

- On our framework EchoStar scores a 3/6 valuation check, suggesting some signs of undervaluation but also a few yellow flags. Next we will break down the main valuation approaches investors use here, before finishing with a more holistic way to think about what the stock is really worth.

Approach 1: EchoStar Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to today, using a required rate of return. For EchoStar, this 2 stage Free Cash Flow to Equity model starts from its last twelve month free cash flow of roughly $4.4 billion outflow, reflecting heavy investment and current cash burn rather than steady profits.

Analysts expect this picture to improve gradually, with free cash flow projections turning positive over the next few years and climbing toward about $3.7 billion by 2035 in dollar terms. Only the first few years are based on analyst estimates. The later years are extrapolated by Simply Wall St from earlier trends, so there is added uncertainty the further out you go.

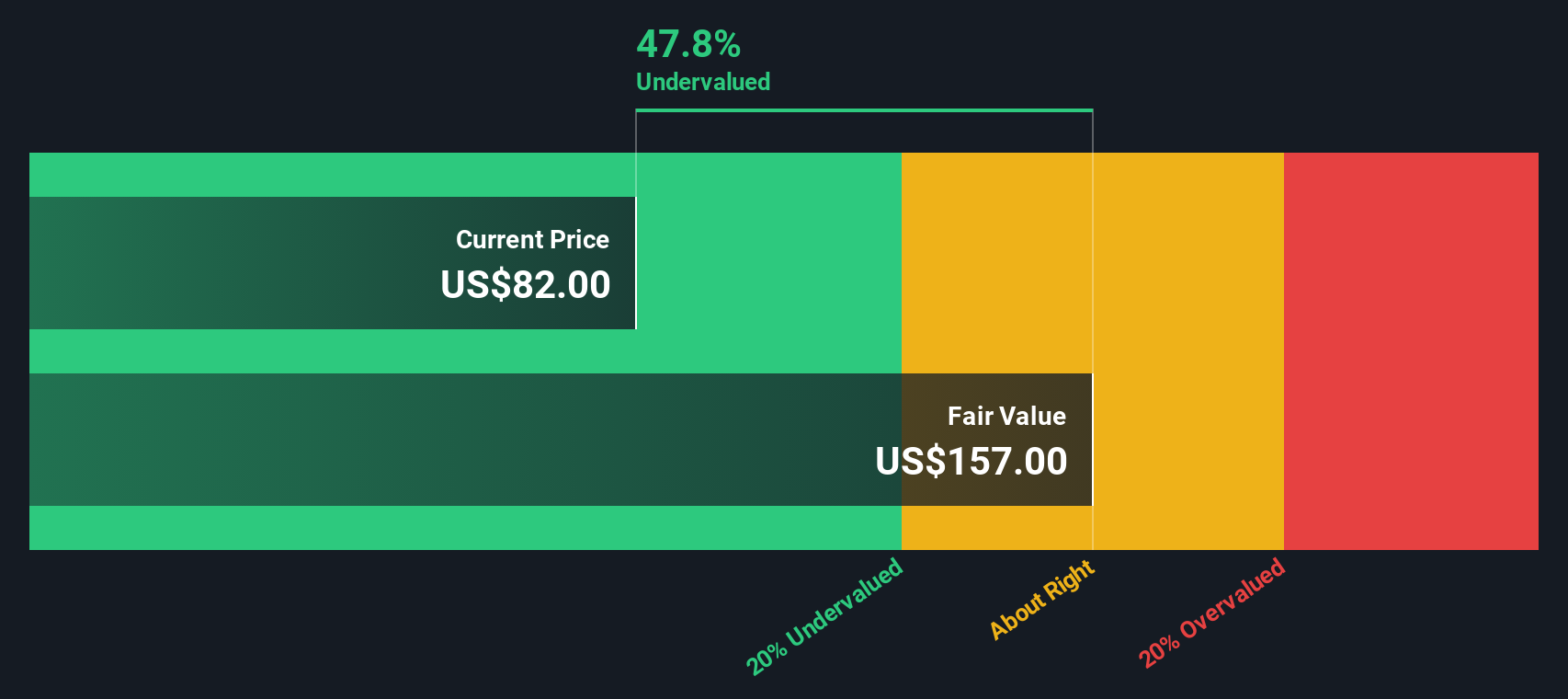

After discounting these future cash flows, the model arrives at an intrinsic value of roughly $167.58 per share, which implies EchoStar is trading at about a 38.8% discount to its estimated worth. On this cash flow view, the stock appears meaningfully undervalued, but also quite sensitive to execution and capital needs.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests EchoStar is undervalued by 38.8%. Track this in your watchlist or portfolio, or discover 916 more undervalued stocks based on cash flows.

Approach 2: EchoStar Price vs Sales

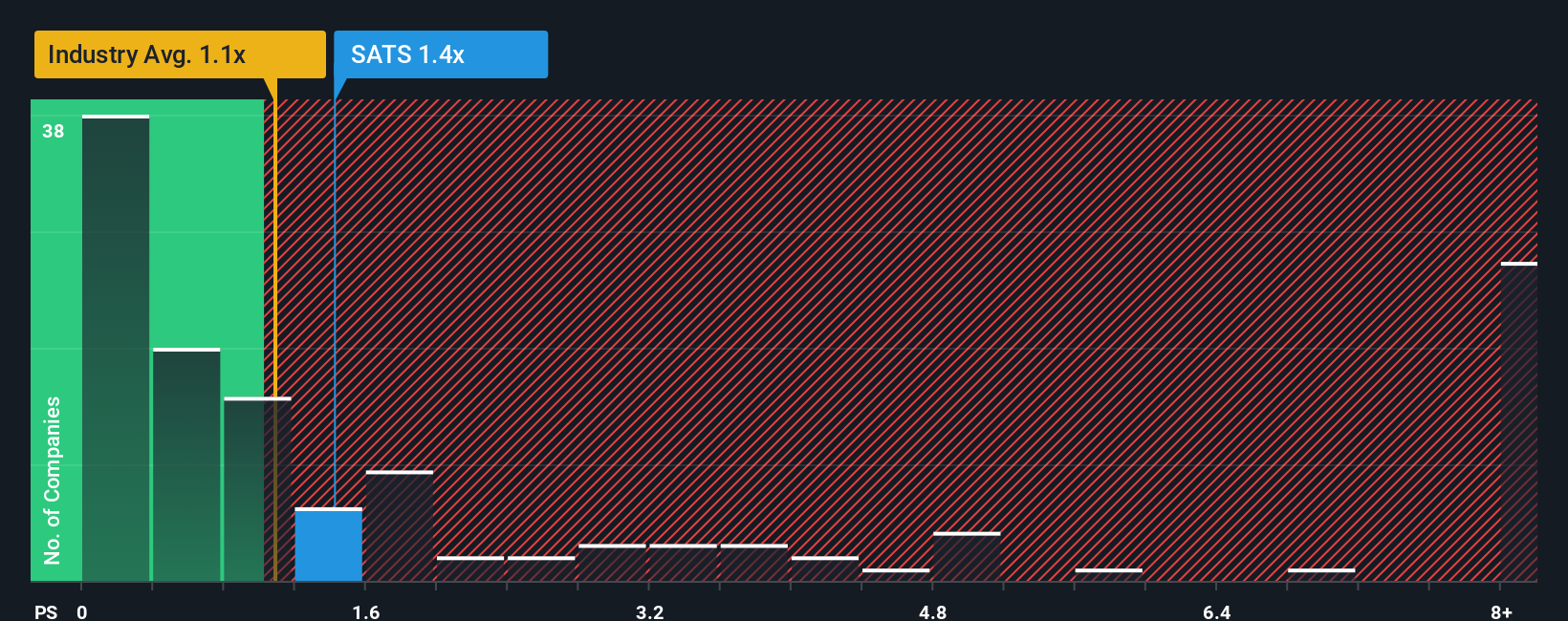

For companies where near term profitability is distorted by investment or integration costs, the Price to Sales ratio is often a better yardstick than earnings based metrics, because revenue is usually more stable and less affected by accounting swings.

In general, faster growth and lower risk can justify a higher Price to Sales multiple. Slower or uncertain growth, thin margins and balance sheet risks argue for a lower one. EchoStar currently trades at about 1.95x sales, which is roughly in line with its own sector’s 1.00x industry average but at a steep discount to the 4.17x peer group average.

Simply Wall St’s proprietary Fair Ratio for EchoStar comes in at 1.41x. This is the level its model suggests is appropriate after accounting for the company’s growth outlook, profitability profile, risk factors, industry positioning and market cap. This tailored benchmark is more informative than a simple peer or industry comparison, because it adjusts for EchoStar’s specific mix of opportunity and risk. With the market paying 1.95x versus a Fair Ratio of 1.41x, the shares screen somewhat expensive on a sales basis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1462 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your EchoStar Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your story about EchoStar to the numbers by linking your view of its future revenue, earnings and margins to a financial forecast, a fair value estimate and then a clear buy or sell decision.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy tool to write down their perspective on a company, translate that story into forecast assumptions and a Fair Value, then compare that Fair Value to the current share price so they can decide whether to buy, hold or sell.

Narratives are dynamic, updating automatically when new information such as earnings reports, regulatory developments or major news hits the market, so your EchoStar view does not go stale just because the world has moved on.

For example, one EchoStar Narrative might assume aggressive spectrum monetization and 5G partnership success and arrive at a Fair Value near $99 per share, while another, more cautious Narrative that focuses on funding risks and execution challenges might land closer to $25, and the Community tools help you see where your own view fits along that spectrum.

Do you think there's more to the story for EchoStar? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if EchoStar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SATS

EchoStar

Provides networking technologies and services in the United States and internationally.

Fair value with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion