- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

Roku (ROKU): Assessing Valuation After Recent Share Price Pullback and One-Year Gains

Reviewed by Simply Wall St

See our latest analysis for Roku.

Zooming out, Roku’s one-year total shareholder return stands at 35.5%, reflecting building momentum even after a sharp one-week share price pullback. With solid YTD gains and resilient longer-term growth, investors seem to be reassessing Roku’s potential as streaming trends evolve.

If recent streaming news has you watching sector moves, it could be a smart moment to broaden your search and discover fast growing stocks with high insider ownership

The key question now is whether Roku’s recent growth and upbeat returns indicate untapped value, or if Wall Street has already baked future potential into the share price. This could leave little room for further gains.

Most Popular Narrative: 15.4% Undervalued

Roku’s fair value is pegged at $110.04, which stands more than $16 above the recent closing price of $93.10. This sizable gap hints at a potential disconnect between recent trading levels and the outlook built into this widely followed narrative.

Ongoing investments in proprietary content (e.g., The Roku Channel), self-service ad solutions, and performance marketing are boosting user engagement and attracting new cohorts of advertisers (especially SMBs), adding incremental high-margin advertising revenue and broadening usage, which are supporting margin and earnings growth.

What is fueling that generous fair value? The key is behind-the-scenes financial engineering such as rapid profit margin shifts, platform monetization, and projected acceleration in earnings. If you’re curious about the numbers and assumptions powering such an aggressive upside, you’ll want to see which future profit levers analysts are banking on.

Result: Fair Value of $110.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition from major streaming platforms and Roku's heavy reliance on advertising revenue could quickly derail analysts’ positive outlook for future growth.

Find out about the key risks to this Roku narrative.

Another View: Multiples Tell a Different Story

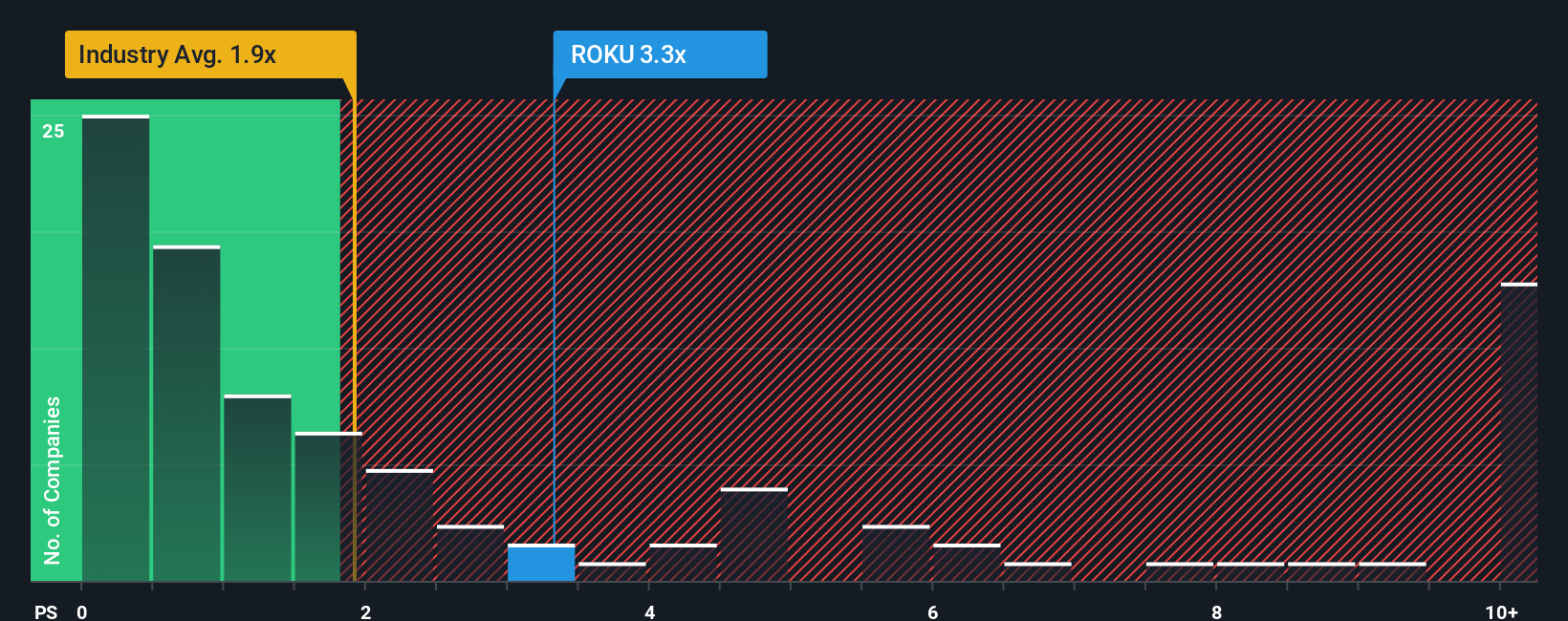

Looking at valuation through a sales-based lens, Roku’s ratio of 3x is more than double the industry average of 1.4x and also sits above the fair ratio of 2.6x. This gap suggests Roku is expensive compared to both its sector and what the market may eventually expect. With signs of momentum, could this premium be justified or does it hint at risk if growth expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roku Narrative

If you see the story differently, or are ready to dig into the numbers yourself, it takes just a few minutes to build your own narrative. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Roku.

Looking for more investment ideas?

Smart investors always keep options open. Get ahead of market shifts and never miss a potential win by tapping into these compelling opportunities from Simply Wall Street:

- Capture tomorrow’s growth by reviewing these 908 undervalued stocks based on cash flows, which offers hidden value and financial strength. This might give you an edge that others overlook.

- Lock in steady streams of income with these 15 dividend stocks with yields > 3%, which provides attractive yields and the chance for resilient returns, even during market uncertainty.

- Position yourself for the rise of artificial intelligence by exploring these 26 AI penny stocks. These stocks are shaping new technology frontiers and pushing industry boundaries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives