- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

Will DoubleVerify’s Partnership Boost Roku’s (ROKU) Competitive Edge in Combating Ad Fraud?

Reviewed by Sasha Jovanovic

- In the past week, DoubleVerify and Roku announced new milestones from their ongoing partnership to protect connected TV advertising, highlighting advances in combating bot-driven ad fraud and the widespread adoption of Roku's proprietary Advertising Watermark technology.

- This collaboration, which has succeeded in blocking billions of fraudulent ad requests and dismantling major ad fraud schemes, addresses the industry's growing vulnerability to ad fraud and enhances confidence in Roku's platform for advertisers.

- We'll examine how Roku's progress in combating ad fraud with DoubleVerify could influence the company's long-term profitability and platform reputation.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Roku Investment Narrative Recap

For investors to remain confident in Roku, the core belief centers on the company's ability to leverage leading technology and partnerships to boost its share of connected TV ad spending, despite fierce competition and evolving digital advertising trends. The recent anti-fraud milestones with DoubleVerify further strengthen Roku’s credibility with advertisers, but do not fundamentally alter the most important short-term catalyst: sustaining robust ad revenue growth in an increasingly crowded streaming device market; likewise, the biggest risk remains ongoing margin pressure from both intense competition and macro-driven ad market shifts.

Among recent announcements, Roku’s latest earnings report stands out: the company posted $1,210.64 million in quarterly revenue and swung from a net loss to a $24.81 million net profit. Continued progress in reducing ad fraud is highly relevant here, as advertiser trust in the platform may contribute to these improved operating results, helping underpin future revenue momentum in digital advertising.

Yet, for all the progress, there remains the risk that if major media companies decide to further fragment content or build tighter walled gardens, Roku’s platform engagement and ad revenue potential could be put to the test, so investors should be aware that even as Roku shores up trust in its advertising ecosystem, a shift in content availability could …

Read the full narrative on Roku (it's free!)

Roku's outlook anticipates $6.1 billion in revenue and $372.1 million in earnings by 2028. This scenario implies 11.4% annual revenue growth and a $433.6 million increase in earnings from the current -$61.5 million.

Uncover how Roku's forecasts yield a $110.04 fair value, a 5% upside to its current price.

Exploring Other Perspectives

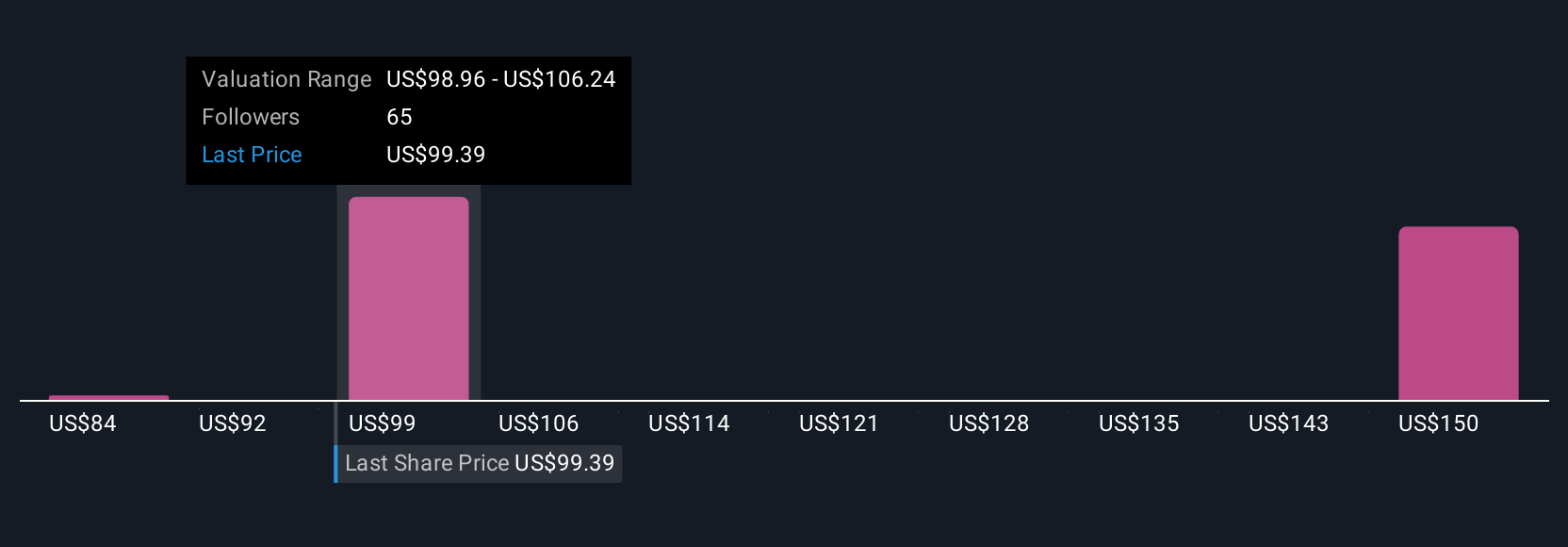

Eleven individual fair value estimates from the Simply Wall St Community for Roku range widely from US$84.40 to US$154.22 per share. Market participants continue to debate Roku's ability to capture greater digital ad budgets as the streaming market evolves, making it important for you to explore multiple viewpoints.

Explore 11 other fair value estimates on Roku - why the stock might be worth 20% less than the current price!

Build Your Own Roku Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roku research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Roku research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roku's overall financial health at a glance.

No Opportunity In Roku?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives