As the U.S. stock market kicks off a holiday-shortened week, major indices like the Nasdaq and S&P 500 have experienced significant gains, buoyed by investor optimism surrounding potential Federal Reserve interest rate cuts in December. In this environment of fluctuating tech valuations and AI spending concerns, identifying high-growth tech stocks requires careful consideration of factors such as innovation potential and financial resilience amidst broader economic shifts.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.01% | 24.80% | ★★★★★☆ |

| Palantir Technologies | 27.16% | 29.98% | ★★★★★★ |

| Workday | 11.16% | 32.14% | ★★★★★☆ |

| Pelthos Therapeutics | 47.44% | 126.65% | ★★★★★☆ |

| Circle Internet Group | 26.05% | 84.56% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Precigen | 55.77% | 79.70% | ★★★★★☆ |

| Zscaler | 15.80% | 40.68% | ★★★★★☆ |

| Procore Technologies | 11.61% | 116.48% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Roku (ROKU)

Simply Wall St Growth Rating: ★★★★☆☆

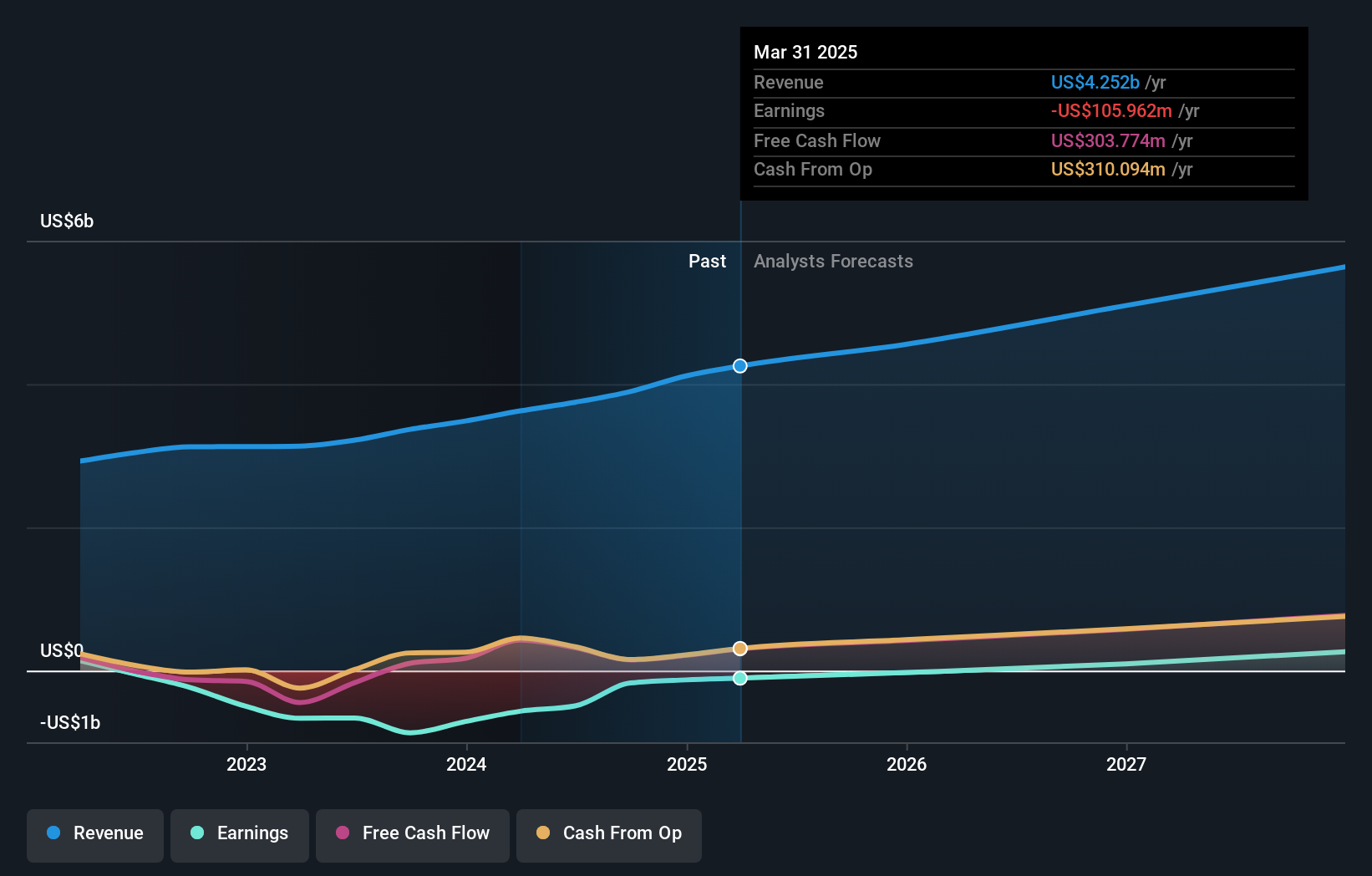

Overview: Roku, Inc. operates a TV streaming platform both in the United States and internationally, with a market capitalization of approximately $13.79 billion.

Operations: Roku generates revenue primarily through its Platform segment, which accounted for $3.96 billion, and its Devices segment, contributing $587.13 million. The company's business model focuses on monetizing the streaming platform via advertising and content distribution while also selling streaming devices to consumers.

Roku's trajectory in the high-growth tech landscape is marked by its strategic focus on combating ad fraud within the Connected TV (CTV) space, a sector plagued by security challenges. Through its partnership with DoubleVerify since 2023, Roku has effectively blocked billions of fraudulent ad requests, showcasing its robust proprietary Advertising Watermark technology that ensures only genuine Roku devices display authenticated ads. This innovation not only enhances platform security but also positions Roku as a leader in CTV advertising integrity. Additionally, recent financials reflect a positive shift with Q3 revenues rising to $1.21 billion from $1.06 billion year-over-year and net income reaching $24.81 million, reversing a previous loss of $9.03 million, signaling potential profitability and resilience amidst industry adversities.

- Click here to discover the nuances of Roku with our detailed analytical health report.

Examine Roku's past performance report to understand how it has performed in the past.

Amphenol (APH)

Simply Wall St Growth Rating: ★★★★☆☆

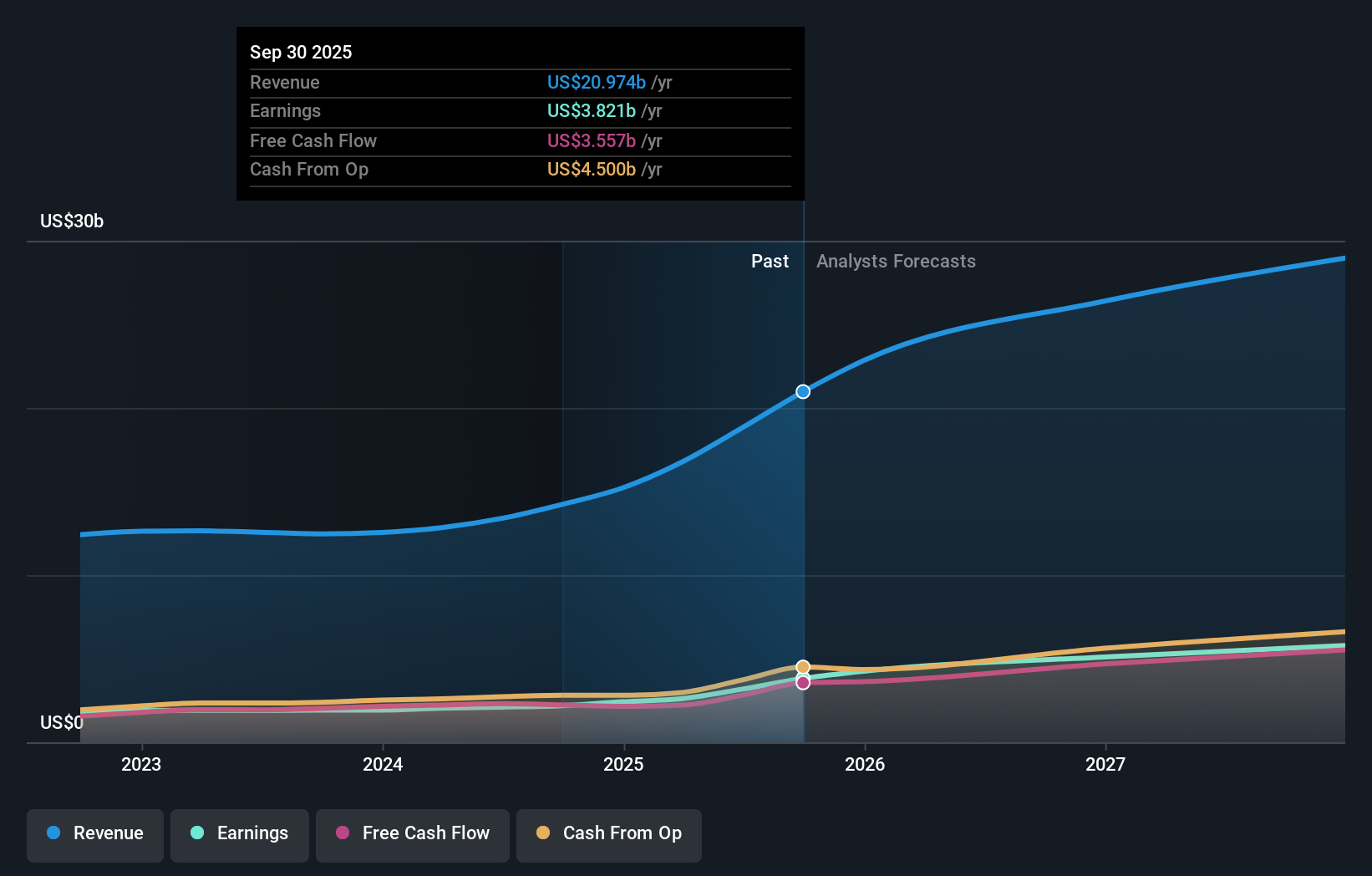

Overview: Amphenol Corporation, with a market cap of $161.09 billion, designs, manufactures, and markets electrical, electronic, and fiber optic connectors globally through its subsidiaries.

Operations: Amphenol generates revenue primarily from its Communications Solutions segment, which accounts for $10.65 billion, followed by Harsh Environment Solutions at $5.61 billion and Interconnect and Sensor Systems at $4.97 billion. The company's operations span the United States, China, and international markets.

Amphenol has demonstrated robust financial performance with a notable 74.3% earnings growth over the past year, significantly outpacing the electronic industry's average of 10.5%. This growth is supported by strategic debt financing, including recent offerings totaling over $7 billion across various maturities, enhancing its liquidity for future investments and acquisitions. The company's commitment to innovation is evident from its R&D focus, crucial for maintaining its competitive edge in the high-tech sector. With a forecasted revenue growth rate of 12.6% per year—surpassing the US market average of 10.4%—and an expected annual profit growth of 18.3%, Amphenol is well-positioned to leverage its technological advancements and financial strategies in expanding its market presence further.

- Click here and access our complete health analysis report to understand the dynamics of Amphenol.

Evaluate Amphenol's historical performance by accessing our past performance report.

Circle Internet Group (CRCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Circle Internet Group, Inc. operates as a platform, network, and market infrastructure for stablecoin and blockchain applications with a market cap of $16.80 billion.

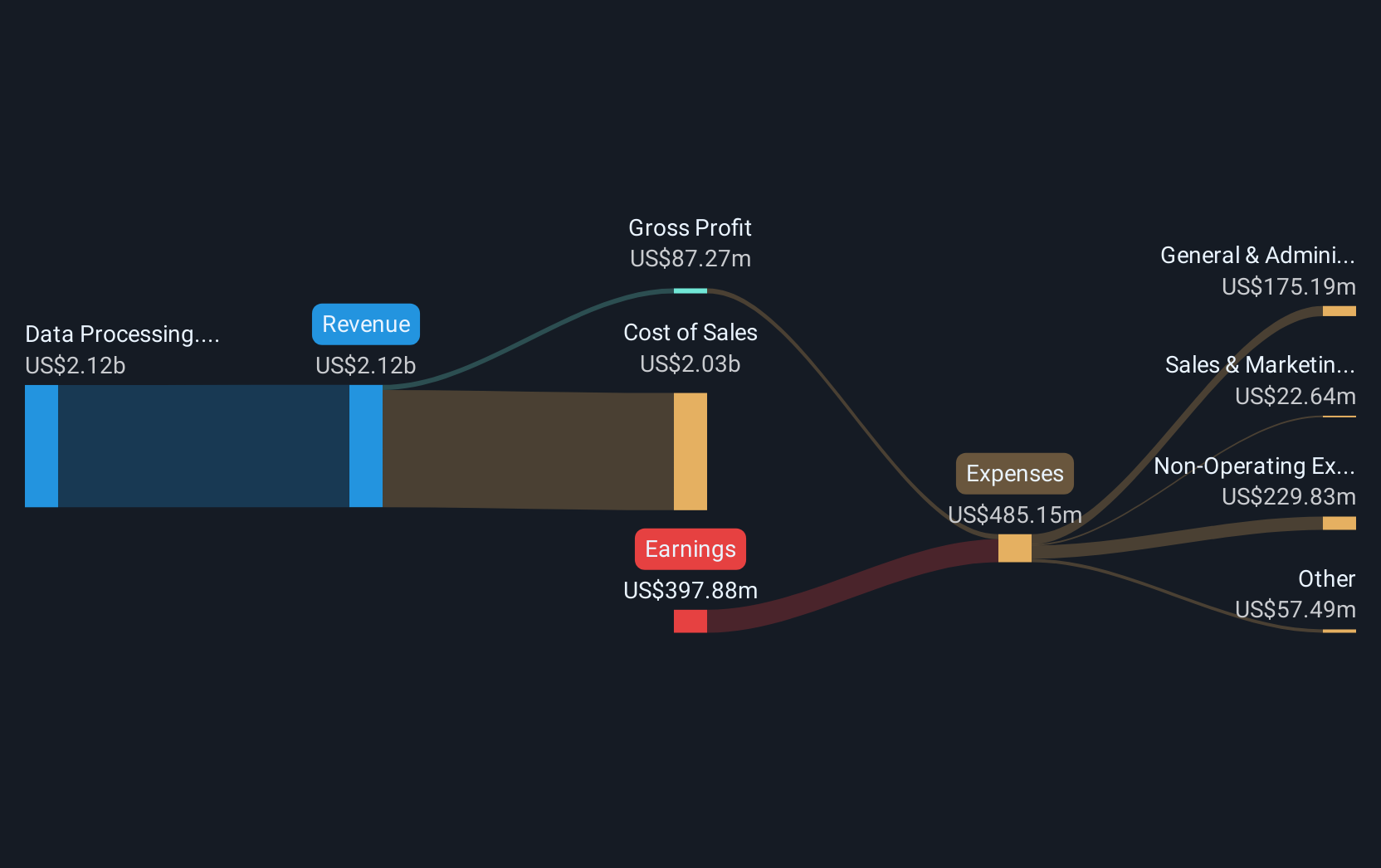

Operations: Circle Internet Group generates revenue primarily from data processing services, amounting to $2.41 billion. The company operates within the stablecoin and blockchain sectors, leveraging its platform and network infrastructure to facilitate these services.

Circle Internet Group's recent performance underscores its potential in the tech sector, with a remarkable revenue increase to $739.76 million from $445.76 million year-over-year and an earnings leap to $214.39 million from $71 million in the same period. This growth trajectory is complemented by strategic partnerships, like the one with Wyclef Jean aimed at leveraging stablecoin technology for global economic inclusivity, and significant advancements such as the launch of Arc, a Layer-1 blockchain network poised to enhance economic activities onchain. These initiatives not only demonstrate Circle's innovative approach but also align with broader industry trends towards digital financial solutions and blockchain integration, positioning it well for future expansion amidst a 26.1% annual revenue growth forecast.

- Delve into the full analysis health report here for a deeper understanding of Circle Internet Group.

Next Steps

- Click through to start exploring the rest of the 69 US High Growth Tech and AI Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives